Crude oil is benefiting from good market sentiment. WTI (OIL.WTI) and Brent (OIL) prices are posting close to 2% gains today following news yesterday afternoon that China plans to increase and extend its property support programme to boost the economy. The news is a positive factor for demand creation in the world's key economy, which supports oil prices.

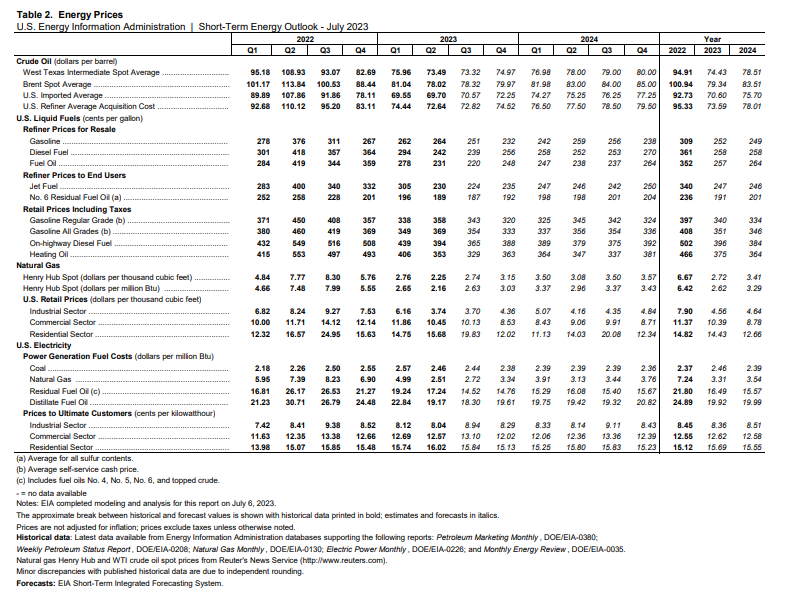

Furthermore, the EIA has raised its oil demand forecasts for 2023 and notified that, according to their models, prices of the BRENT variety will settle around $78 per barrel (for July) and $80 per barrel (in the fourth quarter of 2023). Production forecasts for 2023 have been revised downwards (now: 670,000 barrels per day; previously: 720,000 barrels per day).

Source: EIA

Source: EIA

OIL.WTI quotations have recently been stuck in a broad consolidation, stretching between support at $67 and resistance at $74.70. However, since the end of June, the price of this energy commodity has jumped more than 10% upwards, and the upper limit of the aforementioned consolidation range is currently being tested. In the event of an upward breakout, the next target for buyers will become the resistance at $75.95, followed by the steepness at $19.25.

OIL.WTI quotations have recently been stuck in a broad consolidation, stretching between support at $67 and resistance at $74.70. However, since the end of June, the price of this energy commodity has jumped more than 10% upwards, and the upper limit of the aforementioned consolidation range is currently being tested. In the event of an upward breakout, the next target for buyers will become the resistance at $75.95, followed by the steepness at $19.25.

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.