IBM (IBM.US) shares dropped over 3.0% after Morgan Stanley downgraded the iconic tech company to 'equal weight' from 'overweight', citing concerns of decelerating revenue growth.

-

Bank analysts lowered price target to $148 per share from $152.00 and noticed signs of a slowdown in IT spending, which coupled with deteriorating macroeconomic environment could have a negative impact on "Big Blue" future performance.

-

"Since the beginning of 2022, IBM has been the best performing name in our coverage, outperforming our IT Hardware coverage by 40 points, and the S&P 500 by 25 points. However, as Y/Y comps get more difficult, IBM laps its mainframe and ELA renewal cycles, and macro uncertainty persists, we are increasingly more guarded that IBM can sustain its goal of mid-single digit Y/Y revenue growth (in constant currency) in CY23," the analysts wrote in a client note.

-

On the other hand, analysts' from BofA pointed to the recent outperformance of IBM stock and lifted the price target to $152 per share from $145 as in their opinion the company should benefit from its defensive positioning.

-

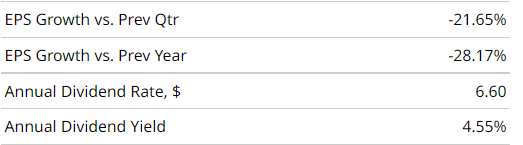

"We expect shares of IBM to outperform in a weaker macro backdrop on an improving fundamental story." BofA analysts pointed to continued turnaround at IBM (expanding revenue and rising FCF), defensive portfolio and high dividend yield.

Key IBM ratios. Source: Barchart

IBM (IBM.US) stock pulled back from its 2022 highs in recent days after recording positive returns in the last 52 weeks. Stock launched today's session with a bearish price gap and is moving towards local support at $137.65, which is marked with previous price reactions and 23.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.