- Market expectations point to a very strong NFP report for March

- 9.5 million jobs are still lacking compared to the pre-pandemic situation

- Vaccinations and reopening of the economy should positively affect recovery of the labour market

- EURUSD, US2000 are two key markets to watch

The publication of the most important data of the week - the NFP report will take place on Good Friday, despite the fact that many markets are closed. However, the Wall Street session will take place. The currency market and cryptocurrency CFDs also work normally. The commodity market for the most part will be closed.

Vaccines and lifting restrictions

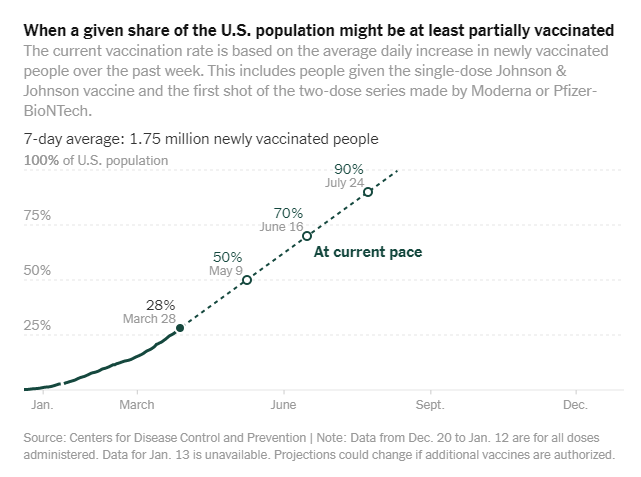

Biden lived up to his promise in terms of vaccinating nearly a third of the US population. Vaccinations increase public sentiment and significantly reduce the number of new COVID-19 cases, leading to a faster recovery. Texas, for example, lifts almost all restrictions, and people reappear in bars, restaurants and cinemas, which increases employment in these sectors.

The US population may be fully vaccinated by mid-year. Source: New York Times

The US population may be fully vaccinated by mid-year. Source: New York Times

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Good February data

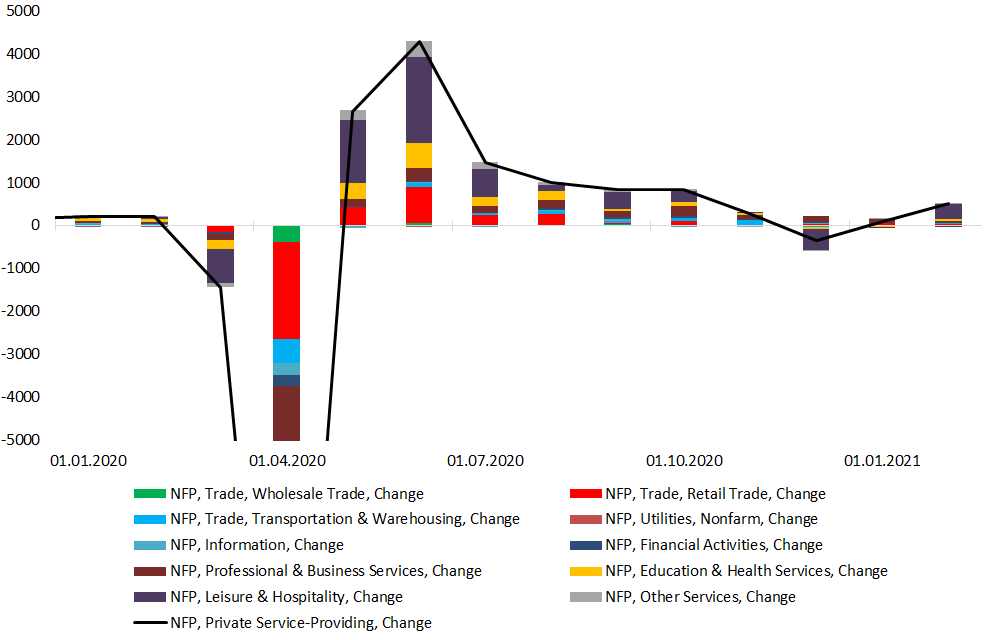

February data beat market expectations, which was probably related to vaccinations and loosening of restrictions. This trend can be expected to continue. It is worth noting that since October last year, the negative trend in employment not only accelerated, but also the data negatively surprised many times. We are currently seeing a revival.

Many sectors have not recovered from the decline in employment seen in March and April last year. Increased vaccinations should restore employment in the sales and restaurant sector. Source: Macrobond, XTB

Many sectors have not recovered from the decline in employment seen in March and April last year. Increased vaccinations should restore employment in the sales and restaurant sector. Source: Macrobond, XTB

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Weather conditions are improving

It is worth remembering that in February we witnessed a real winter attack in the United States, especially in the South, where such weather turbulence was unlikely to take place. All of this could have had a negative impact on employment back then but now that effect has faded away.

Lower number of applications for unemployment benefits and ADP

Recently, unemployment benefit claims have fallen to their lowest levels since the start of the pandemic. Additionally, there are suspicions that the recent extension of federal benefits may have slightly distorted the data and may not fully show the actual improvement in the labor market. With more vaccinations, special pandemic benefits are unlikely to be extended. In turn, the ADP report slightly disappointed compared to expectations, although the reading came in above 500,000, which is the highest reading since September.

How might the market react?

EURUSD

One should certainly expect a positive report for the economy. Nevertheless, the strength of the market reaction will depend on the level of the data itself. Certainly, strong employment growth should work in favor of the dollar, although the dollar has been really strong in recent days and profit taking cannot be ruled out. On the other hand, a very negative reading could in turn lead to a rebound from the key support. However, this is not the baseline scenario.

Yields in the US rose to almost 1.8%, which pushed EURUSD significantly below 1.1800 level. An important support in the form of the 38.2 Fibonacci retracement is currently being tested. In March, the pair recorded the largest decline since May 2018. At that time, short-term support was located at 1.1530. It is worth noting that EURUSD is no longer extremely overbought according to the COT. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

US2000

Significant employment growth should be a sign that the economy is improving, which could lead to a further rebound of the Russell 2000 index, which is mainly cyclical. Moreover, Biden has recently announced a major infrastructure project that should be positive for the companies included in the index. Nevertheless, disappointment with the reading may pull the S&P 500 index down from 4,000 pts level, which could lead to a potential strong correction of the Russell 2000 index.

The US2000 broke above the 50.0 Fibonacci retracement of the recent correction, which is a positive signal for the index. The first major resistance is located around 2,300 pts. Nearest major support lies around 2,170 pts, slightly above the 23.6 retracement. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.