Macy’s (M.US) stock jumped more than 13.0% on Wednesday after the upscale department store chain posted better-than-expected Q3 profit and revenue figures. Company raised its annual earnings forecast on steady demand from wealthier shoppers.

-

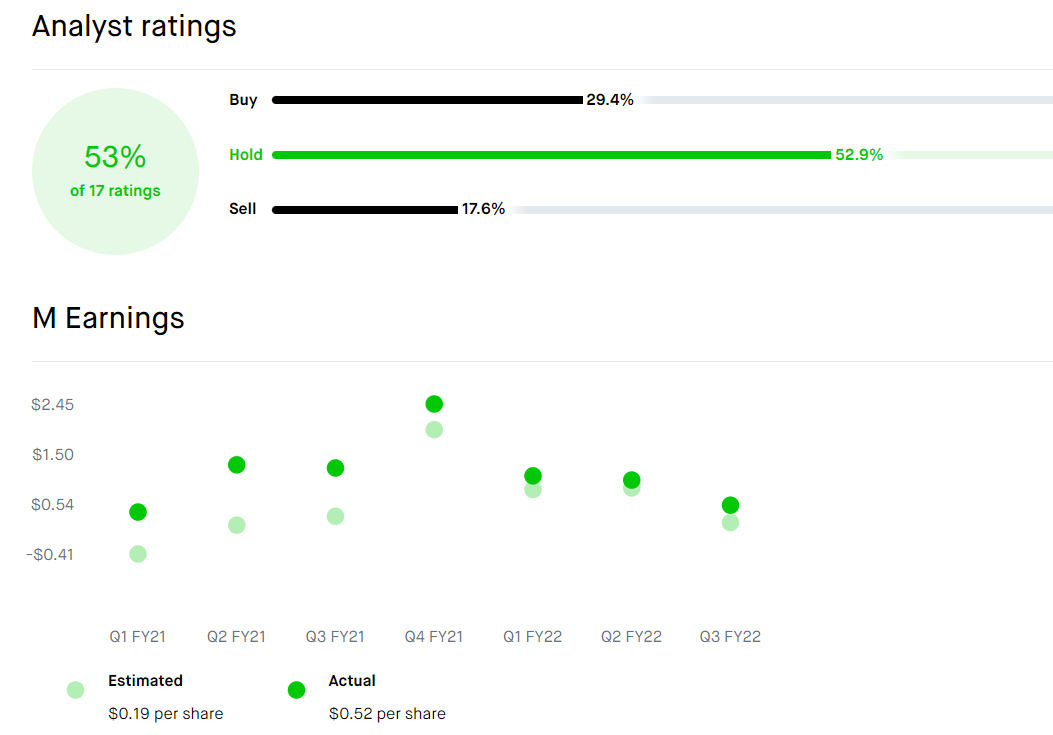

Company earned 52 cents per share, which is a 57% decline compared to the same period last year, however easily topped analysts’ estimates of 19 cents expected

-

Revenue dropped 3.9% to $5.23 billion, slightly above market estimates of $5.2 billion expected

-

Same-store sales fell 3.1%, less than analysts expected

-

For the 2022 financial year, company forecasts net sales in the region of $24.34 billion to $24.58 billion, with adjusted earnings in the range of $4.07 to $4.20 per share, significant improvement compared to earlier forecasts between $4.00 and $4.20 per share

-

“Our Polaris strategy is working. In the third quarter, we achieved solid top line results and a strong beat to our bottom line guidance. Macy’s brand position as a style and fashion source resonated with our customers, while luxury continued to outperform at Bloomingdale’s and Bluemercury,” said CEO Jeff Gennette.

-

Macy's plans to hire more than 40,000 seasonal workers during the holiday period, a sharp decline compared to nearly 80,000 workers last year -including permanent staff - which may indicate that the company expects lower turnover in its key quarter.

Earnings easily topped market estimates in Q3 2022, however have been gradually decreasing since Q4 2021. Source: https://robinhood.com/stocks/M/

Earnings easily topped market estimates in Q3 2022, however have been gradually decreasing since Q4 2021. Source: https://robinhood.com/stocks/M/

Macy’s (M.US) stock rose sharply on Thursday and is currently testing a major resistance zone around $22.40 which is marked with the upper limit of the 1:1 structure and upper limit o the ascending channel. Should break higher occur, upward move may accelerate towards resistance at $25.00, which coincides with 38.2% Fibonacci retracement of the bullish wave from March 2020. On the other hand, if sellers manage to regain control, nearest support to watch can be found at $21.10, which is marked with previous price reactions and 50.0% retracement. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.