Goldman Sachs (GS.US) stock rose over 2,5% on Monday after earnings and revenues topped Wall Street projections by a huge margin despite an uncertain macroeconomic environment. “We delivered solid results in the second quarter as clients turned to us for our expertise and execution in these challenging markets," said CEO David Solomon.

-

Earnings of $7.73 a share, well above Refinitiv estimates of $6.58 per share

-

Revenue of $11.86 billion, also topped market expectations of $10.86 billion as bond trading department generated roughly $700 million more revenue than expected.

-

Also wealth management revenue increased by 25% to $2.18 billion.

-

On the flip side, asset management revenue fell 79% to $1.08 billion, while its investment banking revenue decreased by 41% to $2.14 billion as deal-making slowed dramatically from a strong year-ago quarter.

-

Megabank also increased its quarterly dividend by 25%, to $2.50 per share.

-

Analysts are cautiously optimistic about Goldman stock with a Moderate Buy consensus rating and average price forecast of $373.91.

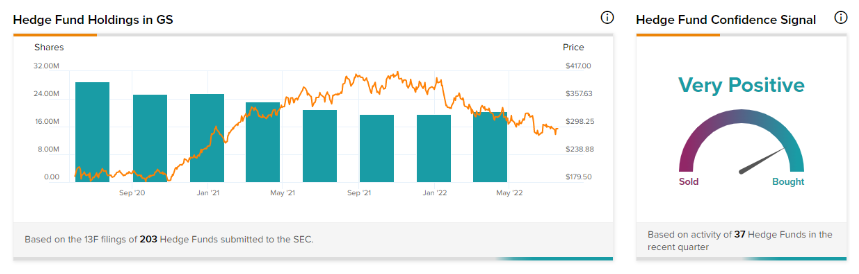

Confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter. Source: TipRanks Hedge Fund Trading Activity tool.

Confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter. Source: TipRanks Hedge Fund Trading Activity tool.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app Goldman Sachs (GS.US) stock launched today's session higher, however sellers failed to break above major resistance at $312.65, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. The nearest support to watch lies at $278.00. Source: xStation5

Goldman Sachs (GS.US) stock launched today's session higher, however sellers failed to break above major resistance at $312.65, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. The nearest support to watch lies at $278.00. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.