Social media giant Meta Plaforms (META.US, formerly Facebook) will report Q2 results after today's Wall Street session. Considering that the company's all apps amass nearly 3.78 billion users, its report could be crucial for many companies that mainly derive their revenues from digital advertising. Yesterday's results from Alphabet (GOOGL.US) indicate that Meta may surprise on the upside in the face of a rebound in the advertising sector. The market will pay attention to the company's costs and investments, primarily those related to AI and the 'Metaverse' concept pushed by Mark Zuckerberg.

- Revenues: $31.06 billion vs. $28.65 billion in Q1.

- Earnings per share (EPS): $2.92 vs. $2.20 in Q1.

- Number of active Facebook users (daily): 2.03 billion vs. $2.04 billion in Q1.

- Number of active Facebook users (monthly): 3 billion vs. $2.99 billion in Q1.

- Operating margin: 30.4% vs. 18.27% in Q1.

- Advertising revenue: $30.43 billion

- Reality Labs revenue: $391.9 million

- Estimated loss for Reality Labs: SD3.68 billion

Meta Platforms shares, after a dismal 2022 for the company, have already risen nearly 140% since January. The attention of the markets will focus not only on app traffic, costs and advertising revenues. Leading topics will be Twitter's rival project Threads and Metaverse, which remains particularly controversial because the development of 'virtual worlds' costs a fortune and is still far from paying off. The company's recent promises to develop AI have somewhat distracted investors from the 'cash burn' by Reality Labs, and if the results are positive investors will probably 'turn a blind eye' to the technology division's several billion loss.

Google revived ads - what about Meta?

- The company may benefit from the improved performance of its ad segment, with daily traffic of 3 billion people on leading apps like Facebook, What'sApp and Instagram. Address registrations on Threads rose to more than 100 million in just five days after integrating with Instagram (but user engagement soon dropped by 70%).

- If the rebranding, restructuring and transformation of Twitter into an X-to-everything platform' by Elon Musk ultimately fails, Meta could be a big beneficiary of all the turmoil. Investors will pay attention to whether Meta will be able to maintain lower costs despite outlays to develop the Threads brand.

- The company's Reality Labs division lost more than $13 billion in 2022, which hasn't deterred Zuckerberg from further investment. The company's latest VR kit, Meta Quest 3, will be released in the fall and may bring more answers to the question of whether the massive outlay will ultimately pay off. Apple is also entering the space with its Vision Pro headset.

Will AI bring Meta Platforms to life?

- As the topic of AI fires people's imaginations, Wall Street will also want to hear more specifics on how artificial intelligence can help the company and entice advertisers using Meta's services. More than 3 billion users give powerful access to data that can be used to develop AI. Meta Platforms and Microsoft recently announced a partnership to support LLM models on Microsoft Azure and Windows platforms.

- Meta plans to use AI to strengthen its presence in the metaverse, integrate users across platforms, improve business messaging and customer service, among other things. The key, however, seems to be not so much automation but how AI will help analyze customer behavior across platforms and how much advertisers will be willing to pay for the data. Zuckerberg recently indicated 'that advertisers should simply give the company a budget and a target, and the company will do the rest' - the company intends to heavily simplify the operating model with generative AI;

- JMP Securities analysts believe the company may be in the early stages of reaping the benefits of AI both in terms of automation supporting lower costs and catalysts for a number of products, including Reels or Threads.

