The conflict between Ukraine and Russia has been discussed for several months, but the gathering of Russian troops on the border with Ukraine began around mid-December. The prices of many commodities have soared since then, largely due to the fact that Russia is a major producer of these commodities. The situation is slightly different in the case of gold, which again protects investors from the risk of armed conflict. If war becomes a reality, gold could become one of investors' most favored hedging assets, especially in times of high inflation.

Russia and gold relation

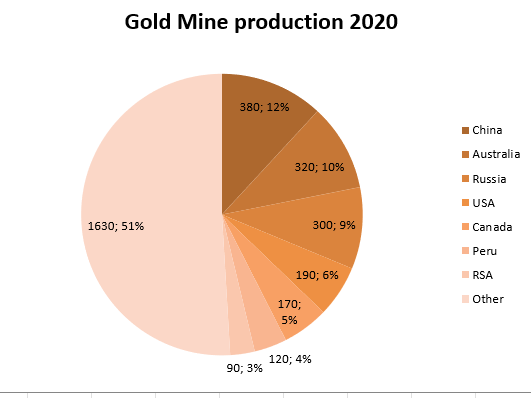

Russia is not the largest gold producer in the world, but it is certainly a significant player in this market. Russia's share of gold production in the last decade accounted for around 10%. In 2020, Russia mined 300 tonnes of gold, slightly less than Australia or China. The key point, however, is that Russia has potentially one of the largest gold deposits in the world, and the central bank itself holds some of the largest reserves in the world. The Bank of Russia holds about 2,300 tonnes of gold, according to World Gold Council data, and is the 5th central bank in the world in terms of gold reserves. Moreover, gold accounts for only 22% of all reserves, which shows that the bank's purchasing power is enormous (in the case of the largest economies in the world, gold reserves usually exceed 50%, sometimes even 60%). The central bank of Russia regularly buys gold in the market. On the other hand, investment demand from consumers or other institutions in Russia is still limited, but this may change if potential sanctions are imposed.

Russia is not the dominant producer of gold, as is the case with raw materials such as oil, gas, palladium and wheat. On the other hand, the potential from consumers side is high. Source: WGC, XTB

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Gold as a safe haven asset

Gold has gained around 8% since mid-December and during todays session is apporaching the local highs of mid-November and major resistance at $1,900 per ounce. Prices fell sharply in August 2020, however currently buyers managed to erase more than half of these losses. Upward move accelerated sharply when news regarding Russia's immediate invasion of Ukraine emerged.

Prices recovered some losses of the last downward wave and are getting ready to attack a key resistance. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

What happened to prices during previous conflicts?

Gold reacts to many factors, including interest rates, US dollar or sentiment towards the stock market. No less important is the status of a safe haven asset, in particular that Russia may not be able to conduct financial settlements with the West (Russia's suspension in the SWIFT system is being considered). Nevertheless, gold's response to previous Russian conflicts has been limited. The war between Russia and Georgia (Russia's invasion) in August 2008 did not lead to greater volatility. However during the annexation of Crimea and the first phase of the war with separatists in the Donbas situation was diffrent. In 2014, gold gained as much as 17%. At the same time, however, immediately after the annexation of Crimea, profit-taking occured. It is worth noting that at the same time the Federal Reserve was normalizing monetary policy and preparing for the first interest rate hike. We currently have a similar situation, although inflation around the world is now much higher.

Gold's earlier responses to Russia's military actions were limited and short-lived. On the other hand, now a risk of full scale military conflict emerged. However, if Russia continues to pursue the hybrid war and Western nations will remain passive, gold price may pull back sharply. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

What could happen next?

In the event of an actual invasion, gold prices could skyrocket due to the enormous risk involved. This would be a very different situation to a pandemic when the markets struggled with a liquidity issues (gold served as a source of cash at the time). Assuming a similar nominal change in price as in 2014, goldprice may rose towards $2000-2070. On the other hand, if the conflict descalates, profit taking may occur similar to 2014. Back then, gold price fell 10% in the the first phase, which at the current prices could push the price to $1700 level.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.