Shares of the U.S. semiconductor chipmaker (INTC.US) are trading down nearly 22% today after quarterly results. The company intends to restructure the business and will lay off 15,000 employees (15% of about 110,000 full-time positions), retaining only the full-time positions necessary to continue operations. All this as part of a cost-cutting program ($10 billion in 2024).

However, this is not the biggest concern for investors. Weak results, as well as Intel's forecasts and news of a DoJ report targeting Nvidia, are putting further pressure on the semiconductor sector. According to CEO Pat Galsinger, Intel needs to fundamentally change the way it operates and has so far failed, on a satisfactory scale, to benefit from the AI trend wave. As a result, the company's shares are falling at the highest scale since October 2000, when the dot-com bubble burst.

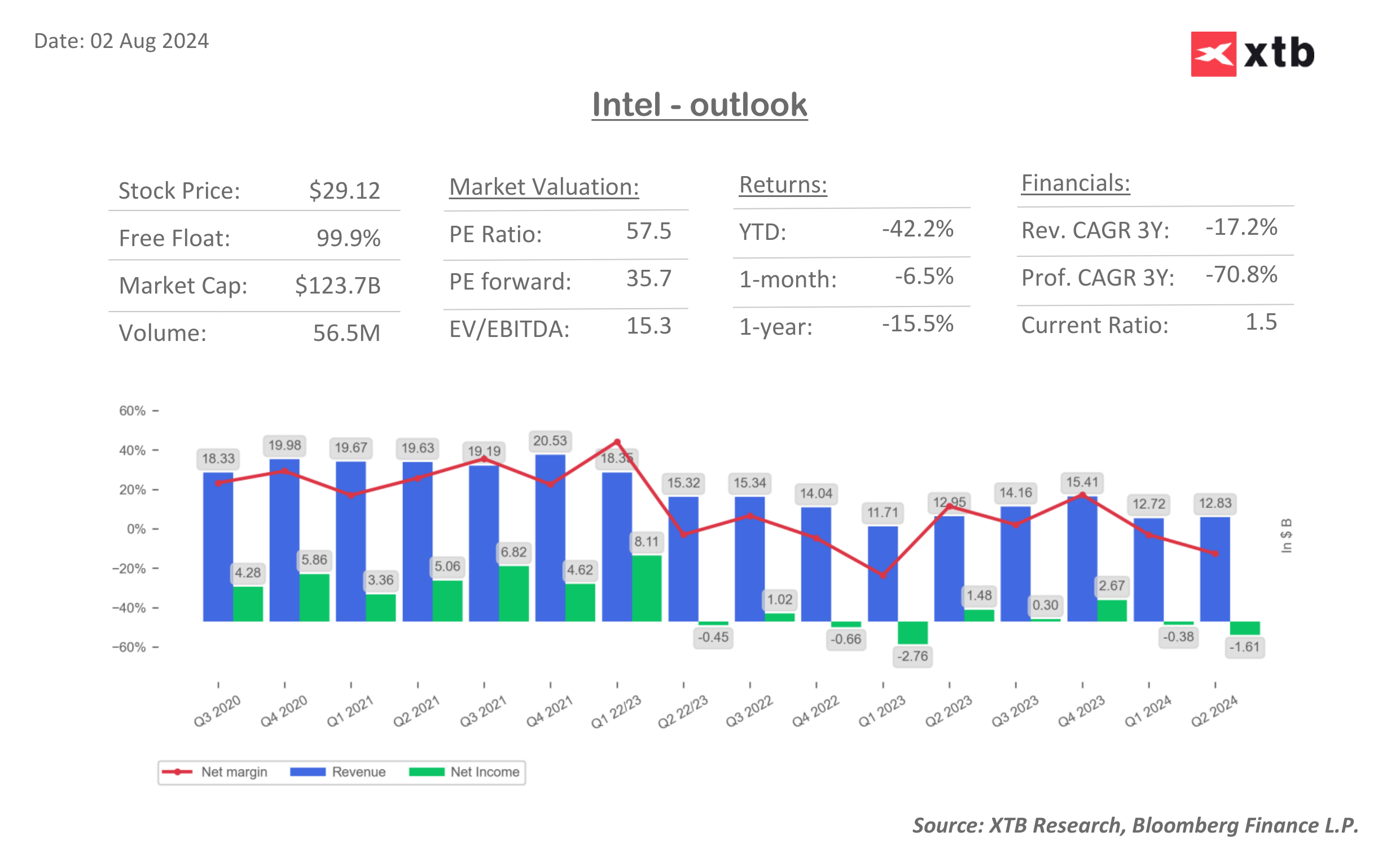

Revenues: $12.83 billion vs. $12.94 billion forecast (down 1% y/y)

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appAdjusted earnings per share (EPS): $0.02 vs. $0.10 forecasts

For Q3 2024, Intel estimates revenue of $12.5 to $13.5 billion, vs. $14.38 billion expected. The company will likely report a $0.03 loss per share instead of the expected $0.3 profit. Sales in the data centre segment fell 3% year-on-year to $3 billion, while competitors are reporting record increases in this segment. The market sees this as evidence that Intel remains a 'marauder' against its peers and is an operational outlier. Sales in the PC sector rose 9% y/y, while sales in the Foundry Unit's services unit rose 4% y/y to $4.32 billion.

The end of the historic dividend?

-

The company will not pay its regular quarterly dividend, paid since 1992, as part of a program to cut costs and increase free cash flow

