EURUSD pair returned above $ 1.18 after the US Federal Reserve said that it was in no rush to withdraw stimulus. Today, apart from the US GDP data, investors' attention will also focus on the inflation data from Germany. Inflation is expected to accelerate significantly to 3.3% YoY from 2.3% YoY (the HICP is expected to rise to 2.9% YoY). Nevertheless, data from individual federal states are much more surprising - in Bavaria 3.8% y / y, in Hessen 3.4% y / y, in Brandenburg 4.3% y / y, in Baden 3.4% y / y, in Saxony 3.7% y / y In addition, the labor market records a significant drop in unemployment. Despite the fact that we do not observe any significant movement of German yields, the euro may strengthen due to possible speculation on changes in monetary policy in Europe. Of course, taking into account the recent actions of the ECB, the chances of any significant changes are slim, but the market response to such issues can sometimes be surprising.

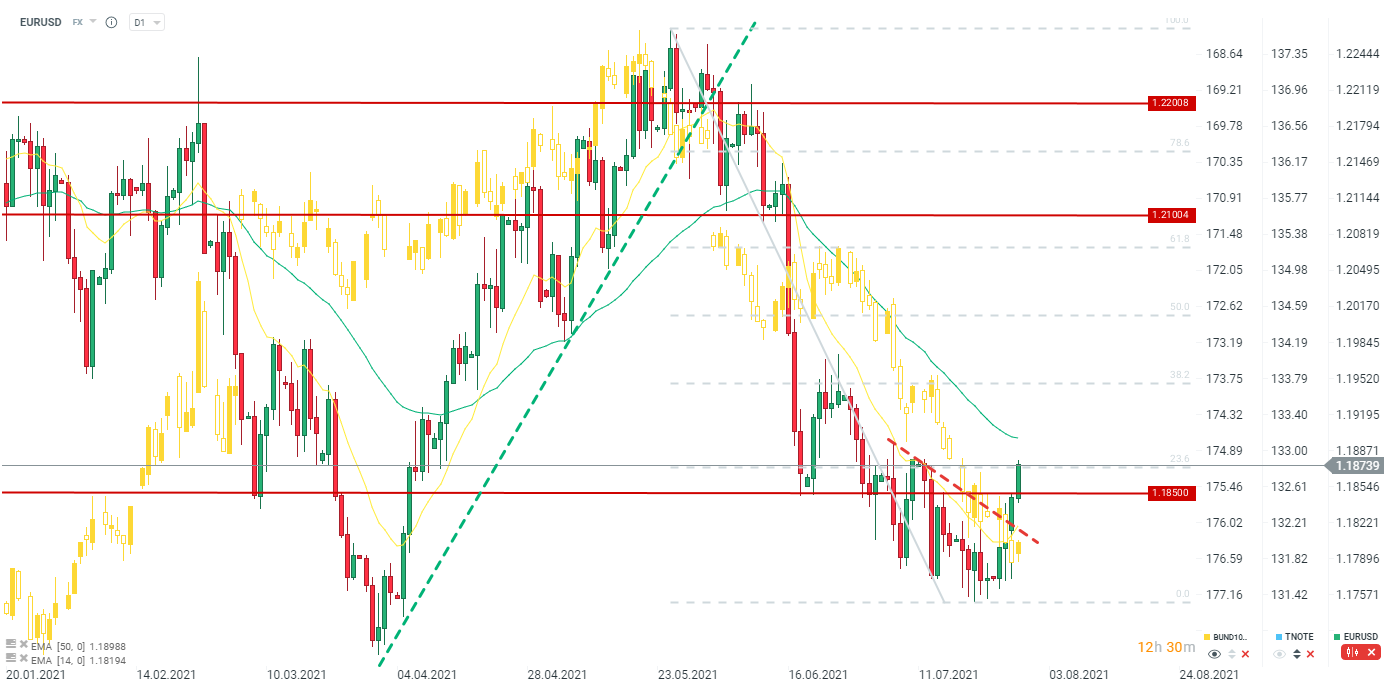

EURUSD is heading towards the 1.1900 area which coincides with the 50 EMA (green line). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.