Social media giant Meta Platforms (META.US, formerly Facebook) today reported Q2 2023 results. The report beat analysts' expectations on both the revenue and earnings per share, with the stock gaining nearly 10% before the Wall Street open. Investors euphorically received the company's comments on the development of AI and the recovery of the advertising sector. The company confirmed its leading position in the global market, with a total of 3.88 billion users on its apps (Facebook, WhatsApp, Instagram), a number that grew 6% year-on-year despite the huge scale. The company is planning a lot of investment and incurring costs that are likely to increase - but the market sees this as a sign of dynamic growth. It also took a positive view of 'caution' in terms of planned investments in 2023, for which the company intends to spend less than Wall Street expected (in response to higher costs, among other things). Mark Zuckerberg accompanied the results with a very positive comment. These are the details of the report:

- Revenues: $32 billion vs. $31.03 billion forecast (11% y/y growth)

- Earnings per share: $2.98 vs. $2.92 forecasts ($2.46 in Q2 2022)

- Net profit: $7.8 billion vs. $7.4 billion forecasts

- Daily number of active users in apps: 3.07 billion (up 7% y/y)

- Monthly number of active users in apps: 3.88 billion (up 6% y/y)

- Daily number of active Facebook users: 2.06 billion (up 5% y/y)

- Monthly number of active Facebook users: 3.03 billion (up 3% y/y)

- Ad impressions (up 34% y/y)

- Average price per ad (down 16% y/y)

- Costs and expenses: $22.61 billion - up (10% y/y, including $1.9 billion in legal costs and a $1.2 billion penalty from the EU)

- Employment: 71,469 (down 14% y/y, half of layoffs 2 2023 included in measurement)

- Investment: $6.35 billion in Q2 2023.

- Share repurchases: $793 million in shares repurchased in Q2, with $40.91 billion approved for further repurchases

- Cash position: $53.45 billion with $10.96 billion in free cash flow

- Long-term debt: $18.38 billion

Company estimates Q3 revenue at $32-34.5 billion, above analysts' expectations of $31.1 billion. It estimates lower-than-forecast investments in 2023, namely $27-$30 billion vs. $30-$33 billion forecast. Costs for all of 2023 are expected to be $88 to $91 billion vs. $86-90 billion previously due to legal costs in Q2 2023 (higher legal costs in Q2 2023). Management expects operating losses of the division working on the development of 'Metaverse' Reality Labs to increase this year.

In July, Meta released a commercial version of its Llama 2 language model, which will be used to create chatbots to compete with rivals like OpenAI, Google and Microsoft. The company intends to enter into agreements with the largest companies in the cloud computing sector ( Microsoft, Amazon or Google) to use the technology (and potentially data) on a large scale.

Analysts at Evercore estimate that Threads' new business could provide the company with $8 billion in annual revenue within two years, with an estimated 200 million users per year. The market takes the report as a signal that the slump in digital advertising is receding after a tough 1.5-year period. This, with a program to control costs, creates additional leverage on the company's performance. The company highlighted the risks, which now lie mainly on the legal costs side.

