After decision of 50 pb rate hike on the ECB meeting, it's time for ECB conferrence live, with Christine Lagarde:

- Inflation remains too high

- Projections show inflation will remain high for a long time

- Projections were made before the recent problems in the banking sector

- Inflation has slowed, but on the other hand, food inflation remains high

- ECB is monitoring market problems related to the banking sector

- Risk of a larger drop in inflation/growth in case of further problems in the banking sector

- Interest rates have risen significantly recently

- Uncertainty causes ECB to continue making decisions from meeting to meeting

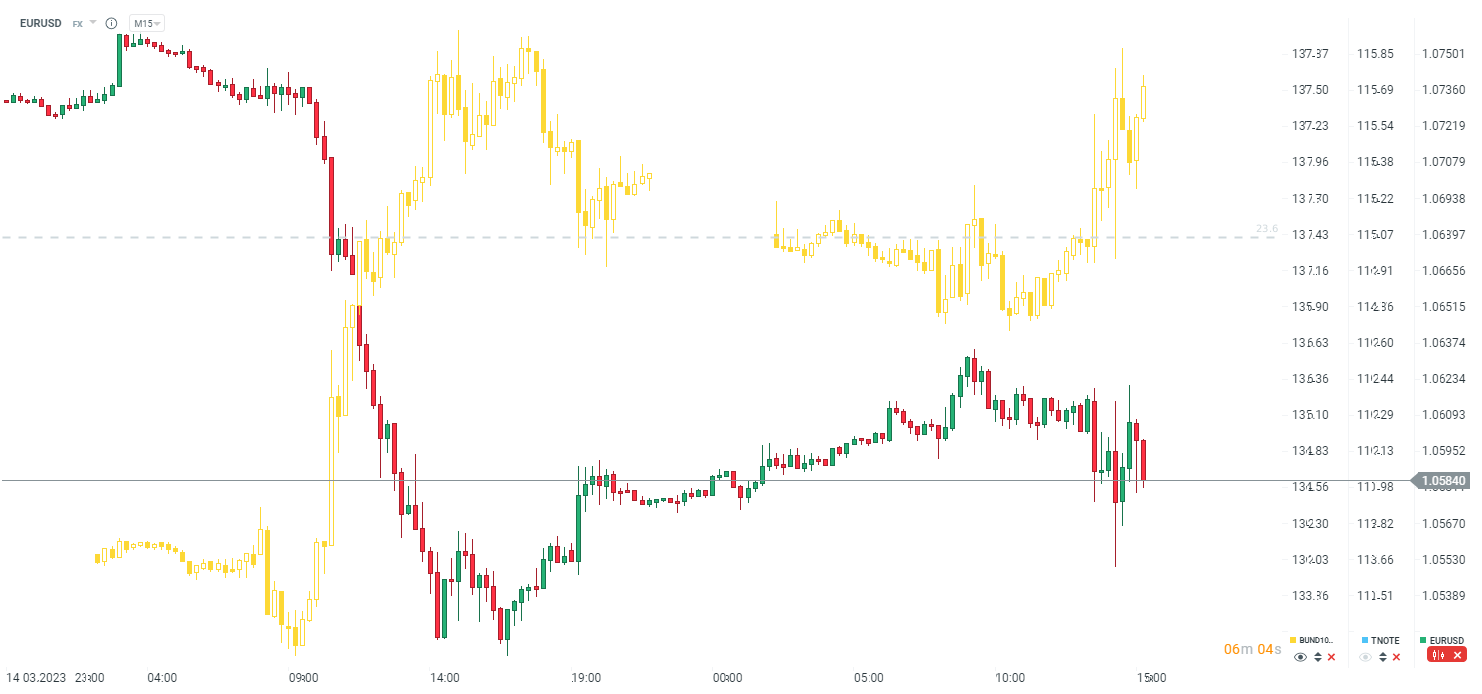

EURUSD and DAX gain after Lagarde's initial statement (15:00)

- If core inflation remains high, with decreasing uncertainty, this will be a problem.

- The banking sector is in much better shape than in 2008

- ECB has many tools to counter the problems

- The ECB's determination to bring inflation down to 2% remains unchanged

- Decisions will depend on data

- The level of uncertainty remains very high

- The decision for today's hike was taken by an overwhelming majority (3-4 ECB central banker supported the decision, but would like to see more data)

Today's Lagarde speech is "relatively boring," given what has been happening in the markets over the past week. The ECB is unconcerned about the problems of the banking system, and says it has the tools to combat liquidity problems. On the other hand, Lagarde is certainly not as hawkish as she was in December or January, which may speak for an attempted recovery on the DAX. EURUSD is gaining during the day, but is very volatile.

Lagarde points out that one can see the transmission of ECB policy primarily in credit data and demand suppression also. This is not the end of the current ECB policy. The ECB will continue to look at the data, at the projections. DE30 recovered from this statement, but at the same time Lagarde was reluctant to say that she sees grounds for reducing the scale of hikes in the coming meetings. Nevertheless, Lagarde did talk about the key next two meetings.

EURUSD nullifies gains, German bond prices rise. The ECB is not as extremely hawkish as it was in December and January. Source: xStation5

EURUSD nullifies gains, German bond prices rise. The ECB is not as extremely hawkish as it was in December and January. Source: xStation5

On the other hand DE30 is holding lower levels. It would be crucial for the bulls to stay above 14800 points. A close below that level today could be viewed negatively by the broad market. On the other hand, it seems that at this point the market is starting to be less afraid of risk. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.