Heineken (HEIA.NL) launched new week's trading with a big bearish price gap and is now trading over 6% lower on the day. Company released earnings report for the first half of 2024 today before opening of the European cash session. Results turned out to be a disappointment and the company also reported a big impairment charge on its investment in China.

Heineken reported disappointing net revenue in every region, with organic revenue growth disappointing in every region except for Africa, Middle East & Eastern Europe. Moreover, revenue growth and organic revenue growth was negative in company's key biggest market - Europe. Adjusted operating profit also missed expectations, although not in every market - the company reported a large beat in Americas. Overall, the report was disappointing but not disastrous.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appHowever, Heineken also announced that it took one-time impairment charge of €874 million due to a decline in valuation of its stake in China Resources Beer Holdings, the largest brewer in China in which Heineken holds a 40% stake. Decline in valuation was due to concerns about consumer demand in mainland China.

Heineken also updated its full-year operating profit growth forecasts and now expects it to grow 4-8%. However, previous forecast called for growth in 'low-to-high single-digit range' therefore it can be said that it is now just more specific.

2024 first half results

- Net revenue: €14.81 billion vs €15.2 billion expected (+2.1% YoY)

- Europe: €5.91 billion vs €6.16 billion expected (-2.1% YoY)

- Americas: €5.25 billion vs €5.31 billion expected (+7.2% YoY)

- Asia-Pacific: €2.10 billion vs €2.15 billion expected (+4.0% YoY)

- Africa, Middle East & Eastern Europe: €1.92 billion vs €2.01 billion expected (-2.5% YoY)

- Organic revenue growth: +5.9% vs +7.9% expected

- Europe: -1.1% vs +2.8% expected

- Americas: +4.1% vs +5.6% expected

- Asia-Pacific: +7.9% vs +10.3% expected

- Africa, Middle East & Eastern Europe: +27.5% vs +24.0%

- Organic beer volume: +2.1% vs +3.7% expected

- Adjusted operating profit: €2.08 billion vs €2.16 billion expected

- Europe: €614 million vs €726.7 million expected (-1.1% YoY)

- Americas: €854 million vs €737.3 million expected (+42.0% YoY)

- Asia-Pacific: €409 million vs €467.9 million expected (+2.3% YoY)

- Africa, Middle East & Eastern Europe: €169 million vs €227.3 million expected (-24% YoY)

- Adjusted operating margin: 14.0% vs 14.3%

- Adjusted net income: €1.20 billion vs €1.23 billion expected

- Adjusted EPS: €2.15 vs €2.18 expected

Q2 2024 volume data

- Total beer volume: 62.8 million HL vs 65.25 million HL expected (-3.8% YoY)

- Europe: 22.8 million HL vs 23.23 million HL (flat year-over-year)

- Americas: 21.3 million HL vs 22.19 million HL (-2.3% YoY)

- Asia-Pacific: 11.7 million HL vs 11.9 million HL (+6.4% YoY)

- Africa, Middle East & Eastern Europe: 7 million HL vs 7.9 million HL (-27% YoY)

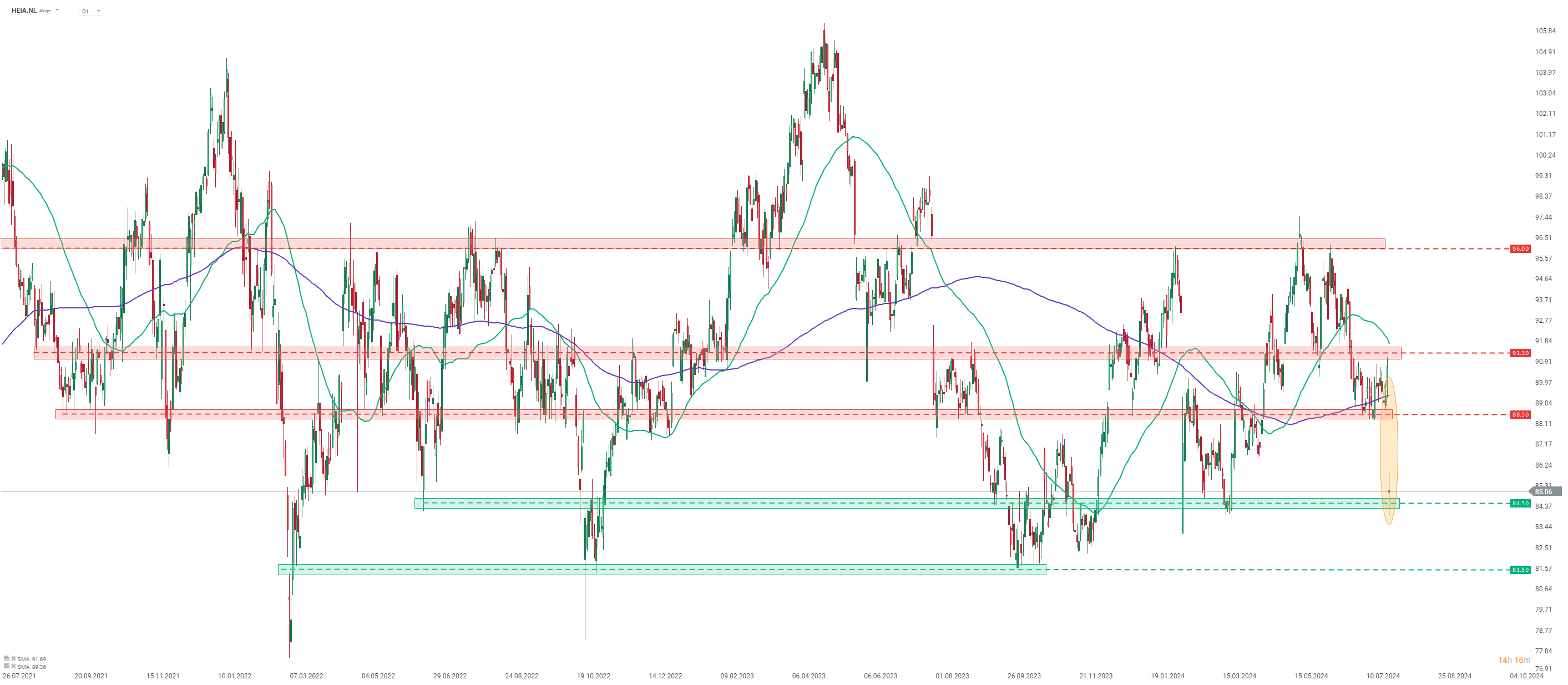

Heineken (HEIA.NL) launched today's trading with an over-6% bearish price gap and is trading at the lowest level since late-March 2024. Stock moved further lower after opening of the cash session and sellers attempted to break below the €84.50 support zone, marked with mid-March lows. However, no break below occurred and the stock has recovered back to the opening price.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.