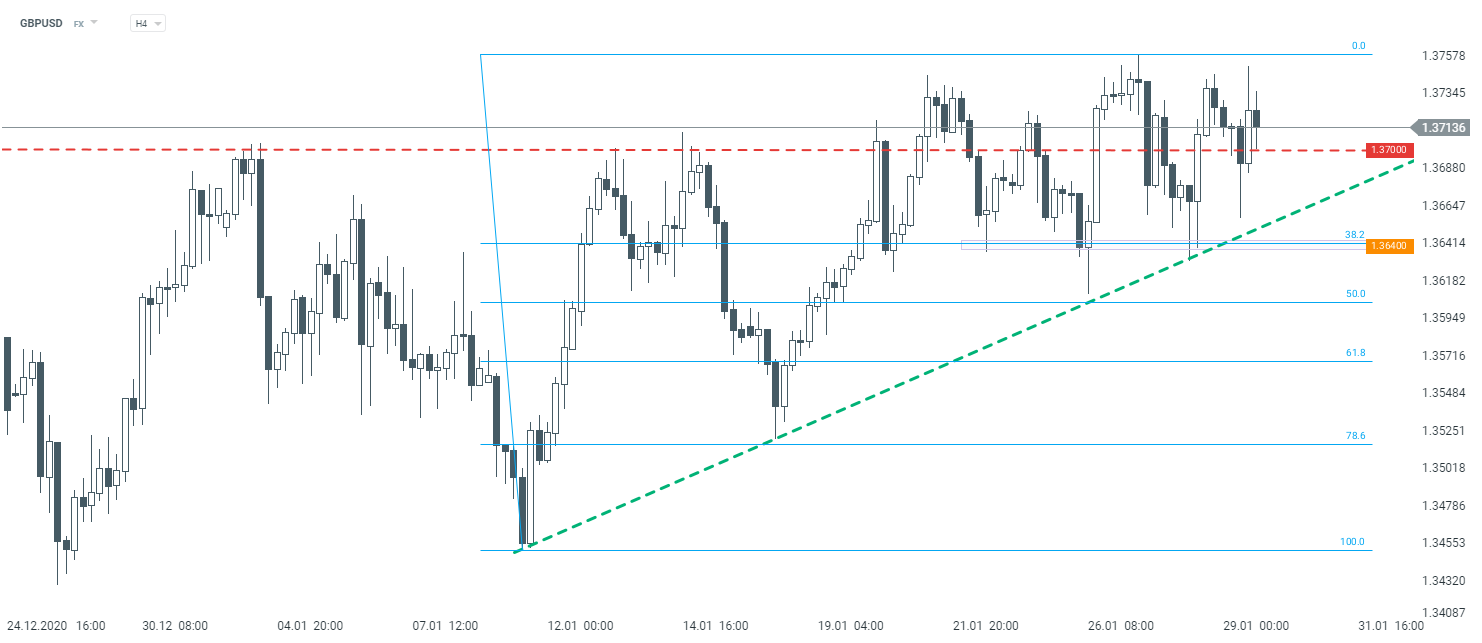

An upward move on GBPUSD has been halted in recent days. Looking at H4 timeframe from a technical standpoint, one might notice that a rally was restrained in the vicinity of 1.3700 area. Should the currency pair fall below support level marked by recent upward trendline, traders might be concerned as such scenario would indicate a sell signal. Apart form that, it is worth to pay attention to 1.3640, where traders may spot the 38.2% Fibonacci level of the recent upward impulse. Buyers did show some strength in that area several times, therefore breaking below that threshold might trigger a bigger move. On the other hand, traders should be aware that despite recent consolidation, the currency pair remains in an upward trend and new highs may be reached anytime.

GBPUSD, H4 interval. Source: xStation5

GBPUSD, H4 interval. Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.