- China unlikely to benefit much from the PhaseOne

- Europe mired in manufacturing slowdown

- US Fed not willing to deliver more cuts

Asia – PhaseOne trade deal could have minimal impact

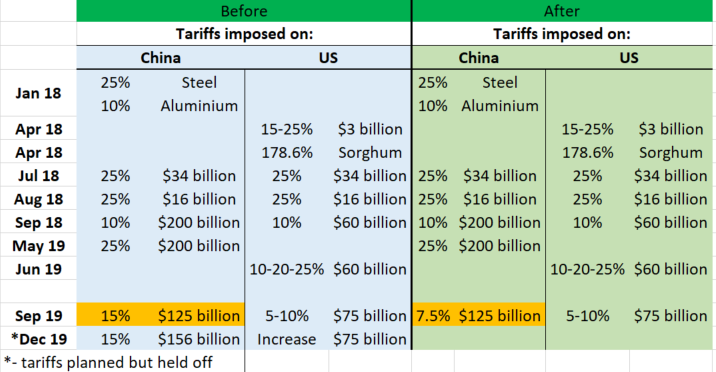

The PhaseOne China-US trade deal has been much hyped on the markets and in the media and there can be impression that it will bring major economic benefits. Do not hold your breath for them. China will see only a minimal bump in exports that could easily be dissolved by other factors (like a persistent manufacturing slowdown) as halving tariffs (15 to 7.5%) on $120bn of imports (mostly clothes) could maybe result in additional $10bn of exports. If China increases its imports from the US by $100bn annually, as it has promised, it could drive US output noticeably but we just cannot see how it could deliver on a promise of nearly doubling (!) imports from the US right away (and with some tariffs still in place). For that reason, markets may soon start having second thoughts about the deal and trade uncertainty is likely to stay with us in 2020.

Effective decline in tariffs on China will be minimal. Source: XTB Research

Effective decline in tariffs on China will be minimal. Source: XTB Research

Key economic event this week: Bank of Japan decision (Thursday)

Europe – manufacturing weakness persists

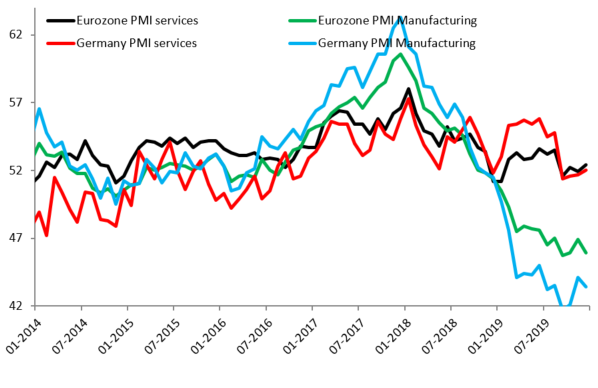

There was a lot of hope on the markets that manufacturing crisis that’s been especially severe in Germany is slowly going away. The latest data pour some cold water on these expectations. PMIs in both Germany and France slid, defying expectations. In Germany the pace of new orders contraction is the lowest in months but the overall index is still in the recessionary territory. Another weak reading in Japan (8th month of sub-50 prints) mean the plight remains global in nature and the drop in UK to multiyear low means some Brexit clarity might not be enough to kick-start growth.

After some hopes last month, December’s PMIs disappoint again. Source: Macrobond, XTB Research

After some hopes last month, December’s PMIs disappoint again. Source: Macrobond, XTB Research

Key economic event this week: Bank of England decision (Thursday, 12:00 pm GMT)

US – Fed refuses to cut rates

The US Fed has maintained interest rates unchanged at the December meeting and has pretty much ruled out further moves – up or down – for many months ahead. On one hand, it’s a good news for indices, as the bar for higher rates now seems to be very high. On the other hand, it means that a major correction would be necessary for the Fed to deliver another hand. This stance could technically support the US dollar but abundant repo operations (and corresponding balance sheet expansion) change this arithmetic and the US currency could be losing in weeks ahead.

With US indices at all-time highs the Fed has little incentive to cut rates. Source: xStation5

With US indices at all-time highs the Fed has little incentive to cut rates. Source: xStation5

Key economic event this week: PCE inflation (Friday, 3:00pm GMT)

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.