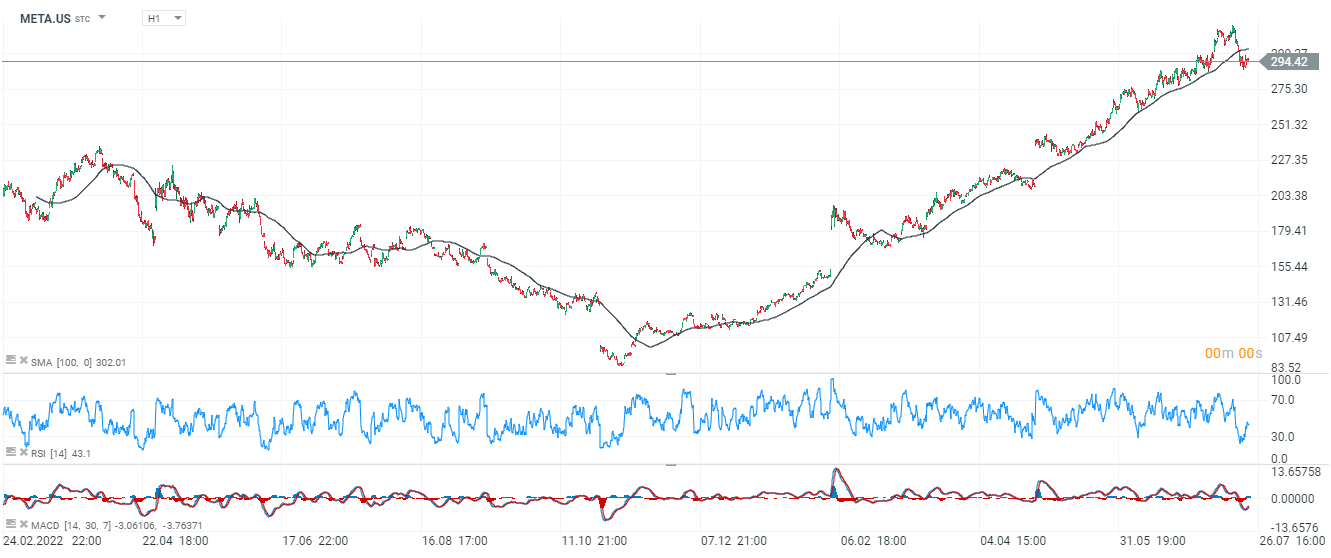

Meta Platforms (META.US) shares, H1 interval. The company's shares on the lower hourly interval have been discounted quite dramatically, which is well reflected in the sudden RSI, which was below 30 points for a while (over 40 points today). Since the autumn of 2022, any drop in stocks below the SMA100 was quickly dialed up by the bulls, and if the results do not surprise negatively we can expect a continuation of such a scenario. Source: xStation5

Meta Platforms (META.US) shares, H1 interval. The company's shares on the lower hourly interval have been discounted quite dramatically, which is well reflected in the sudden RSI, which was below 30 points for a while (over 40 points today). Since the autumn of 2022, any drop in stocks below the SMA100 was quickly dialed up by the bulls, and if the results do not surprise negatively we can expect a continuation of such a scenario. Source: xStation5