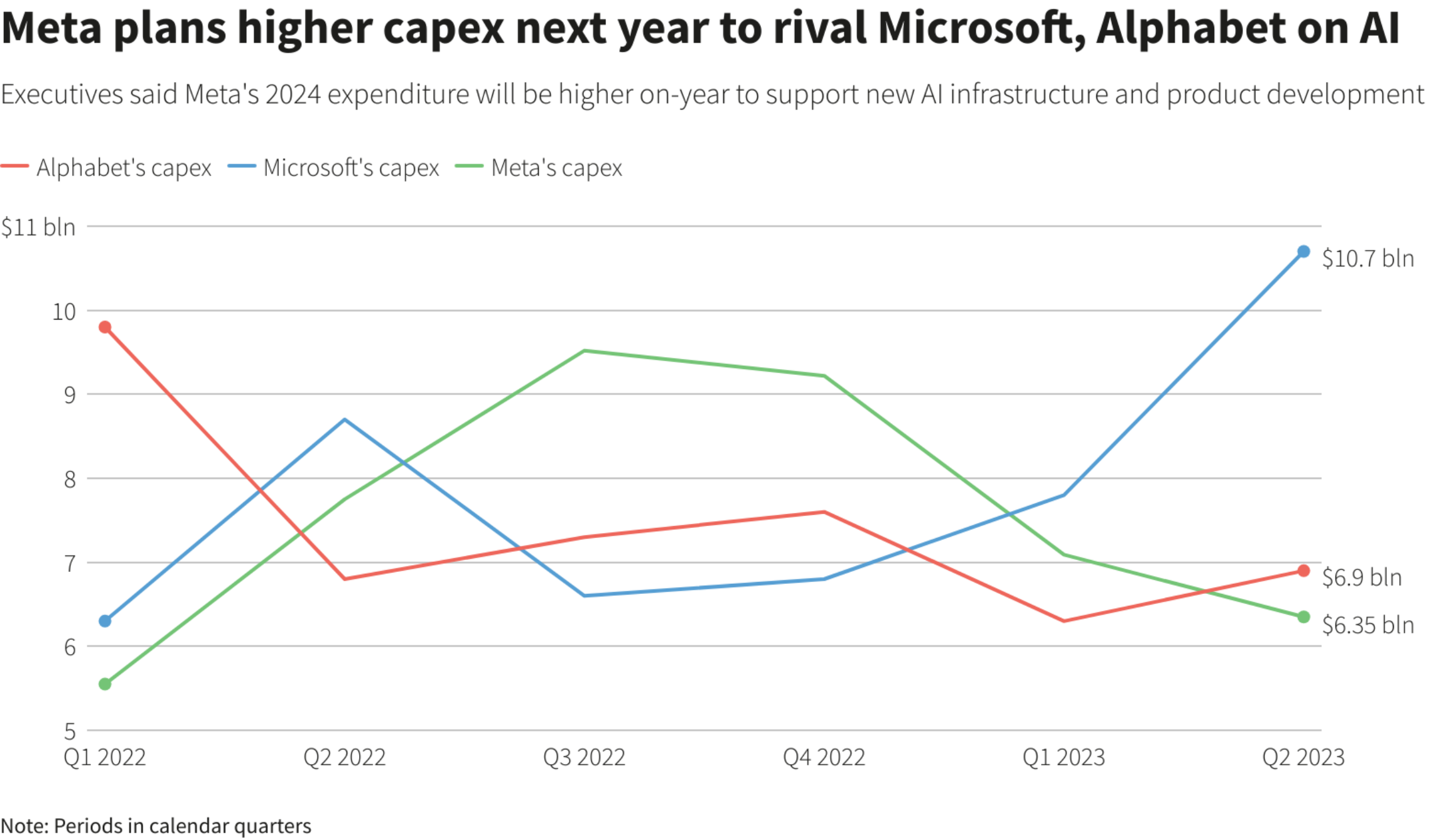

The company intends to increase CAPEX spending, driving development of its products - mainly AI and Metaverse. These are still at relatively low levels compared to competitors. Source: Bloomberg

The company intends to increase CAPEX spending, driving development of its products - mainly AI and Metaverse. These are still at relatively low levels compared to competitors. Source: Bloomberg

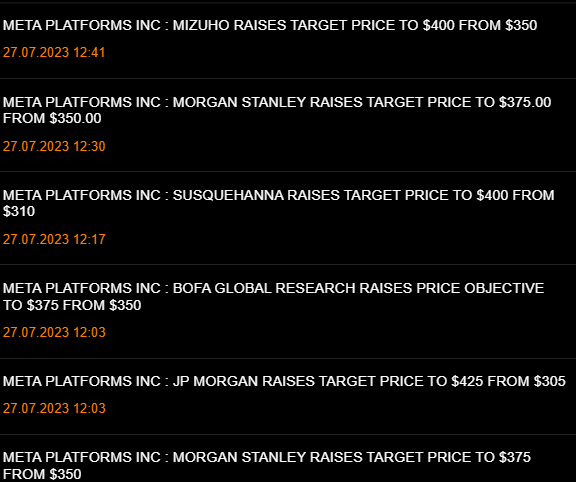

Analysts at JP Morgan, Morgan Stanley or BofA raised their recommendation for Meta Platforms after Q2 results Source: Refinitiv, Reuters

Competition for TikTok and VR on target for the company

- Mark Zuckerberg highlighted the progress of the Reels business (short videos similar to TikTok) and Threads (Twitter's rival), which he pointed to as a potential beneficiary of the problems with Twitter's restructuring and rebranding being carried out by Musk, despite relatively low spending.

