Summary:

-

Solid week of gains so far for the pound

-

Markets starting to price-in Conservative victory

-

US NFP a key event for the US dollar

It’s been a good week for the pound, with the currency rising against all its major peers barring the New Zealand dollar as the markets have started to bet on a Conservaitve victory in next week’s election. While the lead in the polls has narrowed slightly there’s not been the same surge in support for Labour as we saw in 2017 and the Conservative low-key approach to campaigning has meant that the clangers dropped by Boris Johnson’s predecessor have been avoided thus far.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app

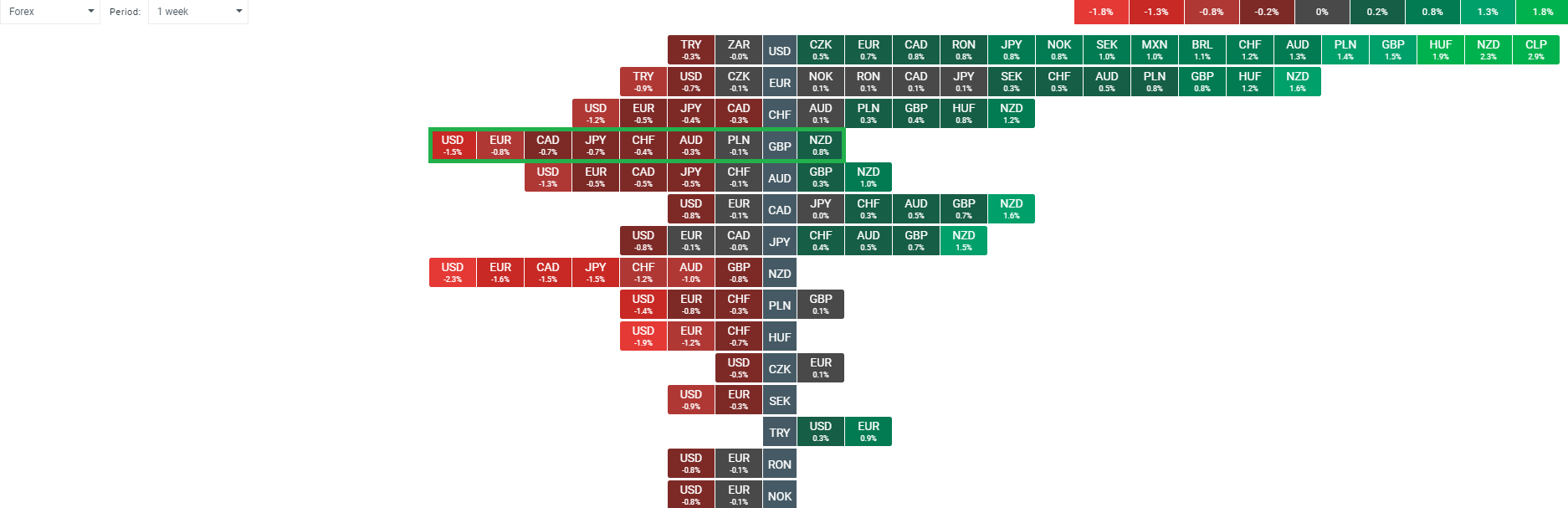

Only the NZD has outperformed GBP in the past week, with the largest gains seen against the USD with GBPUSD up by 1.5% on the week. Source: xStation

This morning Labour leader Jeremy Corbyn has attempted to make an attack on the Tories on Brexit, revealing “cold hard evidence” that shows there will be customs checks between Northern Ireland and Britain under the current deal proposed by Boris Johnson. This is another attempt to discredit the government and a similar strategy to that seen just over a week ago when Corbyn revealed an unredacted document which he claimed showed that the NHS was “up for sale”. Conspiracy theorists are quick to question how Corbyn received these documents and whether the spectre of foreign influence has once more reared its ugly head, but looking past the source of the leaks it does seem that this is unlikely to have too big an impact.

Tonight’s head-to-head debate between the two leaders could well offer the last chance for Corbyn to land a meaningful blow on Boris Johnson and at the minute it seems that we are likely drifting towards a Conservaitve majority. The pound has pulled back a little this morning but still remains firmly higher on the week and against the US dollar has made a potentially decisive break higher after clearing prior resistance around the psychological $1.30 level.

There are two potentially major events set to occur before traders can wind down for the weekend with the US jobs report and OPEC+ announcement following the organisation’s meeting both likely to cause a flurry of activity in the markets. There’s been mixed messages from other data points ahead of the all important non-farm payrolls, with the drop in the ADP number to its second lowest level since 2011 a particular source of concern. It should be pointed out that the 67K ADP read for November doesn’t include the circa 50k GM jobs that are set to return following the end of their strike so this afternoon’s number could avoid dipping under the 100k mark for the 3rd time this year.

OPEC+ are expected to cut production by a further 500k barrels per day, but this has yet to be confirmed and the oil markets will be watching closely this afternoon for any more hints on this front. A press conference is scheduled after the meetings, but the outcome of these events are often leaked before we get official confirmation so any off-the-cuff remarks to journalists from ministers leaving the meeting could well cause a rapid reaction in the crude markets.

GBPUSD has made a strong break higher this week after 6 weeks of consolidation between 1.2770-1.3010. Price is on track to close at its highest level since April but this afternoon’s NFP release could well have a big impact on the USD side of the pair. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.