The US CPI inflation rose to 9.1% YoY - nobody from Bloomberg analysts expected such a high reading.. No wonder that rate hikes expectations in the US soared and EURUSD again tested the parity. The Fed has to prove that it can bring inflation down and, above all, inflation expectations.

Inflation in the United States surges, although core inflation is falling slightly - this is the effect of slower price dynamics of some components like cars. However, prices related to the real estate sector continue to rise despite higher interest rates. However, this is related to the cost of shelter. Source: Macrobond, XTB

The further increase in fuel costs is noticeable which is disturbing because it is the biggest contributor. Of course, housing (shelter) costs continue to rise, and so do utility costs. On the other hand, the dynamics of car prices is falling - prices are still rising, but this dynamics has been falling for 3 months in a row, which lowered core inflation reading. Source: Macrobond, XTB

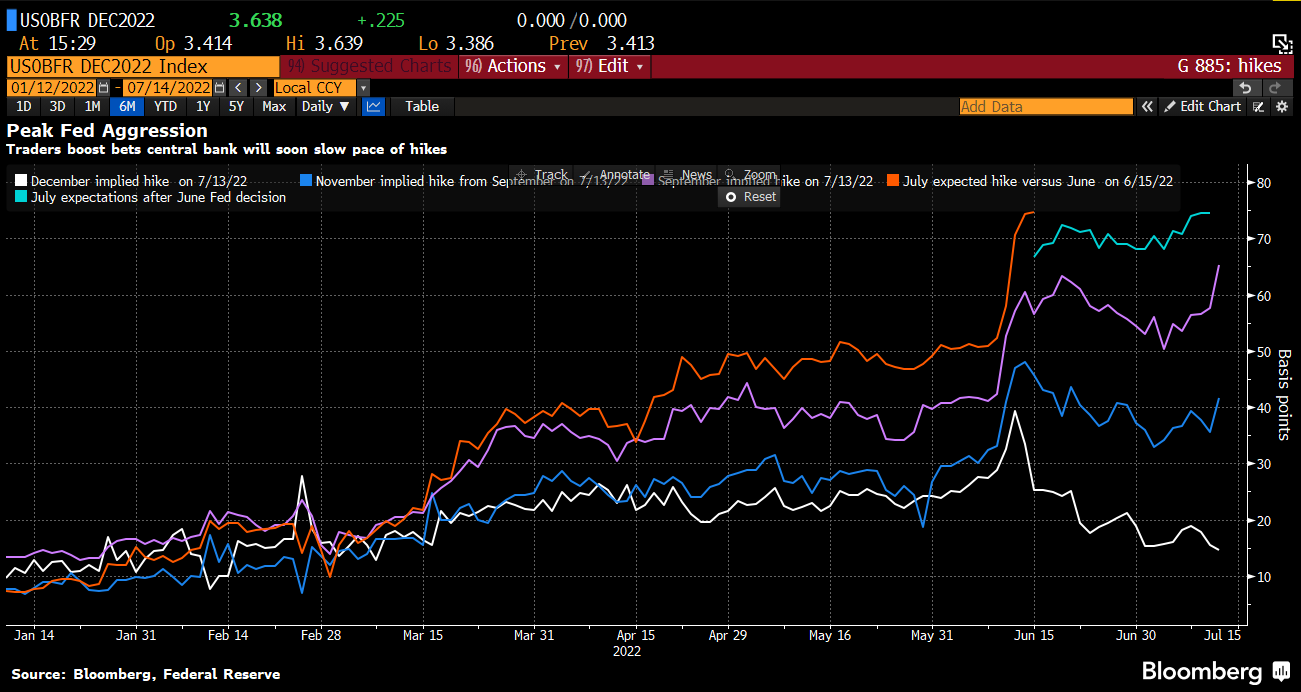

The interest rate market reacted very strongly. Yesterday most of the analysts expected a hike of 74-75 bp in July, and today the forecasts increased to almost 84 basis points. Taking into account September, markets expect two increases of 75 basis points. One cannot exclude such a move as a 100bp rate hike in July and a 50 bp rate hike in September, although at this stage it seems unlikely. We will see what the next comments from the Fed bankers will look like. Nevertheless, strong increases to 3.5% by the end of the year are almost certain.

Markets estimate that by December interest rates will be 3.6%, which is almost 200 basis points from current levels. This means that we should expect a rate of 3.5% at the end of this year. The market sees interest rate cuts as possible from April-June. On the other hand, some Fed members see rates close to 4% by the middle of next year. Source: Bloomberg

The expectations regarding the September rate hike rose the most. Taking into account the next two meetings, there is a chance for a 150 bp rate hike! However, the market expects the Fed will complete the process of raising interest rates at the end of the year, with little chance for a December move. First rate cuts are expected in 2023. Source: Bloomberg

EURUSD tested the parity again. However, aggressive hikes and possible recession may suggest that the dollar has not said the last word yet. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.