-

Another strong NFP report expected

-

Lower ADP, higher ISM employment subindex, drop in jobless claims

-

EURUSD bounce off a key support, yields remain relatively low

-

Wall Street fears that Fed will start tapering, US100 near important support

NFP report for April is eagerly awaited by investors, especially after the latest release showed an over 900 thousand increase in US employment. Market expects a similar report for April, what can be reasoned with further reopening of the economy. What should we expect from Friday's report? How will EURUSD and yields perform? Will Wall Street recover from a recent sell-off triggered by concern of possible increase in interest rates?

High expectations?

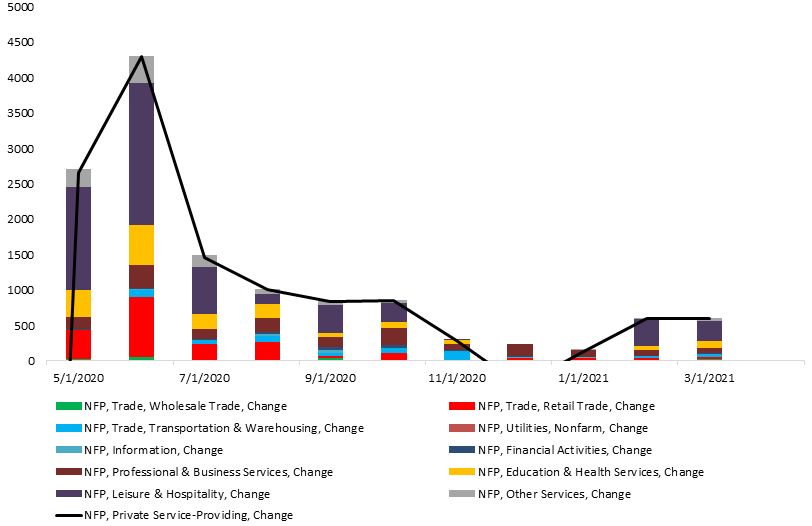

Market consensus compiled by Bloomberg points to a 998k employment gain in April. The lowest estimate hints at 700k increase while the highest suggests that 2100k jobs were created in the previous month. After a few months of stagnation, employment in Leisure & Hospitality as well as Education & Health Services has rebound over the past two months. Retail sector also experienced stagnation but in this case we may see a recovery in April due to a new round of stimulus checks.

Employment in Education & Health Services as well as Leisure & Hospitality segments experienced boom-like conditions in the past two months. However, those employment gains are not enough to satisfy the Fed. Source: Macrobond, XTB

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

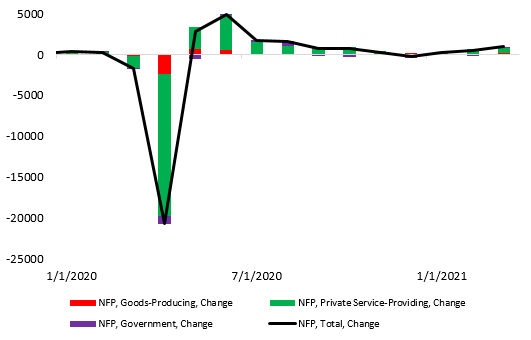

US economy is still short of around 8.4 million jobs lost during the pandemic. Will Fed change its view when employment starts to rise by 1 million jobs on a monthly basis? Source: Macrobond, XTB

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

What can we read from early signals?

Reopening of the economy is one thing but traders should also look at signals sent by companies. Situation looks to be improving on this front but that latest ADP report raises some concerns. It has shown a 742k employment gain, amid expected 810k increase. However, it should be noted that ADP pointed to a 565k increase in March while NFP report showed a gain of over 900k jobs.

Services ISM employment subindex increased in April from 57.2 to 58.8 - the highest readings since mid-2019. Meanwhile, manufacturing ISM employment subindex dropped in April from 59.6 to 55.1.

Average initial jobless claims dropped from around 720k to 610k since the last NFP release. The latest data showed claims significantly below 600k.

US monetary policy

Fed sent a clear signal that it is not concerned about inflation now. Latest remarks from Yellen calling for higher interest rates should not change the Fed's view. Having said that, even a stellar jobs report for April should not have a major impact on the direction of Fed's policy. However, should inflationary pressures mount, US central bankers may signal that there is a need to begin discussion about QE tapering. Given that the Fed has ignored recent signals, it looks unlikely that FOMC will decide to change policy prior to June.

