The Fed surprises with a 50 basis point cut, given the consensus of Bloomberg economists, where more than 110 forecasts pointed to a 25 basis point cut. In the anticipation of the more aggressive Fed rate cuts cycle, US dollar weakens and gold rallied above $2600 per ounce. However, the Fed opted for a stronger cut, pointing to strong declines in inflation and a slowing labor market. The key point, however, is that the Fed's statement does not see economic problems, as the macroeconomic projections also indicate:

- The Fed minimally cuts its GDP growth projection to 2.0% from 2.1% for 2024, but maintains its growth outlook at 2.0% in 2025 and 2026. It also sets a new projection for 2027 also at 1.8%

- The forecast for the unemployment rate has been raised upward, given the current market situation. The unemployment rate is expected to be 4.4% this year (up from 4.0% in the forecast and 4.2% currently). The rate in 2025 also at 4.4% (up from 4.2%), followed by 4.3% in 2026 and 4.2% in 2027 (along with the long term)

- Inflation forecasts were sharply reduced to 2.3% y/y this year from 2.6%. For next year, the PCE forecast was reduced to 2.1% from 2.3%. The forecast for 2.0% for 2026 and the long term was maintained at the same level.

- Forecasts for core inflation were also lowered, to 2.6% y/y this year and to 2.2% y/y next year.

- The target, however, is to be achieved as before in 2026

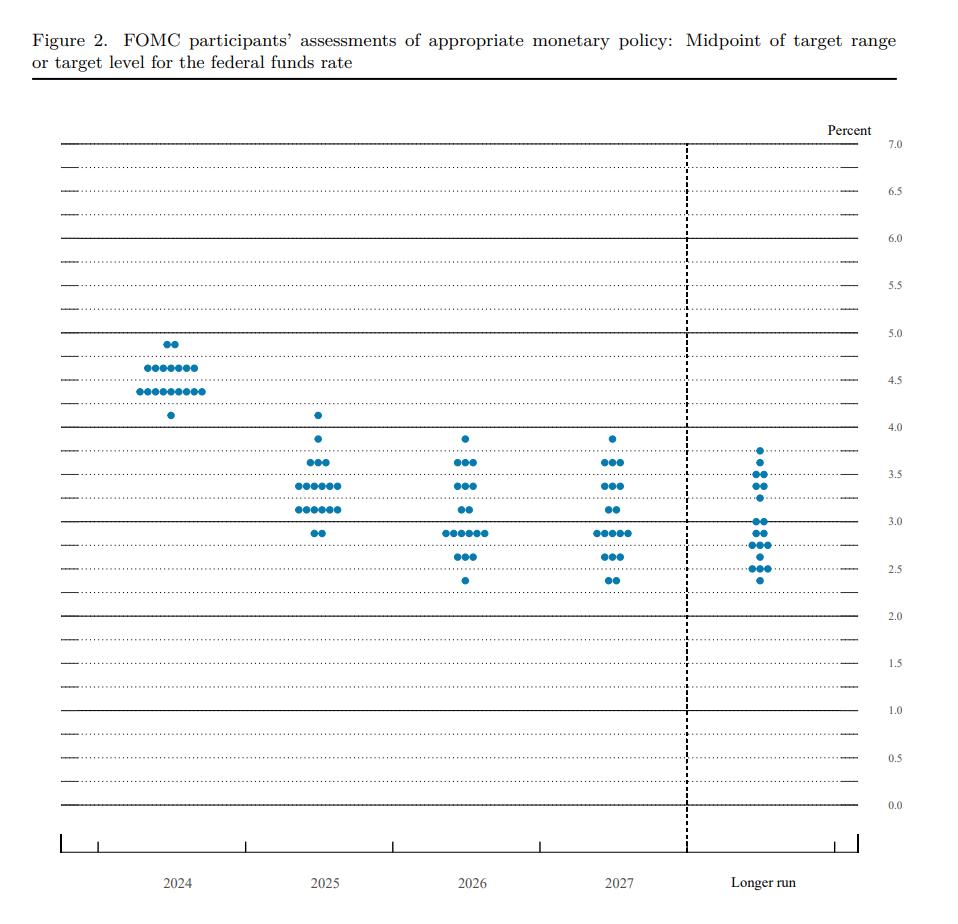

- Expected interest rates have been lowered very sharply, with two-three more cuts expected this year (with a median of 4.4%) and the expectation of another 4-5 cuts in 2025 to 3.4%. The Fed also sees rates at 2.9% in 2026 and the same level in 2027 and long term. It is worth remembering that June forecasts pointed to just 1 cut this year of 25 basis points

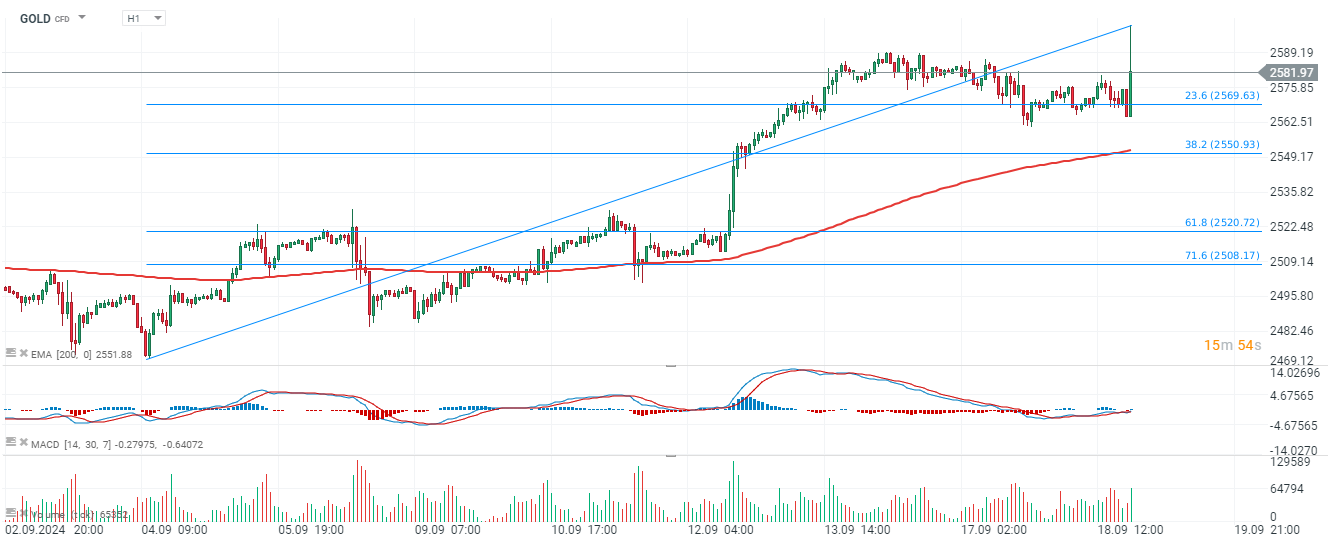

GOLD rallies almost 0.6% today and for a while the precious metal reached new all-time high above $2600 per ounce.

Source: xStation5

Source: xStation5

.

Source: Fed

Source: Fed

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.