Summary:

-

Markets seemingly still hopeful Boris’s deal could pass

-

UK MPs expected to vote in the coming days

-

GBPUSD moves above $1.30 handle for 1st time since May

The first Saturday sitting for UK parliament since the Falklands War turned out to be something of an anti-climax with most observers left none the wiser as to where this leaves us on Brexit. The passage of the Letwin amendment forced Boris Johnson to submit a letter to the EU requesting an extension and while this was not signed from the PM, and also accompanied by additional letters essentially stating to ignore it, this does still satisfy the criteria needed for a legal request. The EU27 are unlikely to offer too much opinion on this and will in all likelihood keep their cards close to their chest until they have witnessed the events of the next couple of days in the House of Commons.

For today all eyes will be on the speaker of the house to see whether he allows a meaningful vote on the latest deal, with John Bercow once more at the centre of attention. The government are thought to privately believe that hopes for a vote today will be scuppered later on and that would mean a more likely route is the second reading of the withdrawal agreement bill tomorrow.

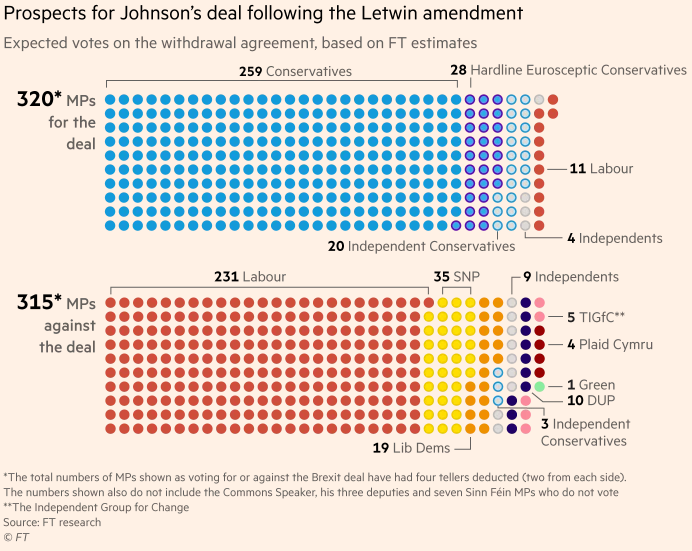

Parliamentary arithmetic remains too close to call with a high degree of conviction, but there is a growing feeling that the government could well achieve the requisite level of backing. Source: FT

However, this wouldn’t be the end of the matter even if it does occur, with parliament then having the chance to vote on amendments to the bill such as the UK staying in a customs union or even a second referendum. Any amendment as such would frustrate the process as that would mean that the UK’s side of the deal no longer matches that of their EU counterparts and therefore the recently agreed upon treaty would be invalidated.

The GBP/USD rate earlier hit its highest level since May above the $1.30 handle but has since pulled back a little. It seems that the markets remains hopeful that this deal could still come to pass but for now politicians, market participants and the public at large are still in the dark as to what will happen next.

In summary, the Brexit merry-go-round remains in full swing for the time being and as is often the case on this topic, while much has happened nothing has really changed.

GBPUSD has been trending higher in recent trade with the 50 SMA on H1 doing a good job of neatly capturing the move. Source: xStation

GBPUSD has been trending higher in recent trade with the 50 SMA on H1 doing a good job of neatly capturing the move. Source: xStation

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.