Honeywell International (HON.US) announced plans to spin off its advanced materials division into a separate publicly traded company by early 2026. The division, which produces products like Solstice brand refrigerants and industrial solvents, is expected to generate approximately $3.8 billion in revenue in 2024, accounting for about 10% of Honeywell's total sales. The move aligns with CEO Vimal Kapur's strategy to streamline the company's focus on its three main segments: aviation, automation, and the energy transition. The standalone advanced materials business could be valued at over $10 billion.

The spin-off aims to provide greater financial flexibility for future acquisitions, complementing recent purchases totaling over $8 billion including Carrier Global Corp.'s security business for almost $5 billion, CAES Systems Holdings for $1.9 billion, and Air Products and Chemicals Inc.'s liquefied natural-gas technology unit for $1.8 billion. Under CEO Vimal Kapur's leadership since June 2023, Honeywell is refining its portfolio to capitalize on industry megatrends, although the stock's performance has lagged behind the S&P 500's during the same period.

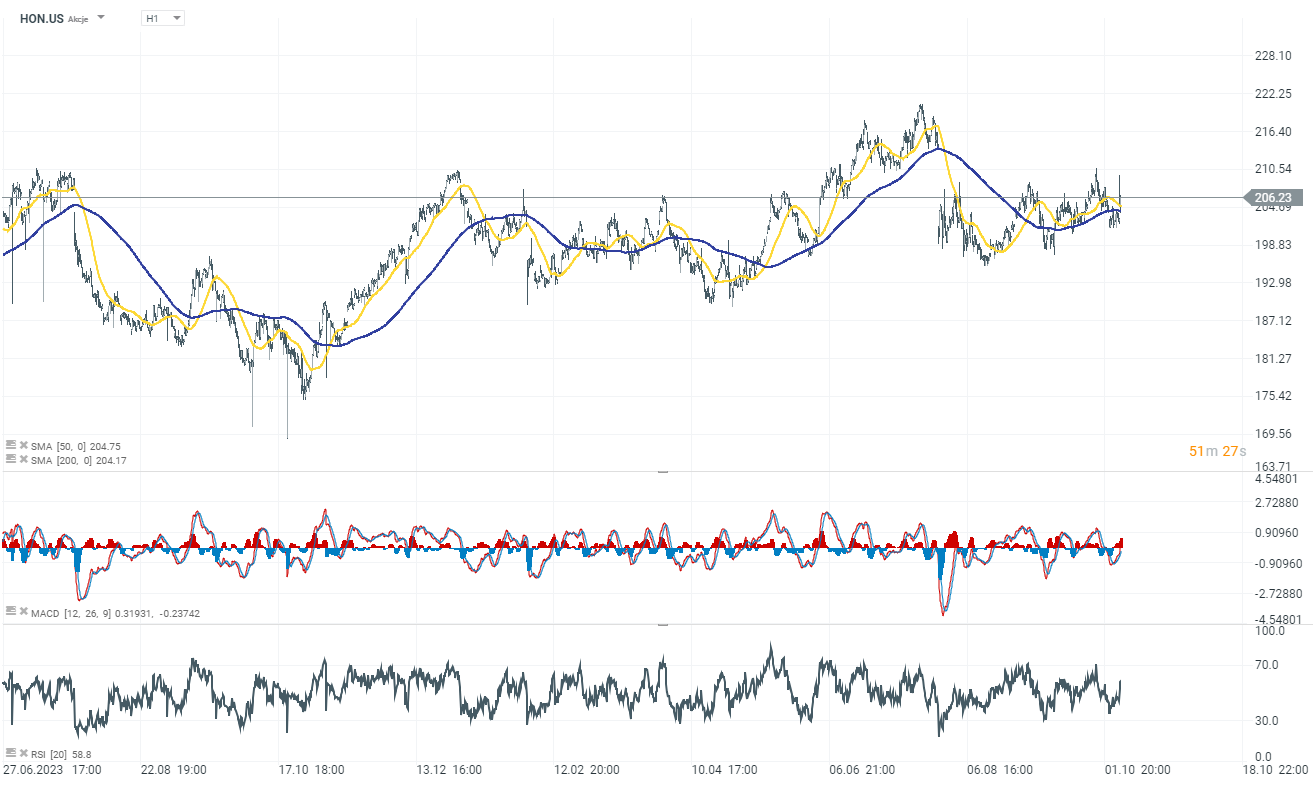

Following the announcement, Honeywell's shares rose nearly 3% in premarket trading to around $207. Currently, the stock has settled at about $206, up approximately 1.6%.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.