Gold is trading over 2% higher on the day and tests a key medium-term resistance zone ranging around $1,960 per ounce level. The move is driven by changing expectations on monetary policy around the world, and especially in the United States. Markets are pricing just 60% chance of a 25 basis point rate hike next week and it would be the end of rate hike cycle. Moreover, the first 25 basis point rate cut is fully priced in for July 2023. This has led to a significant pull back in US yields this week, which is providing support for gold and other precious metals.

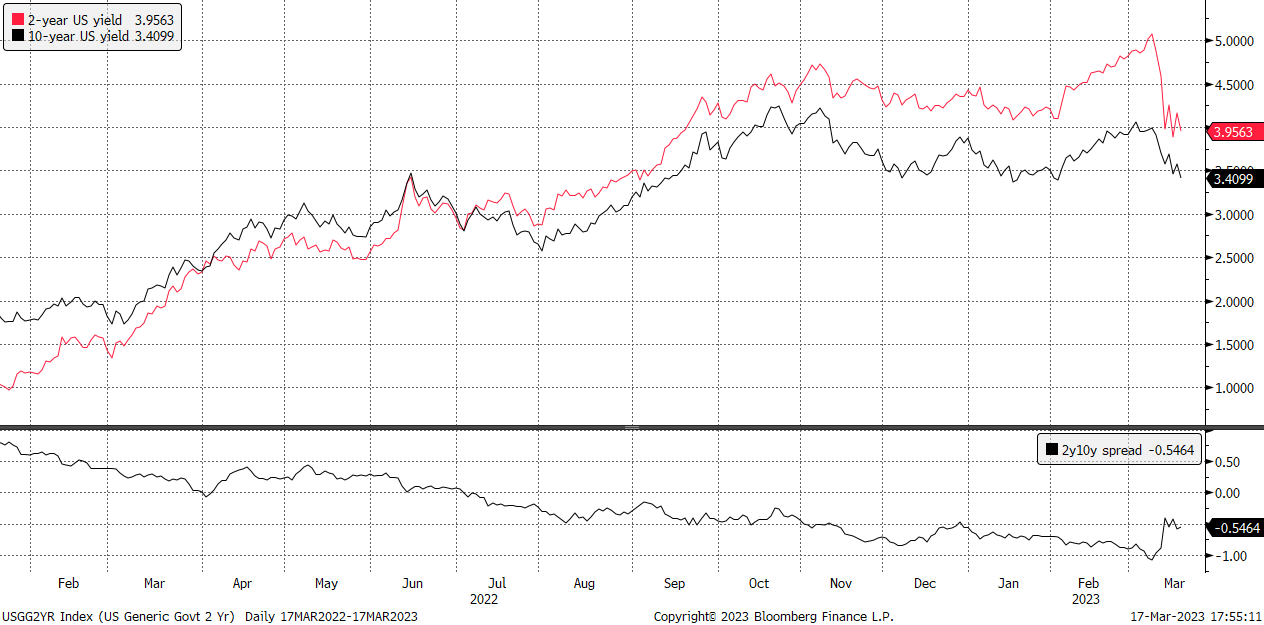

2-year and 10-year US yields pulled back significantly since the beginning of banking sector turmoil, with the former dropping more than the latter. Nevertheless, the 2-10 year yield curve remains inverted but the depth of inversion halved this week. Source: Bloomberg

2-year and 10-year US yields pulled back significantly since the beginning of banking sector turmoil, with the former dropping more than the latter. Nevertheless, the 2-10 year yield curve remains inverted but the depth of inversion halved this week. Source: Bloomberg

Taking a look at GOLD at D1 interval, we can see that the price of this precious metal rallied almost 9% over the past two weeks and is now testing the resistance zone in the $1,960 area. Note that this area halted previous upward impulse at the beginning of February 2023. A break below would pave the way for a test of the $1,990 swing area, and potentially even $2,050 ATH area. A lot will depend on the Fed next week - should US central bank decide to send a cautious, dovish message amid troubles of US banks, the way towards all-time highs may be opened.

GOLD at D1 interval. Source: xStation5

GOLD at D1 interval. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.