Summary:

-

Four US agricultural giants plan to use blockchain in global grain trade

-

DLT project shows promising results in Canada

-

Major coins move higher on Monday, ETHEREUM approaches the upper bound of the consolidation range

Some gains can be spotted on the cryptocurrency market at the beginning of a new week. Most of the major digital currencies are pushing higher on Monday morning but DASH lags behind in the vicinity of yesterday’s close. The capitalization of the whole market hovers around the $209 billion handle with Bitcoin having a 53.7% share in the market.

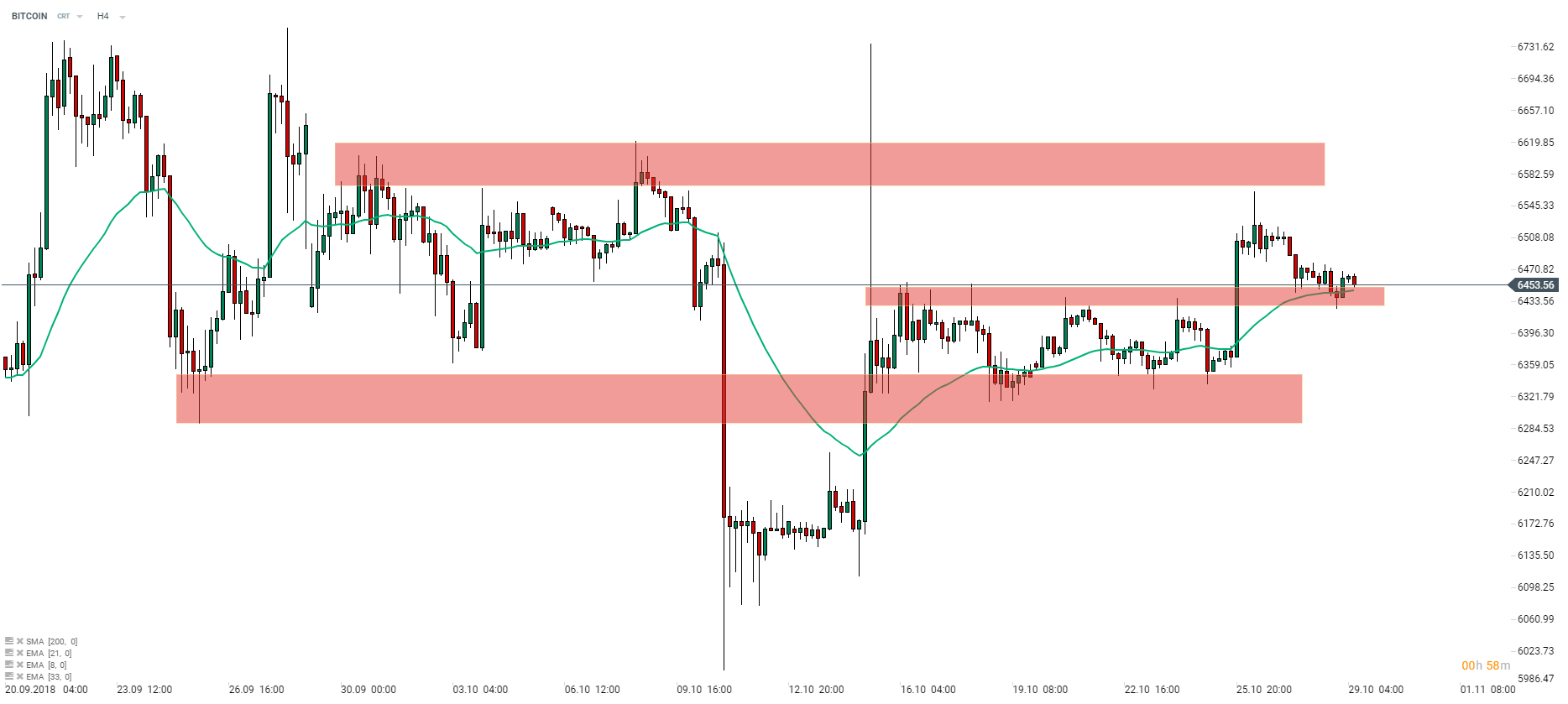

BITCOIN is still trading within the consolidation ranging $6350-6570. The coin recently bounced off the support zone around $6440 handle. Notice that 33-period moving average can be also found there. In case the upward move is to extend the upper bound of the aforementioned consolidation range may be the first area to watch. Source: xStation5

BITCOIN is still trading within the consolidation ranging $6350-6570. The coin recently bounced off the support zone around $6440 handle. Notice that 33-period moving average can be also found there. In case the upward move is to extend the upper bound of the aforementioned consolidation range may be the first area to watch. Source: xStation5

A pleasing development concerning the blockchain technology comes from grains market. Namely, the group of four major agricultural companies announced they plan to utilize modern technologies like blockchain or artificial intelligence in order to standardize and digitize international agricultural shipping transactions. The companies will first focus on automation of the post-trade processes as they are conducted mostly manually and constitute a high-cost portion of the supply chains. Once the progress is made in this field the group will move on to automate other manual and paper-based processes like payments, invoices or contracts. The four companies involved in the project are Archer Daniels Midland Company, Bunge, Cargill and Louis Dreyfus. However, the group welcomes any other industry members to join them and help accelerate the process “for the benefit of the entire industry”.

ETHEREUM, just like BITCOIN, is trading within the consolidation range. The digital asset found support at 33-period moving average at H4 interval recently and approached the resistance zone above $203 handle. This zone also serves as the upper limit of the current consolidation range therefore market reaction to this hurdle may be crucial for the future price movements. Source: xStation5

ETHEREUM, just like BITCOIN, is trading within the consolidation range. The digital asset found support at 33-period moving average at H4 interval recently and approached the resistance zone above $203 handle. This zone also serves as the upper limit of the current consolidation range therefore market reaction to this hurdle may be crucial for the future price movements. Source: xStation5

News surfaced recently concerning another, this time more market-oriented, application of the distributed ledger technology (DLT). Namely, five Canadian entities teamed up and tested the capability of the technology to clear and settle stock market transactions. The team consisted of the Bank of Canada, TMX Group (Canadian stock exchange operator), Accenture (consulting firm), R3 (blockchain company) and Payments Canada (payments system organization). Results of the test look promising as companies said that settlement via DLT turned out to be less expensive and more efficient. Additionally, the test revealed that counterparty risk was also significantly reduced. However, the group said that further tests are needed to see what can be done to maximize benefits of the DLT for the whole financial system.

LITECOIN price once again found bottom at the support zone ranging $50.35-50.95. The subsequent bounce higher brought the coin to the 33-period moving average in the vicinity of $51.70. In case bulls manage to overcome this obstacle the next stop for buyers could be resistance zone above the $55.85 handle. Source: xStation5

LITECOIN price once again found bottom at the support zone ranging $50.35-50.95. The subsequent bounce higher brought the coin to the 33-period moving average in the vicinity of $51.70. In case bulls manage to overcome this obstacle the next stop for buyers could be resistance zone above the $55.85 handle. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.