Key takeaways:

- Analysts expect Meta to report revenue of $33.52 billion (+21% YoY) and EPS of $3.60 for Q3 2023, up from $2.98 in Q2 and $1.64 a year ago.

- Investors will be tracking the benefits of Meta's heavy investment in AI, as well as a rebound in digital advertising driven by Reels adoption.

- CEO Mark Zuckerberg's commentary on new AI products and services, Threads, and regulatory pressure will be closely watched.

- Investors may also want a spending update, as Meta has continued to spend heavily on VR despite cost-cutting in other areas.

- Meta decided to launch significant cost-cutting measures and is expected that SG&A expenses to have dropped more than 30% in the past year (according to Reuters)

Expected financial data (from Bloomberg):

- Revenue Q3 23 estimate $33.52 billion

- Advertising rev. estimate $32.94 billion

- Family of Apps revenue estimate $33.08 billion

- Reality Labs revenue estimate $313.4 million

- Other revenue estimate $211.7 million

- Revenue estimate Q4 23 $38.76

- EPS estimate $3.60 (EPS beat estimates in 8 of past 12 quarters)

- Operating margin estimate 33.9%

Other statistics:

- Facebook daily active users estimated at 2.07 billion

- Facebook monthly active users estimated at 3.05 billion

- Ad impressions estimate +29.6%

- Average price per ad estimate -8.94%

- Family of Apps operating income estimated at $15.23 billion

- Reality Labs operating loss estimated at $3.94 billion

- The average Family service users per day estimated at 3.09 billion

- The average Family service users per month estimated at 3.88 billion

Key metrics to watch:

- Revenue from Meta's Family of Apps, which includes Facebook, Instagram, and WhatsApp. Moreover any comments over Threads, a new platform that is the new rival for X (ex Twitter)

- Ad impressions and average price per ad.

- Operating income from the Family of Apps and Reality Labs.

- Daily and monthly active users for Facebook and the Family of Apps as Meta faces strong competition from platforms such as TikTok and BeReal

- Average Family service users per day and month.

- Operating margin.

The market is generally bullish on Meta's long-term prospects, but analysts acknowledge that the company faces some near-term challenges, such as competition from TikTok, BeReal, or even Snapchat. Moreover, investors will closely watch the introduction of new ways to monetize businesses on its platforms and its deep integration of AI across its services.

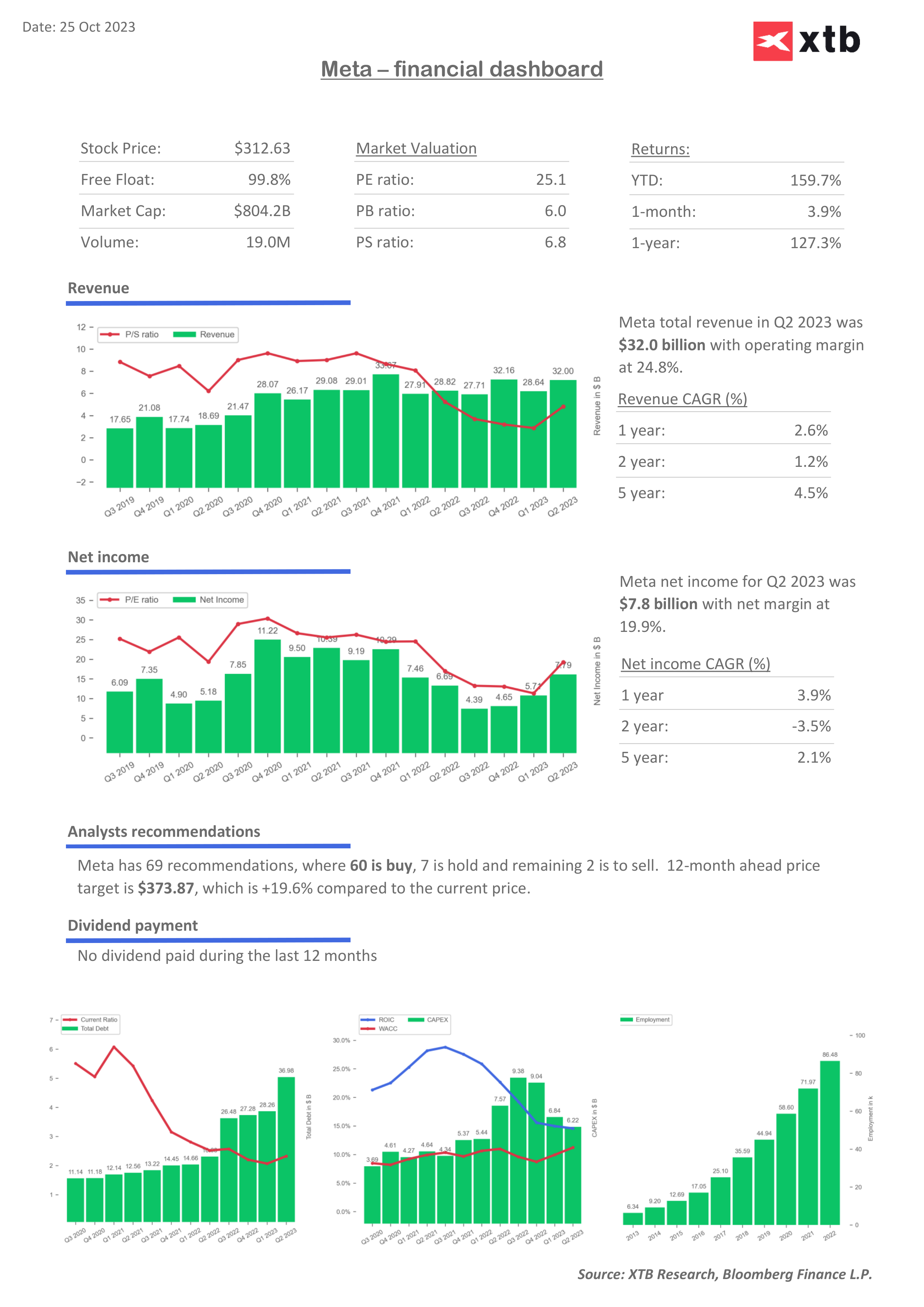

Dashboard for Meta. Source: Bloomberg Financial LP, XTB

Meta Platforms has recently been doing better than Nasdaq100 or the last driving force of the index, Nvidia. However, it is worth noting that the Meta is approximately 23% below the historical highs of 2021. The nearest resistance is at $330 per share, about 5% of the current price. On the other hand, the nearest support is close to $305 which is at the lower bound of the upward trend channel.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.