The japanese index (JAP225) fell nearly 1.40%, following Wall Street's decline. Investors are also concerned about the Bank of Japan's absence of ETF purchases in Tuesday's session, during which the Nikkei experienced its biggest drop since February 26.

Another factor that hurt the market was SoftBank, which fell 2.76% after a news report that the group is expected to announce a record annual net loss after the close

In this analysis on NIKKEI (JAP225), we will focus on three intervals - weekly, daily and H4 - to find out the perspectives for the japanese index.

Weekly interval :

When we look at the weekly time frame, we can see that the NIKKEI (JAP225) has been under pressure in recent months. During this week, NIKKEI was impacted by techs sell-off which caused prices to fall near the Kijun-line (blue line). Closing under this line may announce a deeper decline.

NIKKEI (JAP225), W1 interval, Source : xStation5

Daily interval :

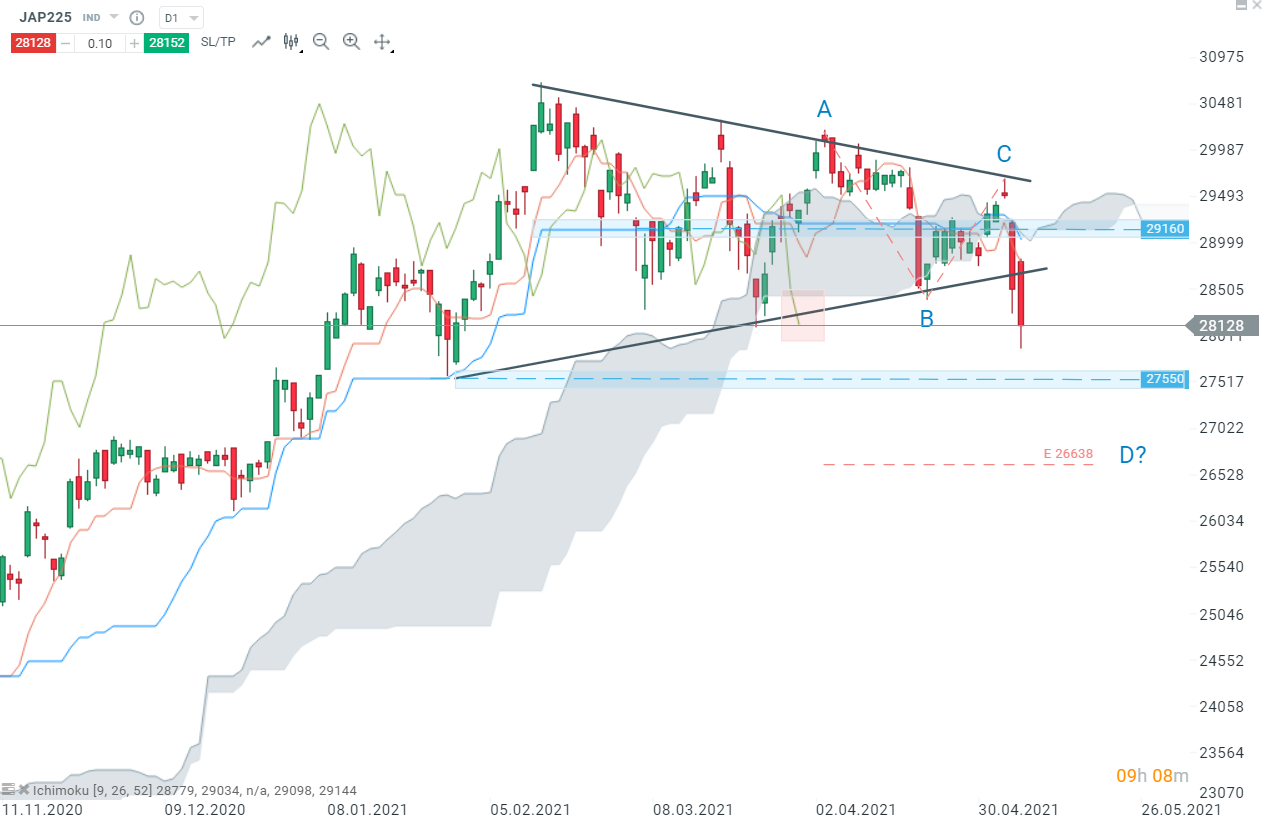

NIKKEI (JAP225) plunged yesterday as tech shares sold off, leading the japanese indexe to break under the lower limit of the triangle. The downward move resumed today and the Chikou-span broke the lower limit of the Ichimoku cloud (red box), confirming the bearish signal. If bears manage to break 27 550 pts support, the next support can be found at 26 640 pts.

NIKKEI (JAP225), D1 interval, Source : xStation5

H4 interval :

After breaking through the cloud (major Ichimoku bearish signal), prices collapsed to significant support marked by previous price reactions. If the hourly candlestick manages to close below this support (green area), the decline could deepen. Next support can be spotted on the daily chart at 27 550 pts. In the other hand, if prices rise, the next resistance can be found at 28 780 pts (blue area) wich coincide with the Kijun-line (blue line).

NIKKEI (JAP225), H4 interval, Source : xStation5

Réda Aboutika, XTB France

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.