GitLab, an all-remote software company, will debut on the Nasdaq stock exchange this Thursday. Company's shares will be available for trading on xStation platform once regular trading starts tomorrow. While an almost $10 billion IPO valuation may look small compared to Coinbase or Robinhood IPOs from earlier this year, the company has some of the world's top tech companies among its customers. Take a look at our brief overview of the company!

GitLab Inc

GitLab Inc is a software company. While not everyone may be familiar with GitLab Inc, it's GitLab platform is well-known among software developers. GitLab is a DevOps platform launched as a free and open-source project that aims to optimize workflow between software development and IT operations. Project began in 2011 and in 2014 an open-core business model was adopted that allows for monetization of open source projects. Using the platform remains free for registered users but additional features become available with paid subscription.

Client base

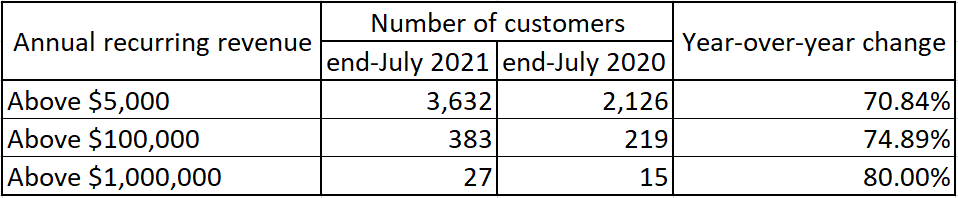

The company has a large client base and claims that its platform is used by more than 100 thousand companies and institutions. Among those we can find some big and well-known companies like Alphabet Cloud Services, NVIDIA, Alibaba Group or Amazon's AWS. Microsoft's Azure was also a client of GitLab until it acquired a rival Git repository, GitHub, in 2018. As GitLab has a subscription-based business, an Annual Recurring Revenue (ARR) is a metric to watch when analysing this company. GitLab's SaaS (software as a service) revenue growth outpaced its total revenue growth in full-2020 as well as during the first half of 2021. This is a positive development as higher share of recurring revenue makes business more predictable. The company has also managed to significantly increase the number of customers across its 3-tiers of services during the year ended on July 31, 2021 (see the table below).

GitLab managed to significantly increase the number of its top ARR customers during a year ended on July 31, 2021. Source: GitLab SEC filing

GitLab managed to significantly increase the number of its top ARR customers during a year ended on July 31, 2021. Source: GitLab SEC filing

What makes company unique?

One thing that makes GitLab a unique company is a model in which it operates. It is an all-remote software company, meaning that all of its employees are working from home. While work-from-home became popular during Covid-19 pandemic, GitLab decided on such a work model at its inception, long before the pandemic surfaced. The company has no headquarters. On one hand, it allows for cost reduction as the company does not have to maintain the office. On the other hand, it creates some risks. The company itself said that lack of office and company-owned equipment creates risk that equipment owned by its employees may be insufficient to perform some tasks.

IPO price

Initial IPO price range set by GitLab Inc. was $55-60 per share. However, it was boosted to $66-69 per share earlier this week due to strong demand. Such an IPO price range values the company at almost $10 billion. While this is nowhere as big as the $32 billion valuation of Robinhood during its debut or the over-80 billion USD listing of Coinbase, GitLab's IPO will be closely watched due to how important the company's services are to some of the world's biggest tech companies. Nevertheless, traders should keep in mind that although the company's business is improving, it is still generating losses.

Shares of GitLab will be available for trading on xStation platform since the company's IPO on Thursday, October 14. Shares will trade on xStation under GTLB.US ticker. However, it should be noted that regular share trading during hot IPOs like this often does not start until 1-3 hours of the cash session have passed.

Basic financial data from GitLab Inc. Source: GitLab SEC filing

Basic financial data from GitLab Inc. Source: GitLab SEC filing

Market update: recovery takes hold, but investors remain on edge

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.