Looking at global economic data and the performance of stock indices, it would be almost blind to say that companies in the aviation sector simply must be doing well. However, this is not the case. The industry faces a number of challenges, some of which are cyclical in nature and others structural. As a result, while the travel season is underway, and the third quarter of the year should be record-breaking and supportive of demand for airline stocks, it is hard to see signs of seasonal euphoria. In the first half of the year, Europe's capitalization-weighted airline sector retreated nearly 10%, against a more than 9% rise in share prices from the STOXX Europe 600 index. Why?

Several factors have had an impact; including inflationary concerns that have altered consumer trends, driving demand toward 'budget' airlines, and rising costs for companies using largely leased fleets. As a result, while the consumer is strong and unemployment is low - this is not translating into satisfactorily high 'holiday' demand, with higher interest rates and service prices cushioning the 'positive' effects of lower oil prices. Hardly, Ryanair, which has been shining with increases until recently, has had a nearly 30% decline since the beginning of April. Investors also expect a discount in valuations due to exposure to geopolitical risk. Higher interest rates are increasing costs for leasing-based airline companies, and margins have come under pressure from rising wages and service rates.

Even 3 years after the coronavirus pandemic, global passenger volume served was still lower than in 2019. The only major airline company whose shares have risen above pre-pandemic levels is Ryanair. Source: ACI World

Flight demand not as strong?

The coronavirus pandemic caused the first 'bump' in the airline industry. Lockdowns led to a series of stock crashes from the airline sector, and consumers had limited or no use of carriers. Ultimately, the pandemic, or rather the central banks' reaction to the prospect of a sustained recession (which unexpectedly turned out to be only seasonal) led to over-stimulation of the economy and increased inflation. The covid-hit airlines barely had time to benefit from market stimulus and dormant demand in 2021-2022, and inflation turned into a problem... Prices rose to levels increasingly difficult for consumers to accept, and central banks were forced to raise interest rates.

This mix of factors for the industry proved disastrous, and the companies' cost increases were not cushioned by a strong consumer who changed preferences and adapted to the new situation. Airports Council International (ACI) World recently released its semi-annual update of estimated demand for air travel in 2024. This forecast included data from 2,600 airports in more than 180 countries. Before the pandemic, global passenger numbers were expected to reach 10.5 billion in 2023. This would represent a 119% increase from 2019 levels. The updated estimate for 2023 was about 8.7 billion passengers globally. This is significantly less than expected (although 31% more than in 2022). To some extent, the lower number of business trips handled is also affecting the industry; new remote meeting options are reducing demand.

Shares of large airlines 'losing out' to small ones

Big airlines mean big costs, long routes and customers willing to spend more money to fly - the problem arises when the latter component fails. Despite historically low unemployment in the European Union (and the United States), as well as a sizable resilient economy and lower oil prices, the stocks of European airlines like Lufthansa and Air France KLM look like no one wants to buy them.

In fact, share price quotations are at the 'covid panic' level of 2020. Both companies are facing significant wage pressures, higher operating and aircraft maintenance costs. Another 'burden' is new fees for sustainable jet fuel, through which Lufthansa has raised ticket prices by nearly 80 euros. Investors fear this will lead to further destruction of demand, creating additional pressure on businesses that are already looking bad. Shares of Frankfurt airport Fraport AG have been similarly 'battered' in recent years.

Source: xStation5

While the stocks of the largest, recognizable airlines on the Old Continent look like they just landed, the stocks of smaller continental airlines are doing better. We're talking about Wizz Air (which recently struggled with engine problems from Pratt & Whitney) or Ryanair. The reasons? Affected by inflation, consumers are forgoing more expensive intercontinental travel and opting for less wallet-demanding destinations. Details also matter in the industry - many operators rely on leasing and borrowing machinery, which further increases the cost of doing business - even more so in a high interest rate environment, when lenders expect a higher premium, for providing capital or leasing machinery.

In the case of Ryanair, this is not the case, and 'lower business leverage' and its own fleet in a problematic environment are perceived by investors as an asset. So we have the first conclusions - the consumer is not denying himself pleasure, but changing his choice and adapting to the situation. Thus, solid wage growth has so far not translated into astronomical demand. What's more, high interest rates offer higher interest rates on savings accounts, or bond yields... The consumer sees the alternative of 'earning' interest on cash.

