Microsoft (MSFT.US) traded 3% lower yesterday in the after-market session following the release of fiscal-Q4 2023 earnings (calendar Q2 2023). Results were not that bad but have hinted that growth in some key parts of Microsoft's business is slowing. Let's take a closer look at earnings release from Microsoft!

Results mostly in-line, cloud growth slows

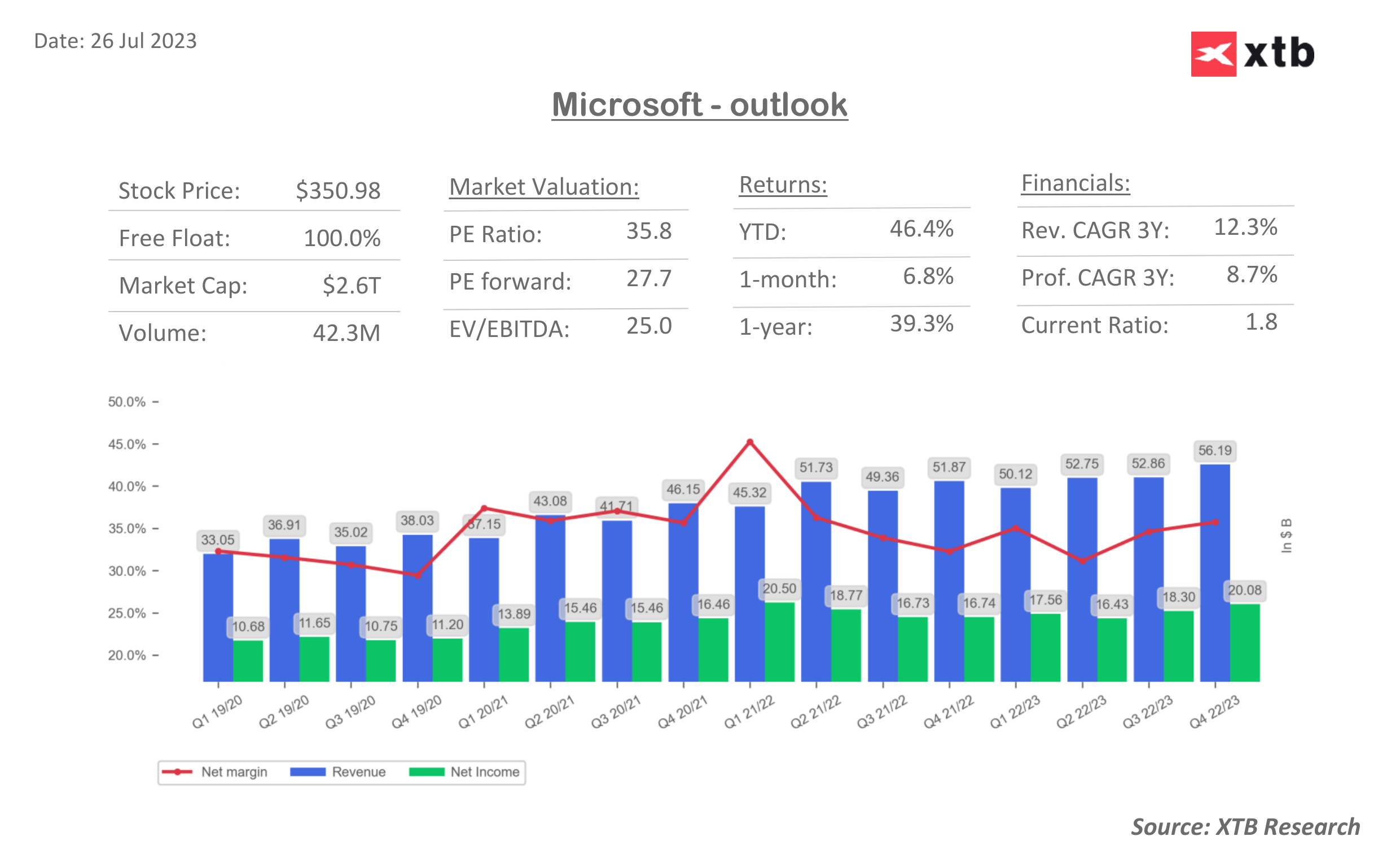

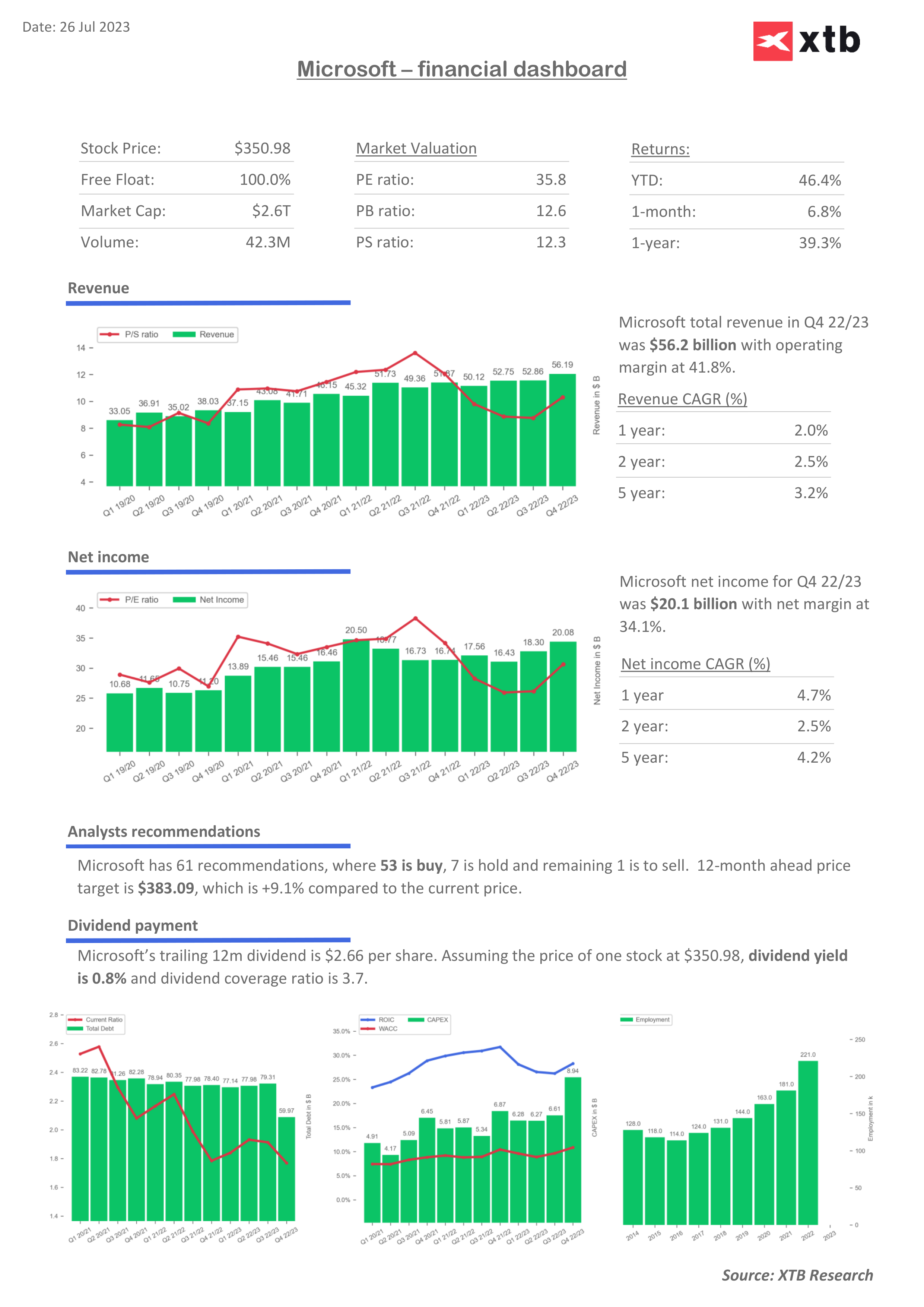

Microsoft results for fiscal-Q4 2023 (April - June 2023) were mostly in-line with market expectations. Total revenue grew by 8.3% YoY, slightly more than expected. This was driven by solid performance of the Intelligent Cloud segment. Total cloud sales reached $30.3 billion during the quarter and were 21% YoY higher. Growth in Microsoft's Azure Cloud at constant currency reached 27% during the quarter. While this is a slowdown, pace of deceleration begins to moderate and it is seen as a positive. Capital expenditure was much higher than expected during the quarter but it is expected to ease after a few years of rising investments, in spite of Microsoft rolling out and boosting its AI offering.

Fiscal-Q4 2023 results

-

Revenue: $56.19 billion vs $55.49 billion expected (+8.3% YoY)

-

Productivity and Business Processes: $18.29 billion vs $18.1 billion expected (+10% YoY)

-

Intelligent Cloud: $23.99 billion vs $23.8 billion expected (+15% YoY)

-

More Personal Computing: $13.91 billion vs $13.58 billion expected (-4% YoY)

-

-

Microsoft Cloud revenue: $30.3 billion vs $30.05 billion expected (+21% YoY)

-

EPS $2.69 vs $2.56 expected ($2.23 in fiscal-Q4 2022)

-

Operating income: $24.25 billion vs $23.28 billion expected (+18% YoY)

-

Net income: $20.1 billion (+20% YoY)

-

Capital expenditure: $8.94 billion vs $7.85 billion expected

