McDonald’s (MCD.US) stock fell over 2.0% ahead of the opening bell despite the fast-food giant posted better than expected quarterly figures. However CEO Chris Kempczinski said that the company expects "short-term inflationary pressures to continue in 2023", which seems to weigh on investors sentiment.

-

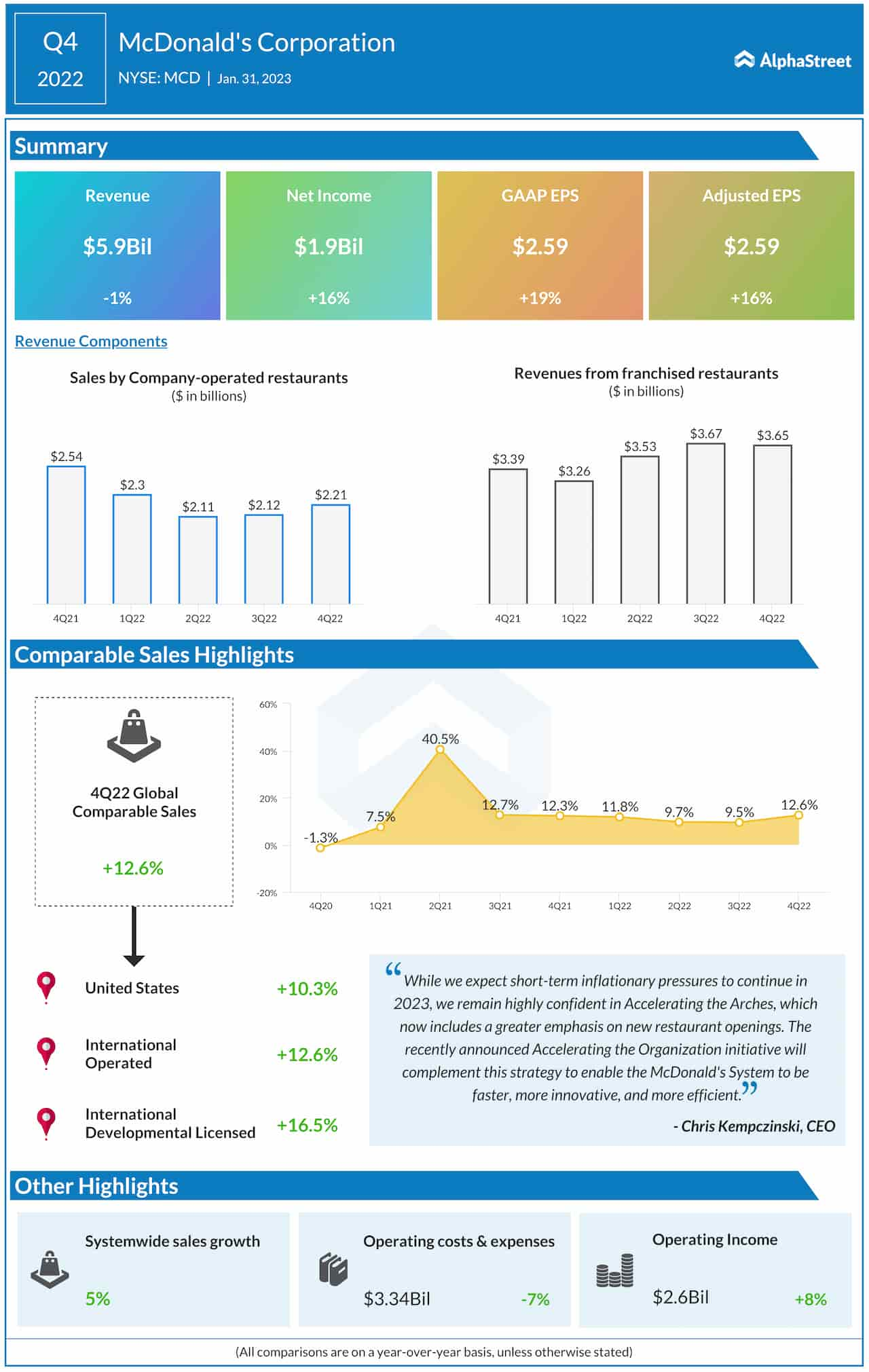

Earnings per share: $2.59 an increase of 19% vs. $2.45 expected by Refinitiv

-

Due to stronger dollar global revenue dropped 1% to $5.93 billion vs. $5.68 billion expected by Refinitiv. In constant currencies, revenue rose 5%.

-

Global same-store sales jumped 12.6% in Q4 2022, well above market consensus of 8.6% increase, according to IBES data from Refinitiv. Sales in the UK, Germany and France rose despite accelerating recession concerns in Europe.

-

Similar to other fast-food chains, McDonald's raised prices of its products last year in order to mitigate rising commodity and labor costs, however this did not discourage customers as traffic jumped 5% for full-year 2022.

Highlights of McDonalds Q4 earnings report. Despite recession fears, comparable sales increased significantly in the final quarter of 2022. Source: Alpha Street

Highlights of McDonalds Q4 earnings report. Despite recession fears, comparable sales increased significantly in the final quarter of 2022. Source: Alpha Street

- “Our Accelerating the Arches strategy is driving growth and building brand strength, delivering exceptional full year performance in 2022 with over 10% comparable sales growth and 5% comparable guest count growth globally,” said McDonald’s President and Chief Executive Officer, Chris Kempczinski. “While we expect short-term inflationary pressures to continue in 2023, we remain highly confident in Accelerating the Arches, which now includes a greater emphasis on new restaurant openings. The recently announced Accelerating the Organization initiative will complement this strategy to enable the McDonald’s System to be faster, more innovative, and more efficient. We’re proud of our continued strong performance, but we’re not satisfied. That’s the hallmark of McDonald’s.”

In the year ahead, McDonald's expects inflation pressures to continue, however this could benefit the company as its meals are cheaper compared to many competitors, which could further attract lower to middle income customers - as it did in Q3 and Q4 of 2022.

McDonald’s (MCD.US) stock pulled back from all-time highs at $282.00 in recent weeks and is currently trading within the local descending channel. Following Q4 earnings release price broke below 23.6% Fibonacci retracement of the upward wave launched in March 2022 and if current sentiment downward may deepen towards lower limit of the channel, which coincides with 38.2% retracement. Last week's sell-off was halted around key support at $250.00, which is marked with 50.0% retracement. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.