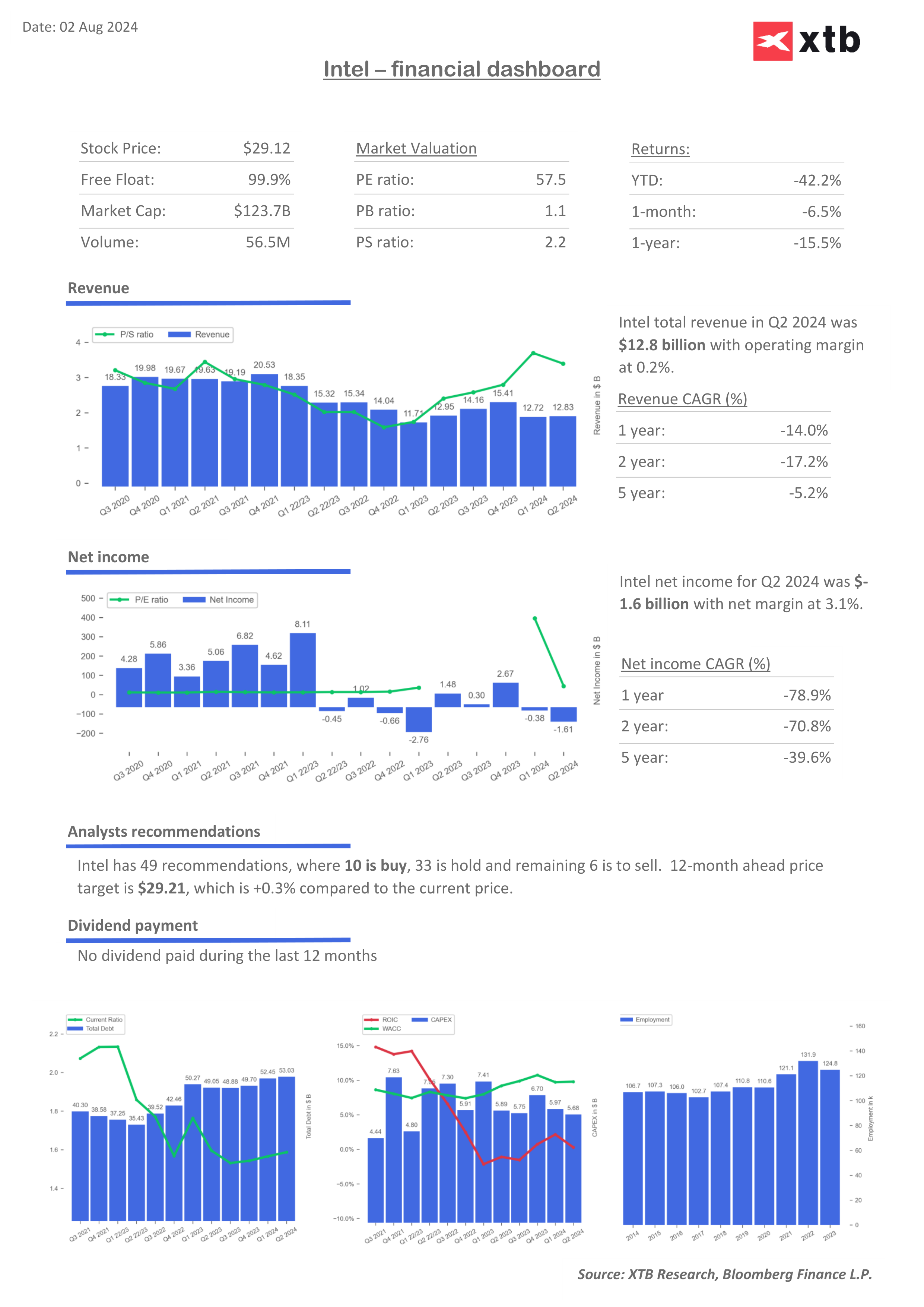

- Intel intends to cut CAPEX by 20% this year, which investors see as a risk of 'deepening' the gap with competitors, who have quite boldly increased capital spending, to grow the chip business, in 2024.

- Investors see signs that Intel's offerings are losing competitiveness in the market, and so far significant investments have failed to improve its business. CEO, Gelsinger prefaced that the company's transformation path will not be easy.

- Spending has put significant pressure on gross margins, which are now 35% versus 60% at their peak. The company sees catalysts for growth in AI chips dedicated to PCs and the transfer of production to its own factories, at a time when subcontractors currently do most of it.

