- Canada, Ivey PMI for April. Actual: 63.0. Expected: 58.1. Previous: 57.5

It is worth noting that much of the rebound in the Ivey PMI index is related to the price factor. The price sub-index is back above the 50-point level. In theory, mounting price pressures could limit the chances of an interest rate cut. The valuation for June still points to the 70% level. This Friday, labor market data, which could still stir up a lot in the Canadian dollar market.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app

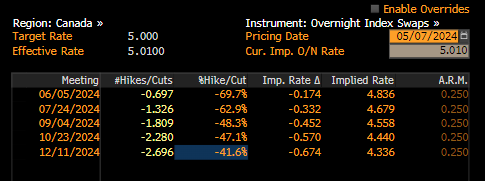

The likelihood of a rate cut in Canada in the coming months. As you can see, the market is pricing that the cut will take place in June or July. Source: Bloomberg

Despite clearly exceeding analysts' expectations; USDCAD pair does not react excessively to macro data reading

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.