USDJPY is continuing to track higher since last week, building on the rising momentum in Treasury yields, supported by the NFP report on Friday. The pair has pushed past the 23 July high at 110.59, with the 14 July high at 110.70 in focus now. If buyers manage to push higher, the 111.00 level is the next psychological resistance before getting to the year's highs around 111.65. The momentum is siding with buyers as the focus in the market leans more towards more positive Fed taper expectations. That said, COVID-19 fears amid delta variant concerns are still a key risk that needs to be monitored in case it brings about a fresh wave of risk aversion in the market.

Monthly interval :

The year began with a bullish signal when the bearish trendline linking the highs since 2015 was broken. Since then, the pair is facing the ichimoku cloud, acting as a resistance. If the USDJPY manages to break through the cloud upwards, crossing the level at 112.400, a bullish signal would strengthen the bullish outlook. Such a signal would be immediately confirmed by the Chikou Span which would emerge from the cloud at the same time.

USDJPY, M1 interval, Source : xStation5

USDJPY, M1 interval, Source : xStation5

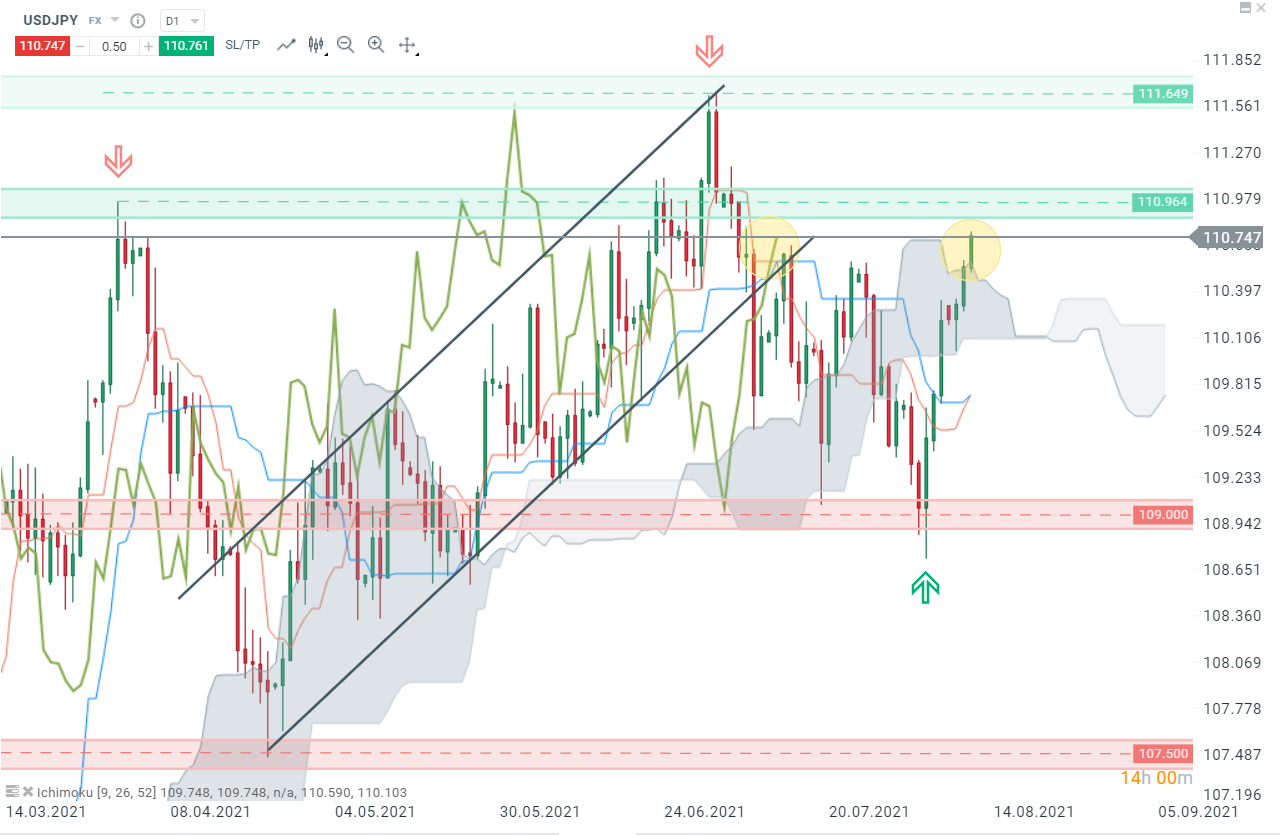

Daily interval :

From an Ichimoku point of view, today's session will be crucial. In fact, a buy signal would be generated in case of a daily close above the cloud (second yellow circle). This signal would be immediately confirmed by the Chikou span (green bold line inside the first green circle) which would be released from any obstacle. In this case, the 111.00 level is the next psychological resistance before getting to the year's highs around 111.65.

USDJPY, D1 interval, Source : xStation5

Réda Aboutika, XTB France

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.