Fed's Waller, Logan, and Goolsbee presented perspectives that collectively leaned towards a cautious approach to monetary policy adjustments, indicating a generally dovish stance. Overall, the bankers' remarks reflected a preference for a careful, measured approach to monetary policy, aligning more with dovish sentiments. Below are the highlights from each of the speeches:

Waller:

- Emphasized that the pace of balance sheet reductions will be independent of policy rate changes.

- Noted that the current overnight repo usage of around $500 billion indicates that the Fed can continue reducing its holdings for some time.

- Expressed a preference for the Fed's Treasury holdings to shift towards a larger share of shorter-dated securities.

Logan:

- Advised that moving more slowly in the current environment could reduce the risk of a premature stop in monetary policy adjustments.

- Hasn't observed a reduction in reserves yet under the current Fed Quantitative Tightening (QT).

- Pointed out that after draining the Overnight Reverse Repo (ON RRP), QT will reduce reserves on a one-for-one basis.

Goolsbee:

- Stated uncertainty about where interest rates will settle.

- Noted that if inflation continues to fall, the Fed should consider the impact on employment.

- Believes the current Fed funds rate is quite restrictive.

- Emphasized the need to monitor housing inflation.

- Speculated that January's inflation might have been an anomaly.

- Commented on the unusual nature of housing inflation.

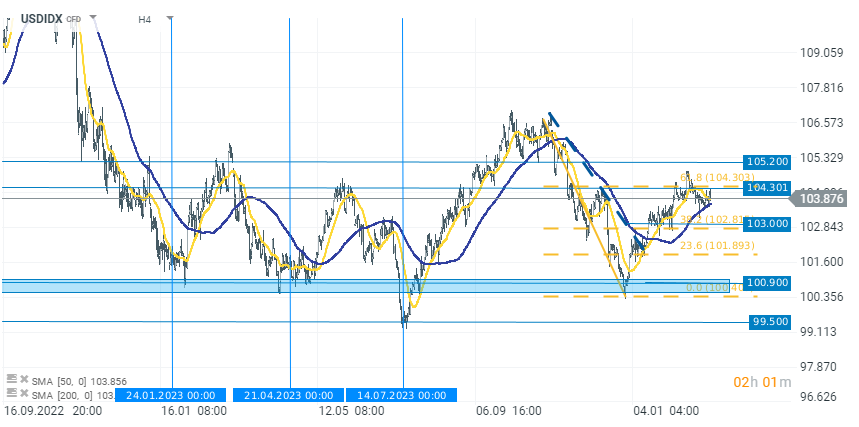

The US dollar index halted its rise at the 61.8% Fibonacci, retracement of its most recent downward move. Today, the USDIDX is losing almost 0.20%. The declines accelerated after the publication of the ISM data, which were significantly worse than expected and revived speculations about faster interest rate cuts.

Source: xStation 5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.