In recent days GBPUSD moved further away from six-month high of $1.2355 reached earlier this month as recession fears sparked demand for safe haven assets including US dollar. Also the outlook for the sterling remains clouded by fears of a domestic recession. BOE Governor Andrew Bailey has been warning markets that tightening expectations is overdone with the UK toppling into a two-year recession. Nevertheless today we can observe some dollar weakness which enables the GBPUSD pair to bounce off the local support at 1.2150. Nevertheless, the main sentiment remains bearish, therefore a move towards 1.20 level or even key support 1.1865 cannot be ruled out.

GBPUSD, H4 interval. Source: xStation5

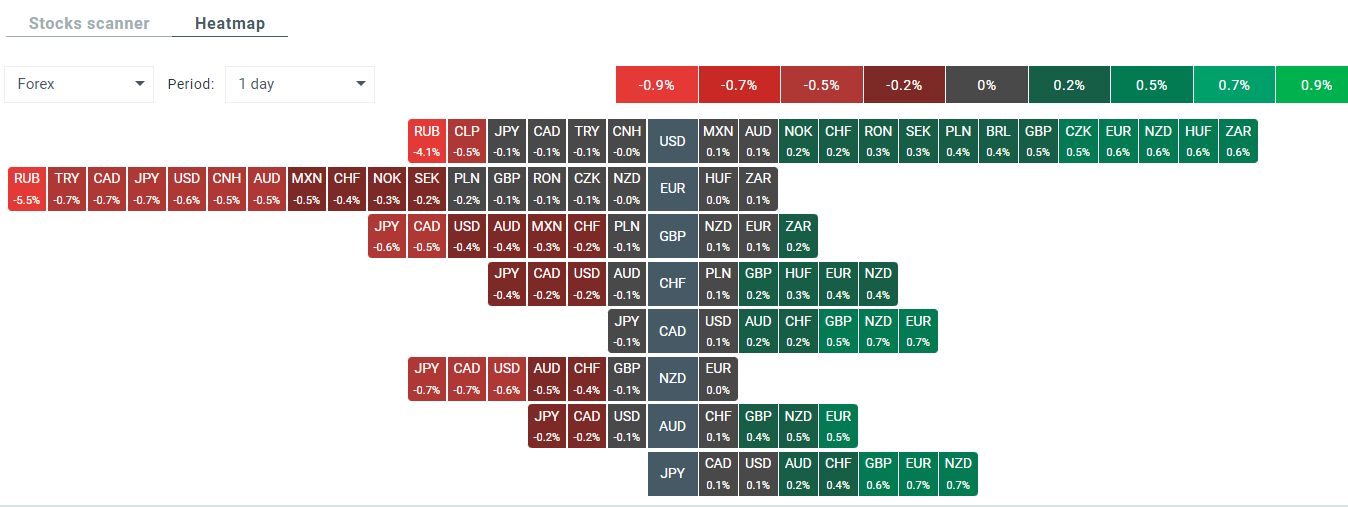

USD weakened slightly on Wednesday. Source: xStation5

USDIDX struggles to break above key resistance at 105.30 which is marked with previous price reactions, 200 SMA (red line) and 23.6% Fibonacci retracement of the upward wave launched in May 2021. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.