- Intel is targeting $20 billion to $23 billion in CAPEX in 2025, compared to $25 billion to $27 billion in 2024, with additional pressure on the company from the US decision in May 2024 to halt sales of Intel chips to China's Huawei.

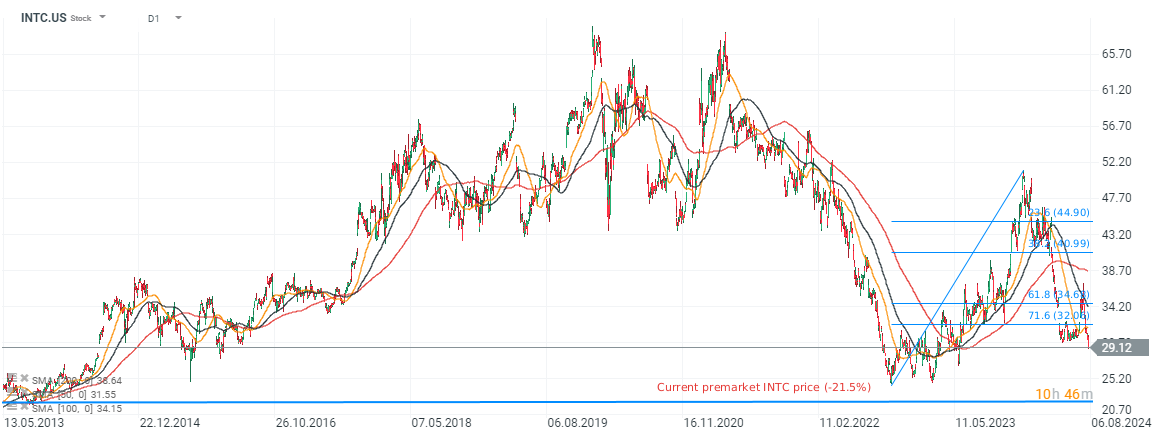

Intel shares (INTC.US), D1 interval

Intel's shares are experiencing a record sell-off and are testing the area of $23 unseen since 2013. At the same time, these are around the local minima of the sell-off, from 2013.

Source: xStation5

Intel financial dashboards and valuation multiples

We can see constantly high WACC level amid dropping ROIC with still very high trailing and forward price to earnings ratios at 57 and 35 level respectively.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.