Home Depot Inc. (HD.US) shares fell over 4.0% before the opening bell after the home improvement retail giant posted disappointing sales figures and issued cautious guidance.

-

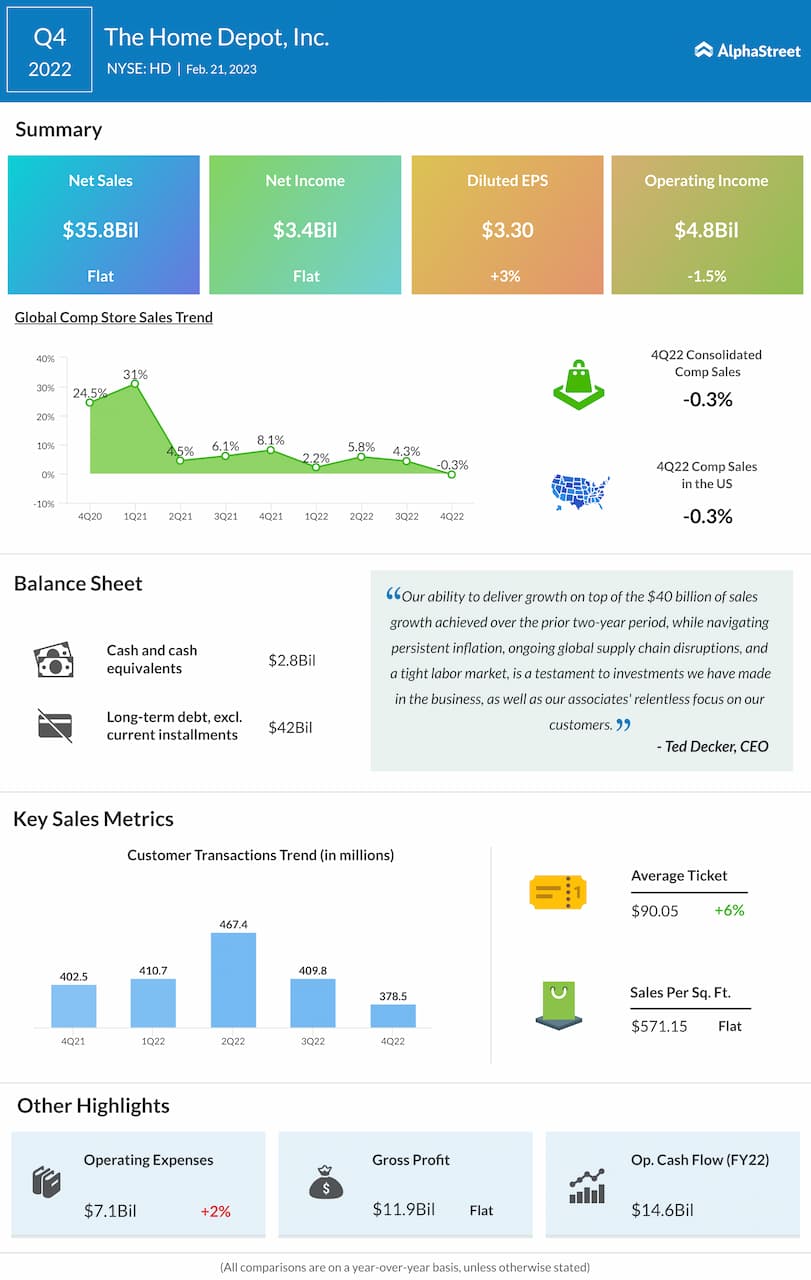

Company earned $3.30 per share, up 2.8% YoY, topping market estimates of $3.28 per share.

-

Revenues were essentially flat from last year at $35.83 billion, slightly below analysts' estimates of $35.97 billion.

-

Comparable sales dropped 0.3% in Q4, while analysts' expected 0.56% increase.

Highlights of Home Depot Q4 2022 results. Customer transaction trend, which is a key sales metric, fell sharply in the latest quarter. On the other hand average tickets rose 6.0% per trip to $90.05, even as the number of individual transactions slowed by around 6%. Source: Alpha Street

-

Management now expects sales and comparable sales to be flat year-over-year in FY23 with diluted EPS expected to decline in “mid-single digits” percentage.

-

The company plans to invest an additional $1 billion in annualized compensation for its frontline, hourly associates, starting from the first quarter of 2023.

-

"Fiscal 2022 was another record year for The Home Depot as our team continued to successfully execute in a challenging and dynamic environment," said CEO Ted Decker. "Our ability to deliver growth on top of the $40 billion of sales growth achieved over the prior two-year period, while navigating persistent inflation, ongoing global supply chain disruptions, and a tight labor market, is a testament to investments we have made in the business, as well as our associates' relentless focus on our customers."

Home Depot Inc. (HD.US) stock fell to lowest level since November following release of latest quarterly figures. Break below 200 SMA (red line) would pave the way towards major support at $280.60, which coincides with 50.0% Fibonacci retracement of the upward wave started in March 2020. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.