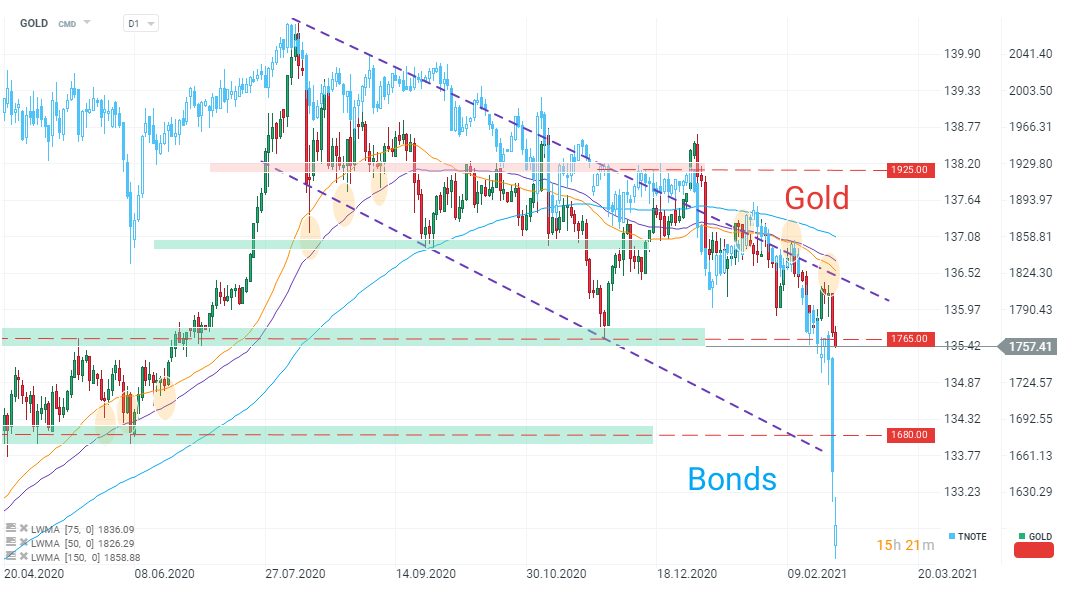

Bond yields continue their sharp rise as traders bet on a quick reflation scenario. One of the major victims is Gold – there is a strong negative correlation between yields and Gold prices as we were showing at the last weekly webinar. Gold prices were underpinned by $1765 level for a while but a surge in yields eventually was too much and now we can see prices moving towards the lower limit of a channel with still plenty of room and horizontal $1680 level along the way. Do notice how 50 and 75 LWMAs now work as a resistances – another sign of a possible trend reversal.

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.