Ryanair's 2023 revenue rose from €4.8 billion to €10.78 billion, with pre-tax profit up 34% annually. The company served 184 million passengers last year, 23% more than before the pandemic and 9% more than 2022, despite problems in Boeing aircraft deliveries. So far, 2024 promises to be a very good year for the company with a 21% y/y increase in average flight prices, but Ryanair reported that the trend for the second part of 2024 - including bookings for the seasonally record Q3 - looks weaker. That was enough for the company's shares to fall about 30% from this year's highs. Investors see this as a signal of weakness for the industry as a whole. Indeed, an intuitive conclusion emerges. If Ryanair, which has been doing best of all so far, is seeing a slowdown, what else will we see in other companies? We saw a foretaste of this recently. Airbus slashed its full-year profit and delivery forecasts by €1.5 billion, sending its shares down more than 12% in a single session. The company cited rising operating costs.

Source: xStation5

We have seen year-on-year growth in Ryanair's key business metrics, but investors are concerned about whether this momentum will be sustained. Source: Ryanair Quarterly Report

Let's not get dramatic

How does the situation look in the US? In May 2024, the United States experienced its second-busiest day on record, with some 2.9 million passengers served at airports across the country... But here, too, there is no excitement among airline stocks of companies, although more and more Americans want to travel after pandemic lockdowns. Looking at the performance of airline stocks, it's hard to say that the situation is dramatically different from Europe. But investors are hoping that lower prices and rising real wages will eventually translate into higher demand, at least on the other side of the Atlantic.

The latest inflation report showed a decline in U.S. airfares, and analysts are hopeful that falling prices may prompt more consumers to travel, boosting already strong demand. The Consumer Price Index report showed that airfares fell 3.6% in May from the previous month. The decline further deepened compared to the April data (-0.8%). At this point, it is worth mentioning that there are also beneficiaries of rising costs in the airline sector. Just look at the stock prices of American Heico, a conglomerate that specializes in the manufacture and servicing of aircraft.

The most serious problem for U.S. airlines this year is Boeing, which, through failures and problems identified mostly in 737 MAX models, will deliver fewer planes. In March, the company delivered 24 airplanes (a 53% year-on-year decline), but during the first two weeks of April, there were only 3 airplanes, according to Cirium. Estimates from AeroDynamic Advisory indicate that the U.S. airline will receive 40% fewer planes than expected, with Europe's Airbus also responsible for an additional 38% of the shortfall. So we have a supply chain factor that will 'unnaturally' reduce US airline sales and profits this year. Given this, some investors may prefer to wait to see how the situation with Boeing and Airbus supplies develops next season.