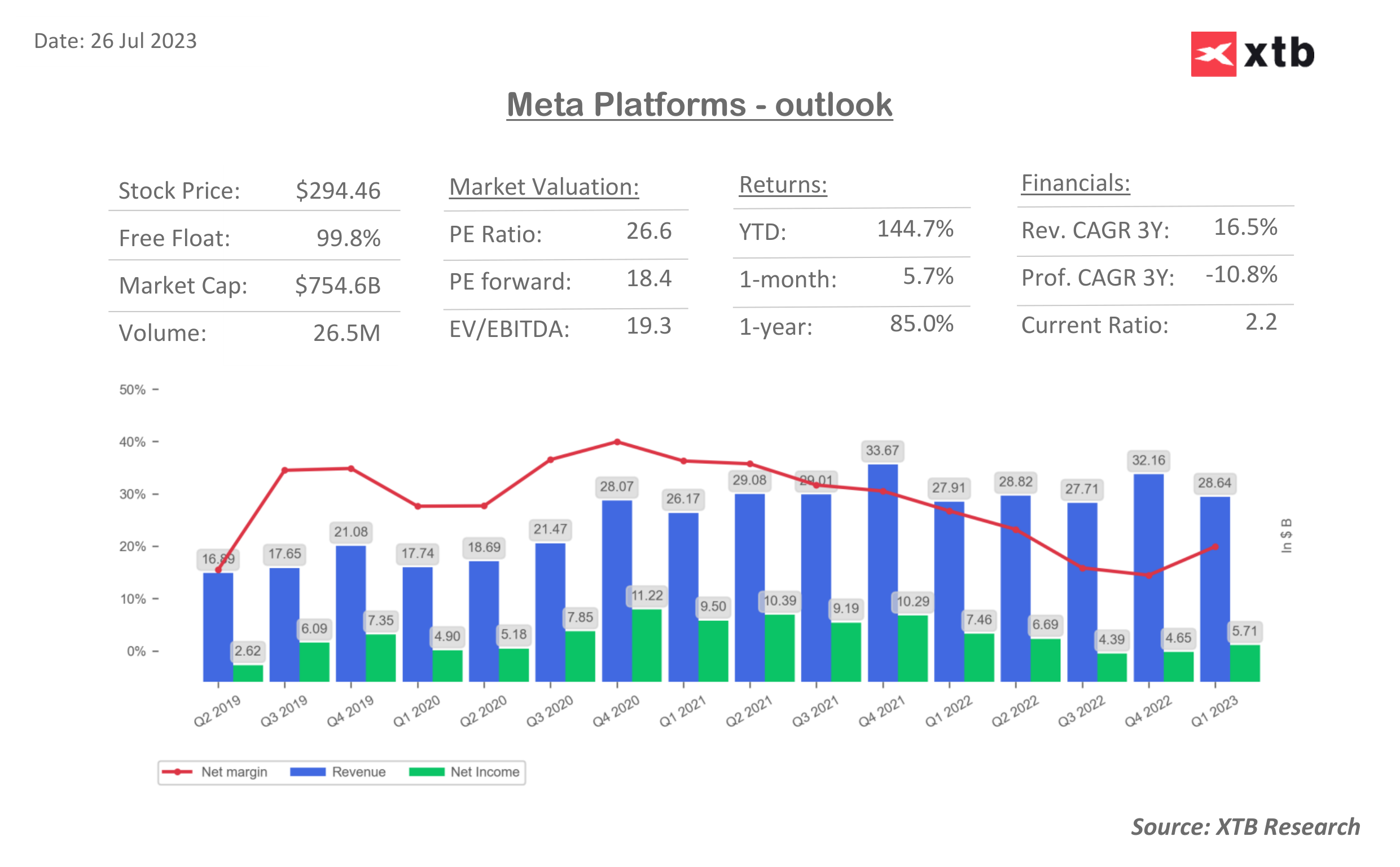

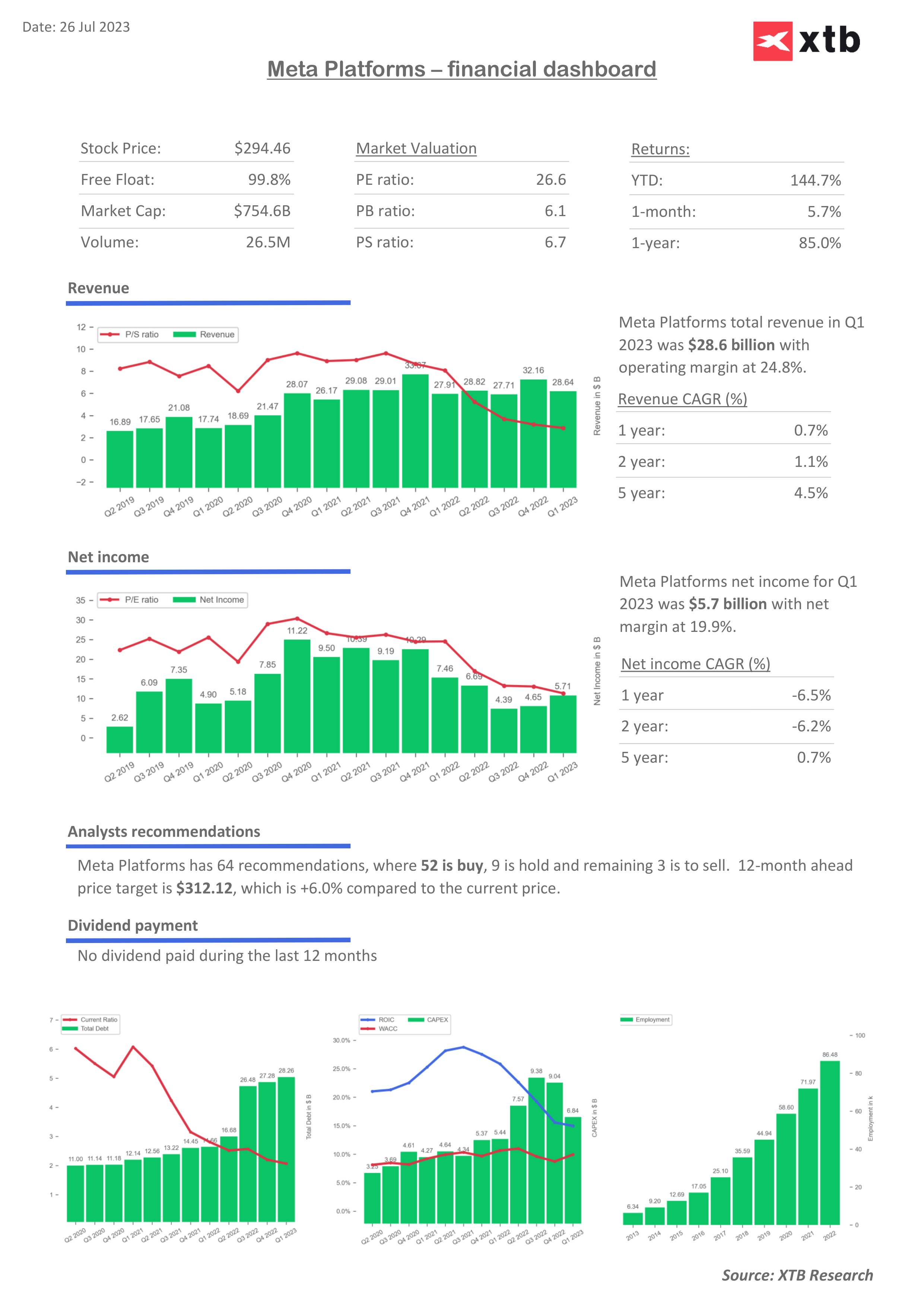

Source: XTB Research, Bloomberg

Source: XTB Research, Bloomberg

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.