Gold (GOLD) futures are trading close to 0.7% higher today, and although they have already retreated more than $10 from their intraday peak at $2142, we can still talk about a great session. The gold market's gains have been helped by a weaker dollar and the yield on the 10-year US Treasury bond, which is losing more than 0.06% today and has seen a very large drop from around 4.3 to 4.15% since 29 February.

- Friday's weaker-than-expected US manufacturing ISM was supported by today's services ISM reading, which also came in weaker than expected. The slowdown was evident in the sub-indexes of employment, new orders and, most importantly, prices, which, in the context of PCE inflation in line with forecasts, could be a 'dovish signal' for the Fed.

- Jerome Powell will deliver his semi-annual report on the US economy and monetary policy tomorrow and Thursday. Possible dovish comments could raise expectations of a mid-year rate cut, and the 'backdrop' to his speech seems somewhat warranted.Wall Street cannot be sure whether weaker macro data from the US is just a temporary surprise or a new trend showing the postponed effects of restrictive monetary policy.

- Also, the announcement from the Chinese parliament has put a big question mark over whether China's economy will recover from its economic problems, in the absence of a strong fiscal stimulus programme. China reiterated its GDP growth forecast of 'close to 5%'.

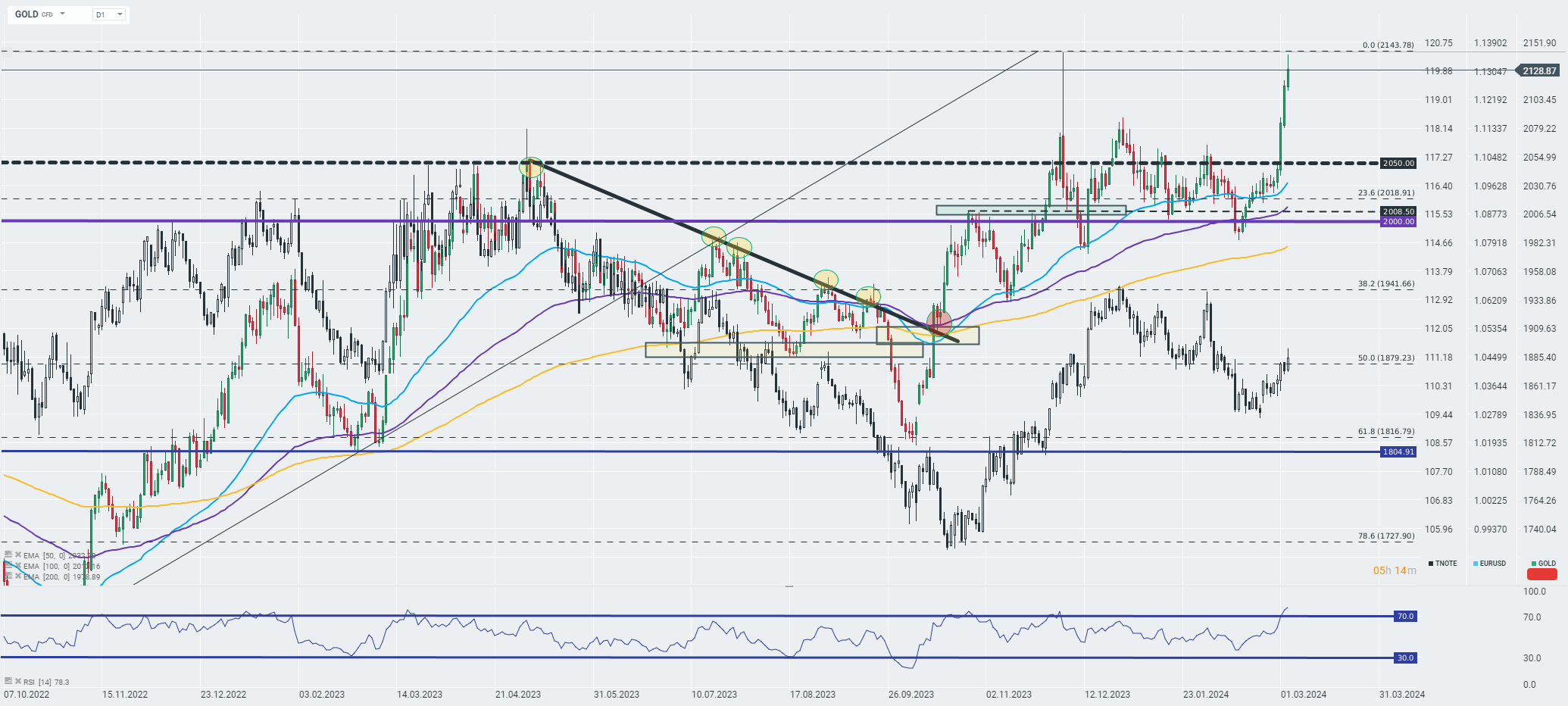

Gold tested historic highs today before initiating a downward correction. At the moment, however, the precious metal remains in the zone of the highest breakouts. Moreover, the commodity has a positive correlation with TNOTE quotations. Source: xStation

Gold tested historic highs today before initiating a downward correction. At the moment, however, the precious metal remains in the zone of the highest breakouts. Moreover, the commodity has a positive correlation with TNOTE quotations. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.