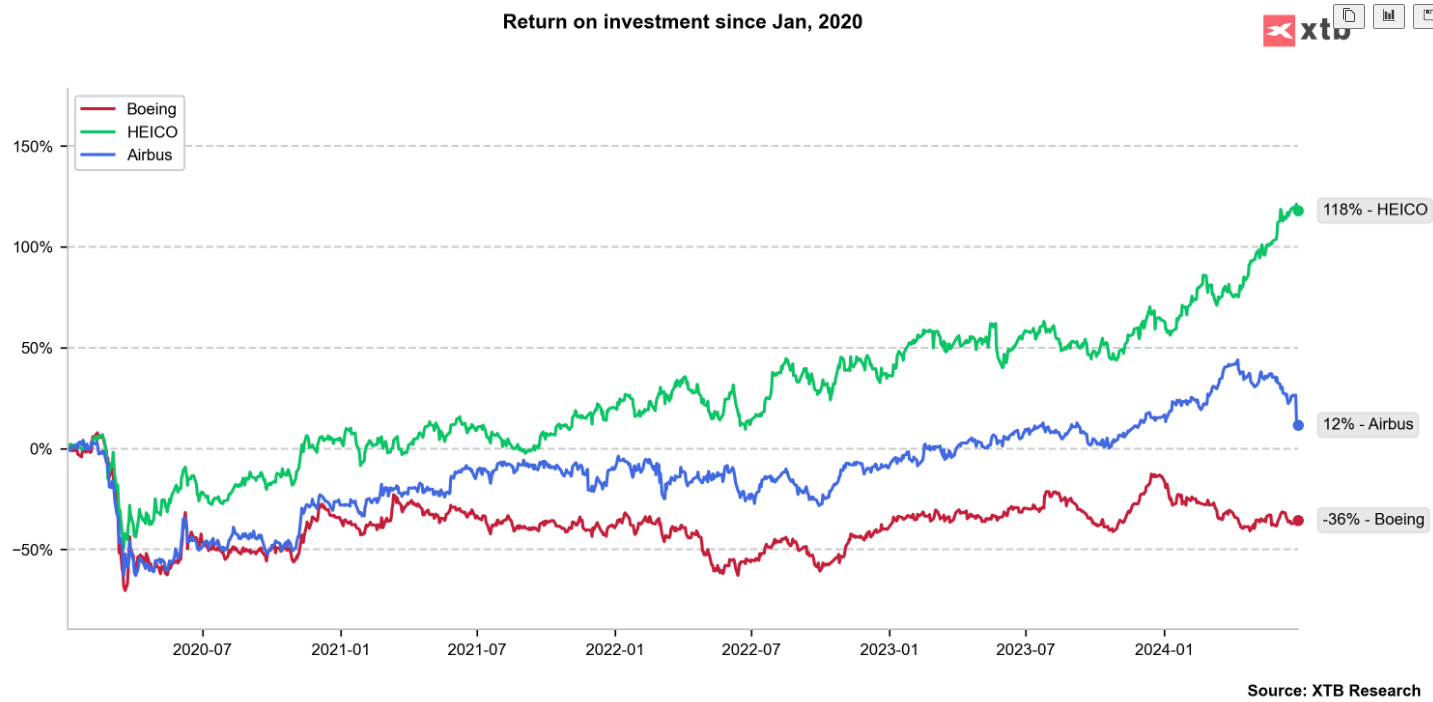

HEICO shares have risen more than 119% since January 2020, compared to a modest 11% increase in Airbus and a 36% decline in U.S. Boeing shares. Source: XTB Research

HEICO shares have risen more than 119% since January 2020, compared to a modest 11% increase in Airbus and a 36% decline in U.S. Boeing shares. Source: XTB Research

Are there reasons for optimism?

As investor sentiment around the airline industry is weak, we might consider whether this situation represents an opportunity. The latest inflation report from the U.S. indicated falling ticket prices, which in an optimistic scenario could translate into a seasonally higher number of people interested in flying. Month-on-month, U.S. ticket prices fell 3.6% in May, compared to a 0.8% drop in April. It's really hard to expect to what extent the lower prices will translate into increased demand, and to what extent they are a de facto reflection of falling demand. Valuations of European companies in the sector, in terms of price-to-earnings ratios, have fallen, and are trading close to 50% below the average carried through 2019.

In the long term, however, the number of global passengers served is expected to grow both within countries and internationally. Especially dynamically in Africa and Asia. So we can say that for long-term investors in the industry, there are still good reasons for optimism. Source: ACI World forecasts

Certainly, the scenario of a soft landing (falling inflation and the absence of a simultaneous slowdown in the economy and rise in unemployment) and gradual reductions (or rather, normalization) of interest rates at major central banks could trigger favorable moves for the sector. Similarly, the rise in real wages may finally suggest that consumers will stop worrying excessively about inflationary pressures. On the other hand, however, a potential recession and a sudden rise in oil prices could increase pressure on airline stocks and 'prolong' the slump. Similarly, the escalation of armed conflicts, including those in Ukraine or the Middle East, remains a significant risk factor for the global aviation sector and companies operating on 'sensitive' routes.

However, it does not appear that the current season will be exceptionally successful for companies in the industry, which seems to be gradually reflected in company valuations. One thing is certain - to maintain business growth, aviation companies will have to pass on rising costs, to consumers. While oil prices remain uncertain and could still fall, there are certain aspects that will almost certainly weigh on them - talk of wage pressures or costly compliance with new green environmental standards, among others. The question is, how much will consumers be able to afford in the coming years, and will they cushion airlines from this fact?

Eryk Szmyd Financial Markets Analyst XTB

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.