-

Revenue at constant currency: +10% vs +8.52% expected

-

Capital distribution: $97 billion

Full fiscal-2023 highlights

-

Total revenue: $211.9 billion (+7%)

-

Operating income: $89.7 billion (+8%)

-

Net Income: $73.3 billion (+6%)

-

EPS: $9.81 (+7%)

-

Microsoft Cloud revenue above $110, up 27% at constant currency

Bleak forecast for fiscal-Q1 2024

While analysts are upbeat that deceleration in cloud is moderating, turnaround may still be some time away. Company expects total revenue in fiscal-Q1 2024 (July - September 2023) to grow around 8% YoY, to $53.8-54.8 billion. While this is in-line with fiscal-Q4 2023 revenue growth, the market's forecast of $54.94 was above the top range of the company-provided forecast. Microsoft expects growth in Azure cloud to slow further this quarter, to 25-26%. That's down from 27% in fiscal-Q4 2023 and 42% in fiscal-Q1 2023. While Microsoft said that it has over 11,000 clients for its Azure OpenAI product already (an increase from 4,500 in mid-May), increase in revenue from AI products are likely to materialize gradually.

Fiscal-Q1 2024 forecasts

-

Revenue: $53.8-54.8 billion vs $54.94 billion expected (+8~% YoY)

-

Azure growth at constant currency: 25-26% YoY

A look at the chart

Shares of Microsoft (MSFT.US) trade around 3.5% lower in premarket today. Stock reached the $350 resistance zone yesterday but failed to break above. Shares currently trade near $339 in pre-market - below 200-hour moving average (purple line) but above a short-term uptrend line. A support zone to watch can be found in the $335 area, where previous price reactions as well as the aforementioned trendline can be found.

Source: xStation5

Source: xStation5

Microsoft - financial dashboard

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.