- Threads recorded 100 million new users in 5 days, however, their activity has declined significantly according to portals analyzing the data. However, Zuckeberg conveyed that he will not add ads to Threads until the portal reaches 1 billion active users;

- Meta's CEO stressed that the company continues to prioritize the Metaverse (virtual reality development) and is ready to invest in the trend. He expressed his belief that virtual worlds represent the future of the entire technology industry

- Zuckerberg stressed that the current 'development map' for Meta is one of the most electrifying in the company's entire history. In addition to the impact of AI as a brand new catalyst, we have the release of the new VR headset Meta Quest 3 in the fall, this year

The growth catalyst - AI

- Meta estimates higher spending on AI-related servers and data centers. Zuckerberg indicated that investments in using AI to improve personalization of ads and user preferences are 'clearly paying off';

- The company will launch AI virtual agents and chatbots. The goal is to help businesses and creators interact with users and use generative AI (to increase ad effectiveness and productivity). We assume that quite a few businesses may come knocking at Meta in such a deal to see if AI will translate into increased sales;

- Zuckerberg indicated that it remains unclear how quickly investments in AI will pay off and how they will grow. Meta is debating the estimated scale of investment in the new trend. It is not certain that AI will increase revenue very quickly, for example, Llama 2 is not included in the additional payment but is made available for the moment as open-source (developers can see the code and use it);

- One thing is certain - the company will make an effort not to lose out on AI, and there are many indications that artificial intelligence will support its business. After a 'lean year' of 2022 for the company during which it lost more than $200 billion in capitalization in just one trading session, this year can be considered exceptionally 'fat'.

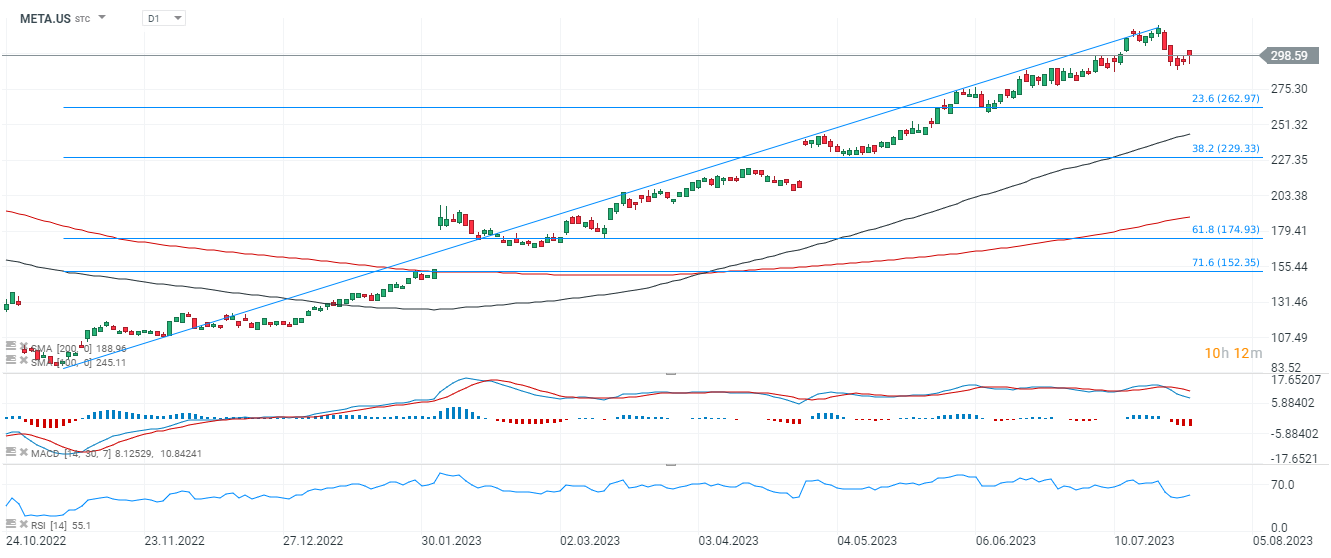

In pre-opening Wall Street trading, the stock is trading 10% higher, near $330 - levels not seen since January 2022. Source: xStation5

In pre-opening Wall Street trading, the stock is trading 10% higher, near $330 - levels not seen since January 2022. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.