FOMC delivered a 75 basis point rate hike, putting the Federal Fed Funds rate in the 2.25-2.50% range. This was the second 75 basis point rate hike in a row and only a third one over in the past 30 years. However, such a decision was widely expected and market attention turned to the press conference of Fed Chair Powell as investors looked for more hints on the outlook for economy and monetary policy. Key takeaways from Powell's presser:

Opening statement

-

Inflation is much too high

-

Wage growth stays elevated

-

Labor market remains extremely tight

-

Growth in consumer spending is weakening

-

Overall demand within the economy remains solid

-

Fed continues to reduce balance sheet significantly

-

Another unusually large increase in rates will depend on data

-

It is likely appropriate to slow rate increase at some point

-

Fed will communicate its thinking as clearly as possible

Q&A session

-

75 basis point hike was the right magnitude

-

Wouldn't hesitate to make larger hikes if appropriate

-

Fed funds in the range of neutral now

-

There is some evidence of slowdown in economic activity

-

FOMC members think that rates need to get to moderately restrictive levels

-

It's time to go to meeting-by-meeting basis and not provide a clear guidance as before

-

Creating recession is not our goal but a period of below-potential growth may be needed to let supply catch up

-

I do not think US economy is currently in a recession

-

First US GDP reports tend to be revised later on and should be taken with a grain of salt

-

Did not make decision on when to slow rate hikes

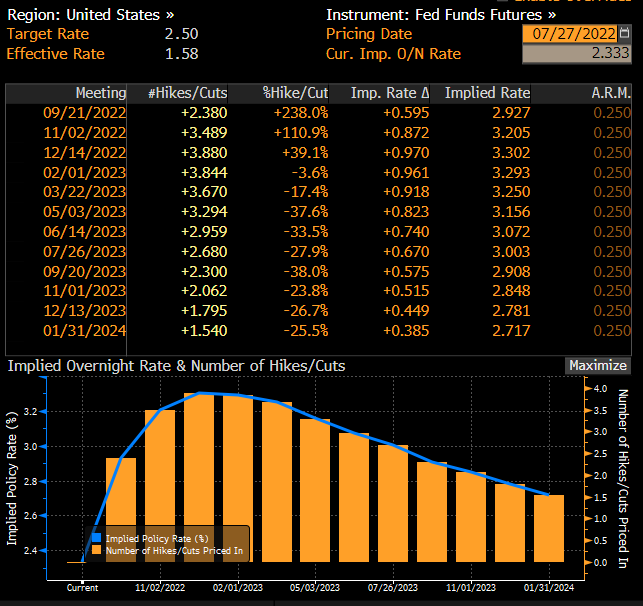

Money market currently prices in 59.5 basis points of tightening during FOMC meeting in September. Source: Bloomberg

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.