McDonald's (MCD) reported lower than expected comparable sales growth, lower than expected revenue but higher earnings per share (EPS) for the fourth quarter and full year of 2023, sending its stock price slightly higher in pre-market trading.

Key Highlights:

- Comparable sales: Global comparable sales increased 3.4% year-over-year (YoY), which was lower than Bloomberg estimate of 4.79%. US comparable sales grew 4.3%, while International Operated Markets and International Developmental Licensed Markets increased 4.4% and 0.7%, respectively. Estimations for both figures were higher than prints for Q4 2023.

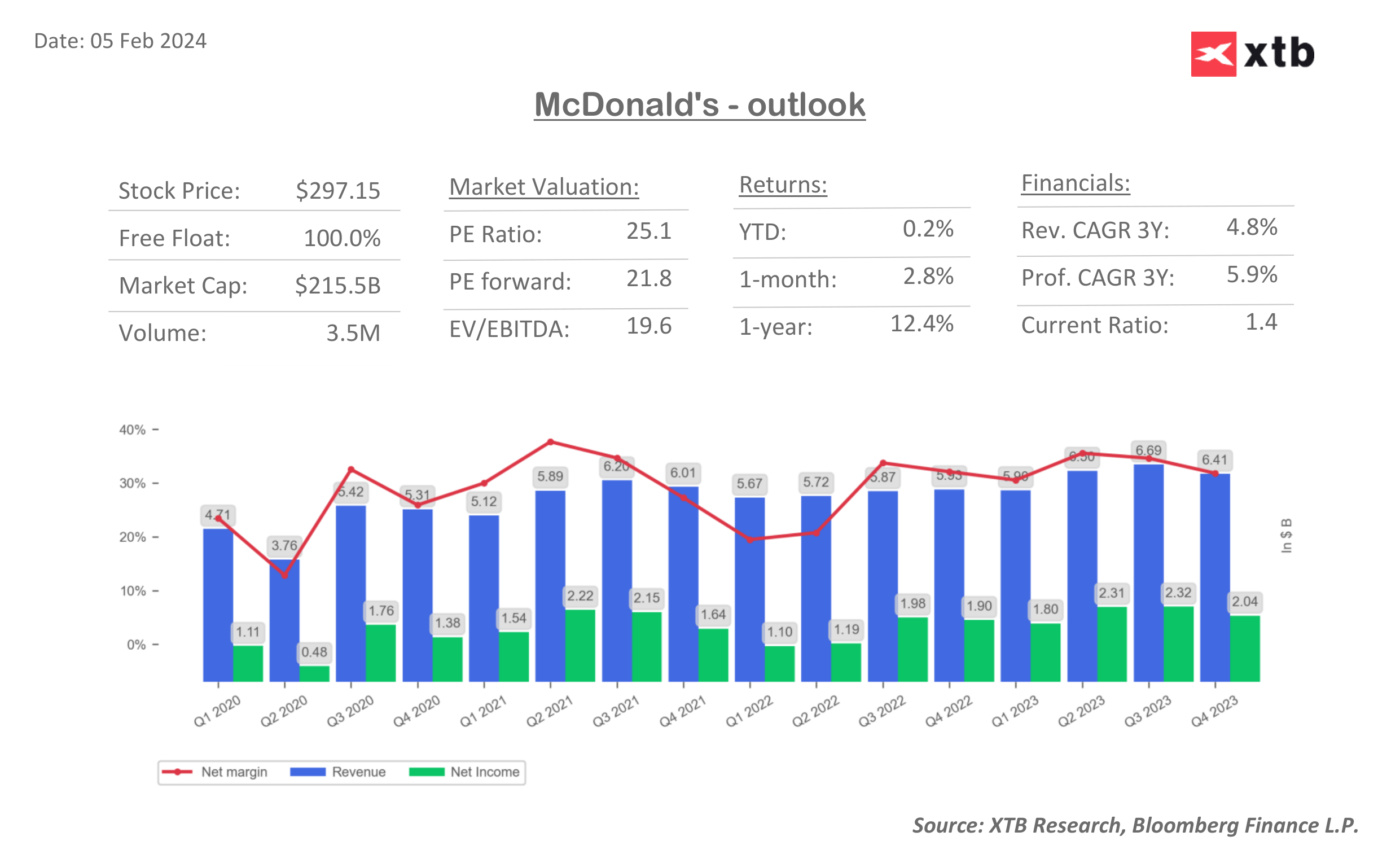

- Earnings: Adjusted EPS of $2.95 came in above the analyst consensus estimate of $2.82, representing a 14% increase YoY. Revenue of $6.41 billion was slightly below the estimate of $6.45 billion but still grew 8.1% YoY.

- Profitability: Operating income rose 8.5% YoY to $2.80 billion. The company expects its 2024 operating margin to be in the mid-to-high 40% range.

- Expansion: McDonald's plans to open more than 2,100 new restaurants globally in 2024, with over 1,600 net additions. The company expects to invest $2.5 to $2.7 billion in capital expenditures, with a focus on the US and International Operated Markets.

- Outlook: The company sees 2024 free cash flow conversion rate in the 90% range and expects year-over-year interest expense to increase by 9% to 11%. Despite "macro challenges," McDonald's CEO expressed confidence in the business's resilience.

Market Reaction:

McDonald's stock price rose about 0.3% in pre-market trading on the news. Analysts were generally positive on the results, despite that comparable sales growth came out below expectations, as the company's expansion plans were more important for the future.

The company has 33 buys recommendation, 10 holds and 0 sells. The stock increased 0.18% this year and 12.86% in 12 months.

Key data for MCD.US. Source: Bloomberg Finance LP, XTB

MCD stock is flat this year but is only 1.5% short to all-time high. Source: xStation5

MCD stock is flat this year but is only 1.5% short to all-time high. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.