EURUSD

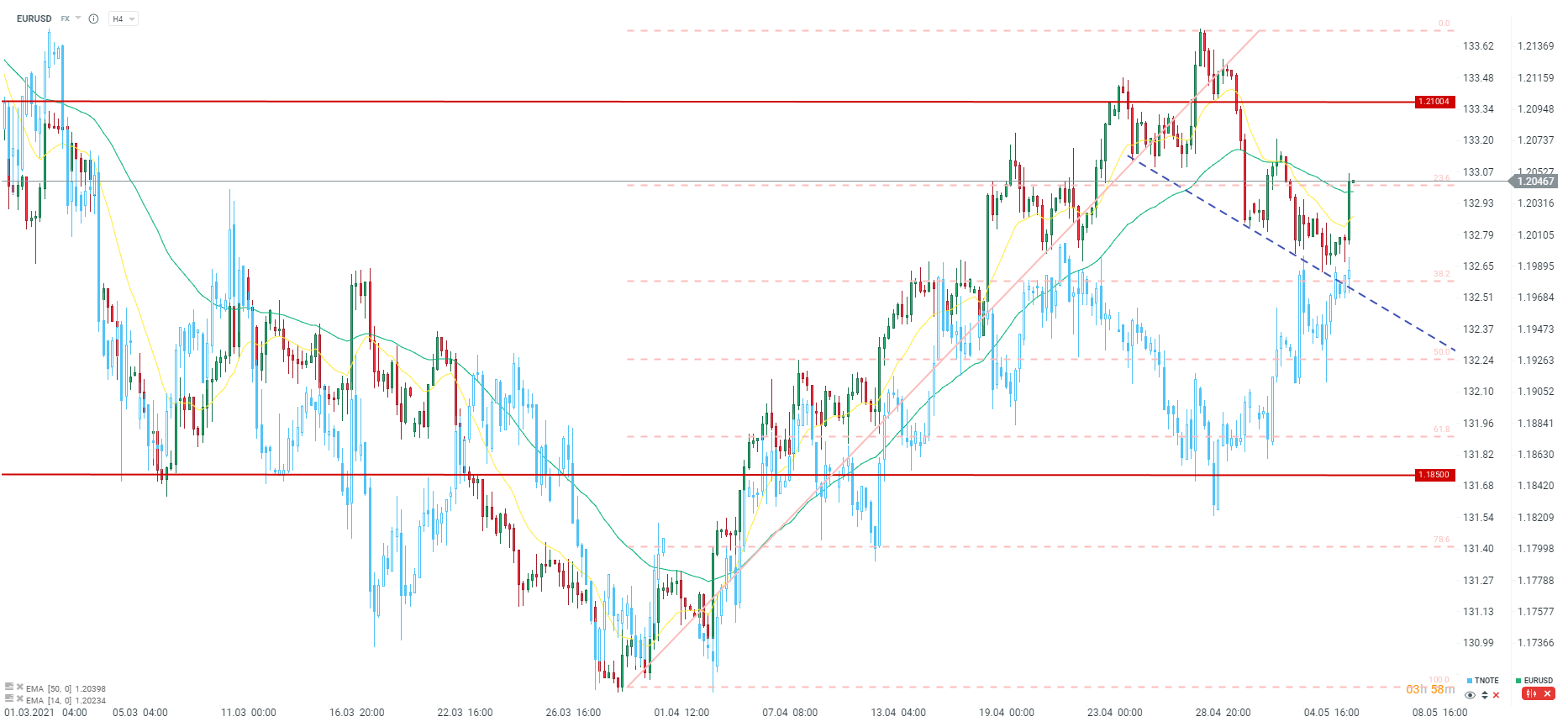

EURUSD managed to defend the key support area at 1.20 and relatively low yields may be the reason. As one can see, TNOTE trades near key short-term resistance at 132.8 points. Source: xStation5

EURUSD managed to defend the key support area at 1.20 and relatively low yields may be the reason. As one can see, TNOTE trades near key short-term resistance at 132.8 points. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

US100

US100 dropped hard following Yellen remarks on the need for higher interest rates. US100 reached the target of a double top pattern. 13,333 pts area is a key support for now. Source: xStation5

US100 dropped hard following Yellen remarks on the need for higher interest rates. US100 reached the target of a double top pattern. 13,333 pts area is a key support for now. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

NFP Market Live

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.