IBM (IBM.US) stock rose over 4.0% on Thursday after the iconic technology company posted upbeat quarterly results and lifted its full-year financial outlook despite an increasing headwind from the surging U.S. dollar.

-

Company earned $1.81 per share, a 2% decrease from last year, however it topped analysts’ projections of $1.78 per share. Revenues jumped 6% from last year to $14.1 billion, well above market expectations of $13.5 billion.

-

Revenues from Red Hat, the cloud computing group which was acquired by IBM in 2019 for $34 billion increased 12%, while software revenues surged 7.5% to $5.8 billion. Consulting revenues increased 5.4% to $4.7 billion.

-

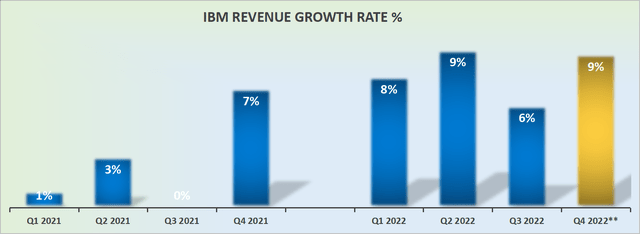

"Based on our revenue performance in the first three quarters, we now see constant-currency revenue growth above our mid-single-digit model for the year," said CFO Jim Kavanaugh.

Source: seekingalpha.com

Source: seekingalpha.com

-

IBM estimates that foreign-exchange rates should result in 7% less revenue than it otherwise would generate in the full year. Company reiterated its financial outlook from July of around $10 billion in free cash flow.

According to the issued ratings of 8 analysts, the consensus rating for IBM (IBM.US) stock is Moderate Buy based on the current 3 hold ratings, 1 strong sell, 1 moderate buy and 3 strong buy. Source: Barchart

IBM (IBM.US) stock rose sharply during today's session and is currently testing a major resistance zone around $128.45, which is marked with previous price reactions and 38.2% Fibonacci retracement of the upward wave started at the beginning of the pandemic. If buyers manage to break above, upward movement may accelerate towards next resistance at $137.50 which coincides with 23.6% retracement. On the other hand, if sellers regain control, then another downward impulse towards local support at $123.40 may be launched. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.