The ECB has decided to raise rates by 25 basis points today. Christine Lagarde, the head of the ECB, is speaking:

-

Inflation has been decreasing but is projected to remain too high for too long. The ECB is determined to ensure that inflation returns to their two per cent medium-term target in a timely manner.

-

The rate increase reflects the updated assessment of the inflation outlook, the dynamics of underlying inflation, and the strength of monetary policy transmission.

-

Eurosystem staff expect headline inflation to average 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025.

-

The economy is expected to grow by 0.9% in 2023, 1.5% in 2024 and 1.6% in 2025.

-

The past rate increases are being transmitted forcefully to financing conditions and are gradually having an impact across the economy.

-

The Governing Council confirms that it will discontinue the reinvestments under the asset purchase programme as of July 2023.

-

The labour market remains a source of strength, with almost a million new jobs added in the first quarter of the year and the unemployment rate at its historical low of 6.5% in April.

-

The outlook for economic growth and inflation remains highly uncertain, with downside risks including Russia’s war against Ukraine, potential increases in broader geopolitical tensions, and potential renewed financial market tensions.

-

The ECB's monetary policy tightening continues to be reflected in risk-free interest rates and broader financing conditions. Funding conditions are tighter for banks and credit is becoming more expensive for firms and households.

-

The financial stability outlook has remained challenging.

-

ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to their two per cent medium-term target.

-

The ECB has not ended the cycle - there is still plenty of room to tighten policy - rates will likely also rise in July despite the Fed's pause. ECB's decision was made with a very broad consensus of ECB members.

-

The labor market is key - wages are rising, employment is increasing, and this fact also influenced the slightly higher inflation forecast of the ECB. Higher labor costs affect inflation.

-

The ECB is aware that the ECB policy works with a delay - ans the first effects can be seen in the banking and credit market.

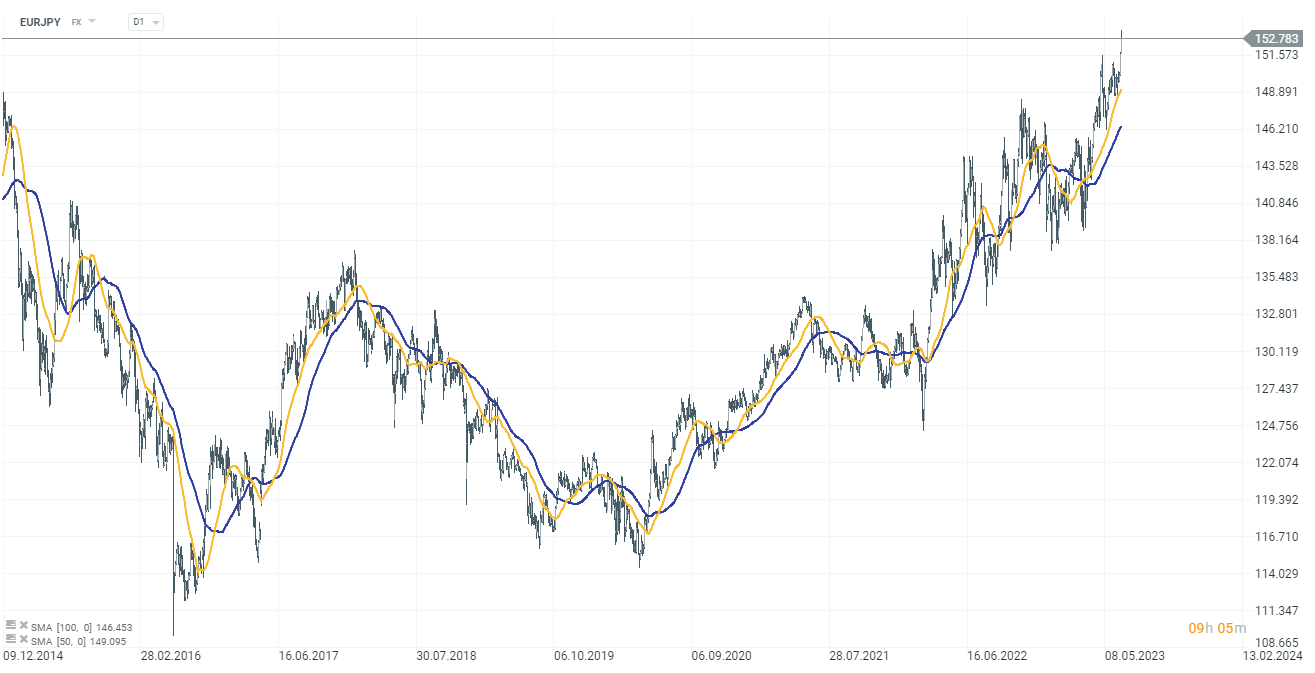

EURJPY has reached its highest point since 2008, up by 1.1% to 153.39., D1 interval, source xStation 5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.