JPMorgan (JPM.US), a major US investment bank, reported Q4 2022 earnings today ahead of the Wall Street session open. Bank managed to beat expectations in terms of net revenue and earnings as higher interest rate environment benefits banks. However, JPMorgan has trailed estimates in trading business with both equities and fixed income trading revenue coming in below market expectations. . Bank said that $2.29 billion in provisions for credit losses is made up of net $1.4 billion reserve build-up and $887 million net charge-offs. The Bank said that it may be able to resume stock buybacks this quarter but even this information did not offset negative impact of poor trading performance - stock is trading almost 3% lower in premarket trading today.

JPMorgan result highlights:

-

EPS: $3.57 vs $3.07 expected (+7% YoY)

-

Net Income: $11.01 billion (+6% YoY)

-

Net revenue: $35.57 billion vs $34.3 billion expected (+17% YoY)

-

Fixed income trading revenue: $3.74 billion vs $3.91 billion expected

-

Equities trading revenue: $1.93 billion vs $1.98 billion expected

-

Investment banking revenue: $1.39 billion vs $1.66 billion expected

-

Provision for credit losses: $2.29 billion vs $2.05 billion expected

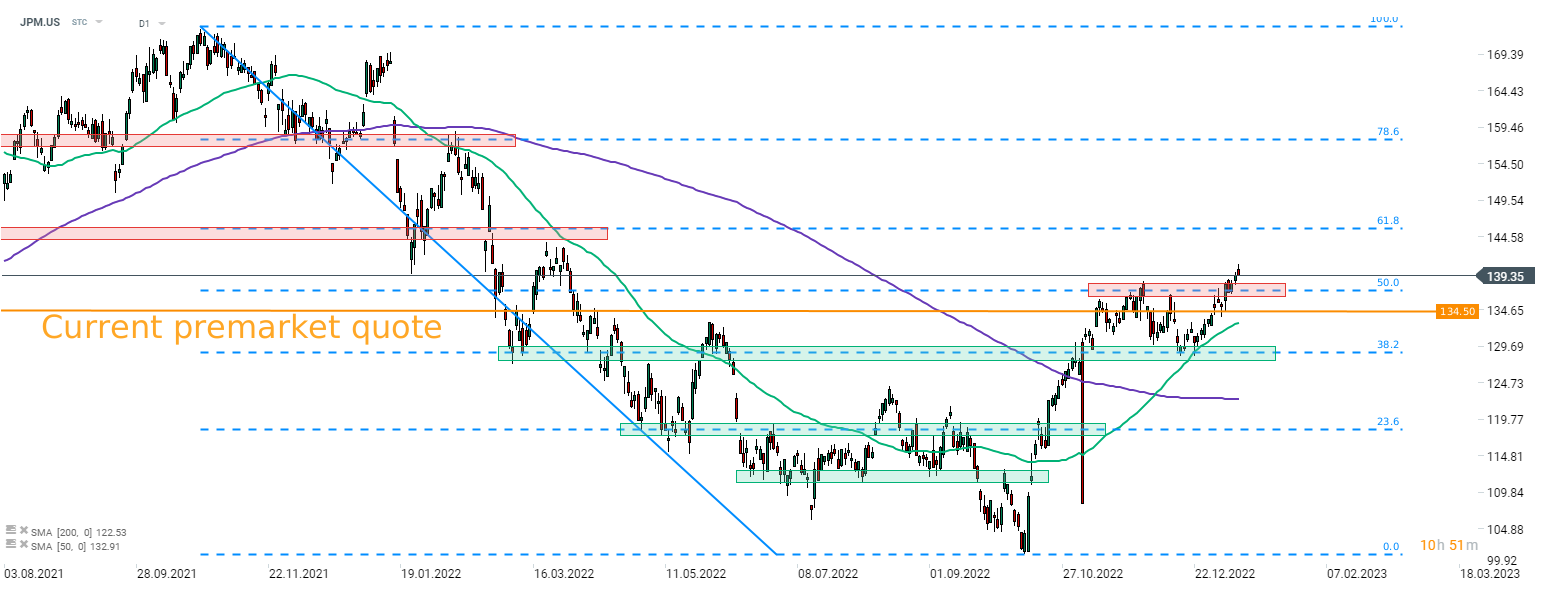

According to current premarket quotes, JPMorgan (JPM.US) is set to launch today's cash trading session with a bearish price gap. Stock is seen opening slightly below a recently-broken resistance zone marked with 50% retracement of the downward impulse started in late-October 2021. In case bulls fail to regain control, a pullback towards the support zone at 38.2% retracement ($128.50 area) cannot be ruled out.

JPM.US at D1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.