Markets are interpreting the Fed's speech as dovish. We are observing capital flow to risky assets along with a weakening of the dollar. US500 and US100 are already gaining over 1.0%, while Bitcoin is rising nearly 4.0%.

Federal Reserve chair, Powell speech:

- We will make future decisions on totality of data, evolving outlook and incoming risks

- Given how far we've come and given uncertainties, we are proceeding carefully

- We're well into restrictive territory

- The path forward uncertain

- Higher interest rates are also weighing on business fixed investment.

- Growth in economic activity has slowed substantially.

- Activity in the housing sector has flattened out.

- The full effects of tightening are likely not yet felt

- We anticipate getting inflation to 2% will take some time.

- The lower inflation readings over the last several months are welcome.

- We estimate core PCE prices rose 3.1% in 12 months ending November.

- Policymakers expect labor market rebalancing to continue.

- We expect the labor market easing to continue.

- Labor demands is still exceeding supply though.

- Nominal wage growth appears to be easing.

- The labor market remains tight, but is coming into better balance.

- Policymakers don't want to take possibility of further hikes off the table.

- We will keep policy restrictive until we're confident we're on the path to 2% inflation.

- We're prepared to tighten policy further if appropriate.

- While we believe our policy rate is likely at our near its peak for this cycle, we have been surprised in the past.

- The Fed estimates the November PCE prices up 2.6% YoY, with core up 3.1%.

- We anticipate getting inflation to 2% will take some time.

Summary:

-

The Federal Reserve will base future policy decisions on a comprehensive assessment of economic data, evolving economic outlook, and potential risks.

-

Given the significant progress made and prevailing uncertainties, the Fed is adopting a cautious approach in its policy decisions.

-

The current interest rates are in a restrictive phase, aimed at tempering economic activity. This restrictive stance is impacting business investments and has led to a substantial slowdown in economic growth.

-

Activity in the housing sector has stabilized, indicating a plateau. The full effects of the Fed's monetary tightening are still unfolding and are expected to manifest more fully over time.

-

Inflation and Labor Market Dynamics:

- Inflation Reduction: Lowering inflation to the 2% target is a key goal, but it's anticipated to be a gradual process. Recent lower inflation readings are encouraging, with core PCE prices estimated to have increased by 3.1% over the past year.

- Labor Market: The labor market is expected to continue its rebalancing, with easing conditions. Although labor demand still exceeds supply, this gap is narrowing, and nominal wage growth is slowing. The market remains tight but is moving towards a better balance.

-

Policy Flexibility and Outlook:

- Open to Further Rate Hikes: Policymakers are not ruling out the possibility of additional interest rate hikes if necessary.

- Maintaining Restrictive Policy: The Fed plans to keep its policy restrictive until there is confidence in the path to achieving 2% inflation. There's a readiness to tighten policy further if appropriate.

- Policy Rate Near Peak: While the current policy rate is believed to be near its peak for this cycle, the Fed acknowledges the possibility of past miscalculations and surprises.

-

The Fed's estimates show a 2.6% year-over-year increase in November PCE prices, with a core increase of 3.1%. Achieving the 2% inflation target remains a long-term objective, requiring time and careful policy management.

US dollar is weakening, supporting the rise in indices. On EURUSD, we are observing a dynamic upward movement above the 1.088 level. Thus, today's gains extend yesterday's and confirm a rebound from the support level around 1.075. Source: xStation 5

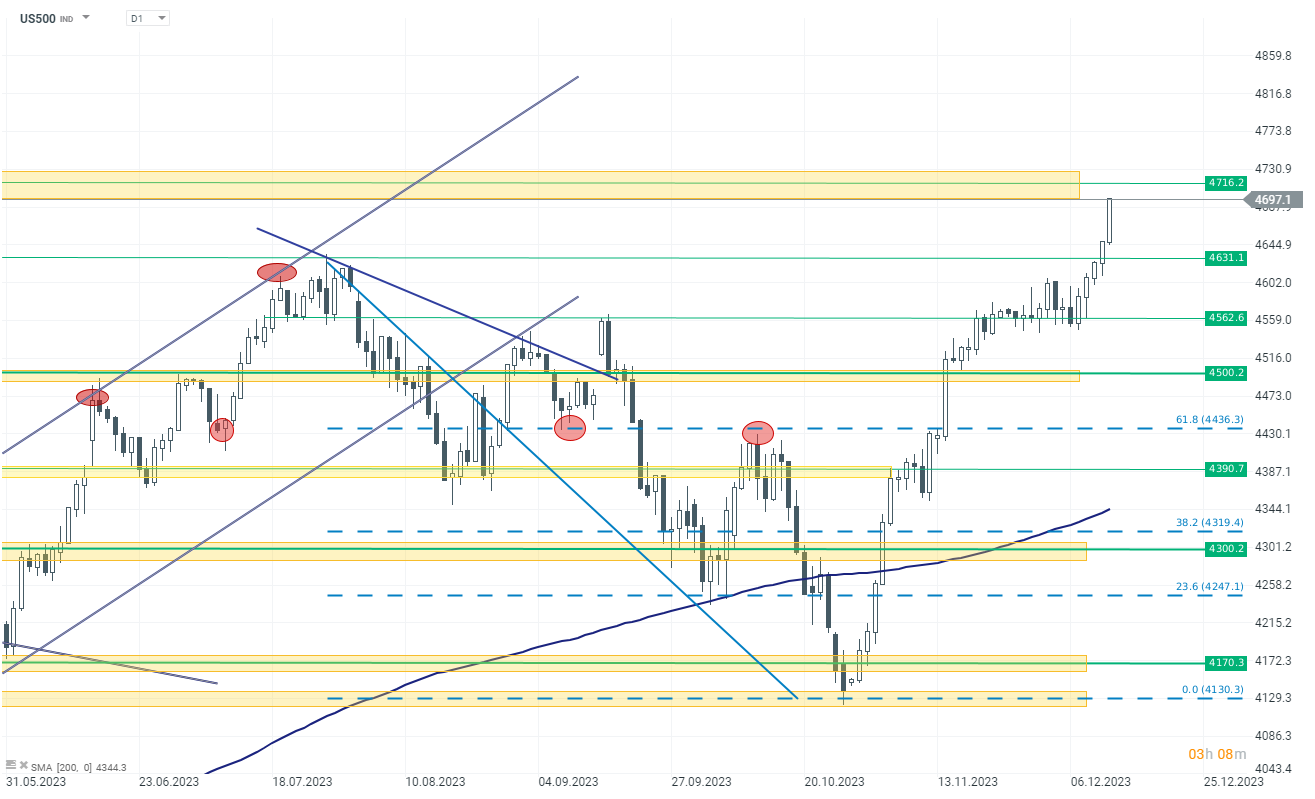

On US500, quotes are approaching the next zone of 4700 points. Today, the index has recorded a rise of over 1.0% since the announcement of the FOMC decision. Source: xStation 5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.