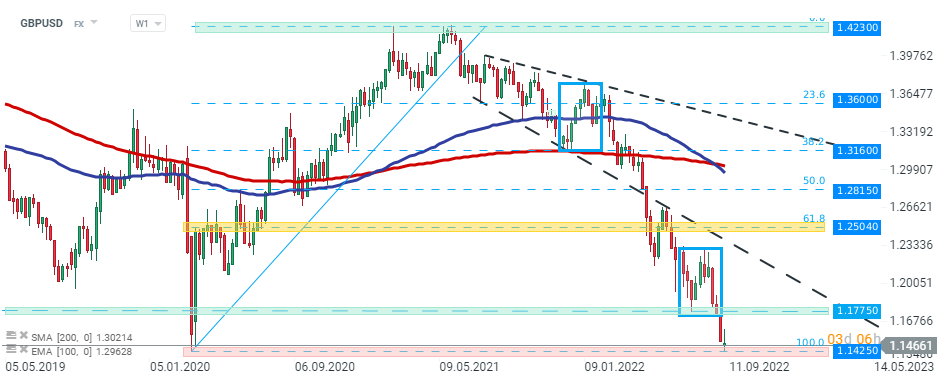

GBPUSD fell during today's session to the lowest level since March 2020 amid worsening UK macroeconomic outlook, surging inflation and soaring energy prices. Also hawkish remarks from several Fed members support the US dollar. Today Fed Mester said it is far too soon to conclude that inflation has peaked while wage pressures show little sign of abating. Therefore, in her opinion, the US central bank needs to raise rates to 'somewhat above 4%' by early next year, then hold it there. On the flip side, political uncertainty in the UK eased a bit, after new prime minister Liz Truss took over the office. Tomorrow the new government is expected to unveil an energy rescue plan, with measures worth £200 billion which aims to freeze energy bills in the UK. From a technical point of view, GBPUSD bounced off the key support at 1.1425, where pandemic lows are located. As long as the pair sits above, upward correction may be launched towards local resistance at 1.1775.

GBPUSD, W1 interval. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.