Last week saw the GBPUSD post its largest 2-day rally in over a decade as the pound surged across the board on rising hopes of a new Brexit deal. With the market soaring over 600 pips from last week’s lows is it setting itself up for a big disappointment or will there be further gains ahead?

Summary:

-

GBP volatility rises close to post-referendum highs

-

Key events ahead - EU summit tomorrow, UK MPs to vote on Sat?

-

GBPUSD close to 5-month high

The pound has injected some long overdue volatility into G10 FX markets with some wild swings seen of late as traders react to the latest developments on the Brexit front. Reports that the UK and EU could be closing in on a new Brexit deal has caused some to believe there is now light at the end of the tunnel but there remains several hurdles that need to be overcome before this can be finalised ahead of the current October 31st deadline.

1-month implied volatility in GBPUSD has moved sharply higher of late and is not far off the post referendum highs seen last November. Source: Bloomberg

Pathway to a possible deal?

The big breakthrough came last week after Irish Taoiseach, Leo Varadkar, and UK PM, Boris Johnson emerged from a three hour meeting claiming that there was a pathway to a possible deal which has paved the way for frantic discussions between the EU and UK. There has yet to be final confirmation as to what exactly a deal that is acceptable to both sides would involve, but it seems that the controversial backstop will be dropped.

Northern Ireland solution remains a stumbling block

The latest proposal from the UK would take Northern Ireland out of the EU customs union, but give special treatment to goods moving from Britain to Northern Ireland. In effect the UK would enforce the EU’s customs rules and tariffs on these goods and create a rebate system to compensate businesses affected. There are obviously practical issues with this approach, such as how goods that go UK-NI-Ireland or the reverse are treated and at present the EU seem unwilling to accept.

The bloc are holding out for a customs border in the Irish Sea, something that Britain is publicly opposed to due to the implications of threatening unity within the UK and this idea was rejected by Theresa May earlier this year. However, there are some reports that the UK government may be willing to accept this and there’s a growing feeling that a deal could be struck.

What next?

For any deal to be successful it would need to pass two separate tests; first the unanimous approval of the EU 27 and secondly to be approved by the UK parliament. A special EU summit is scheduled to start tomorrow and should a deal be agreed upon then a vote on it can be expected in UK parliament during an exceptional session this Saturday. In terms of parliamentary arithmetic it looks like it would be close with the DUP and ERG votes far from certain at this juncture and the PM would certainly have his work cut out for it to pass.

Technical overview:

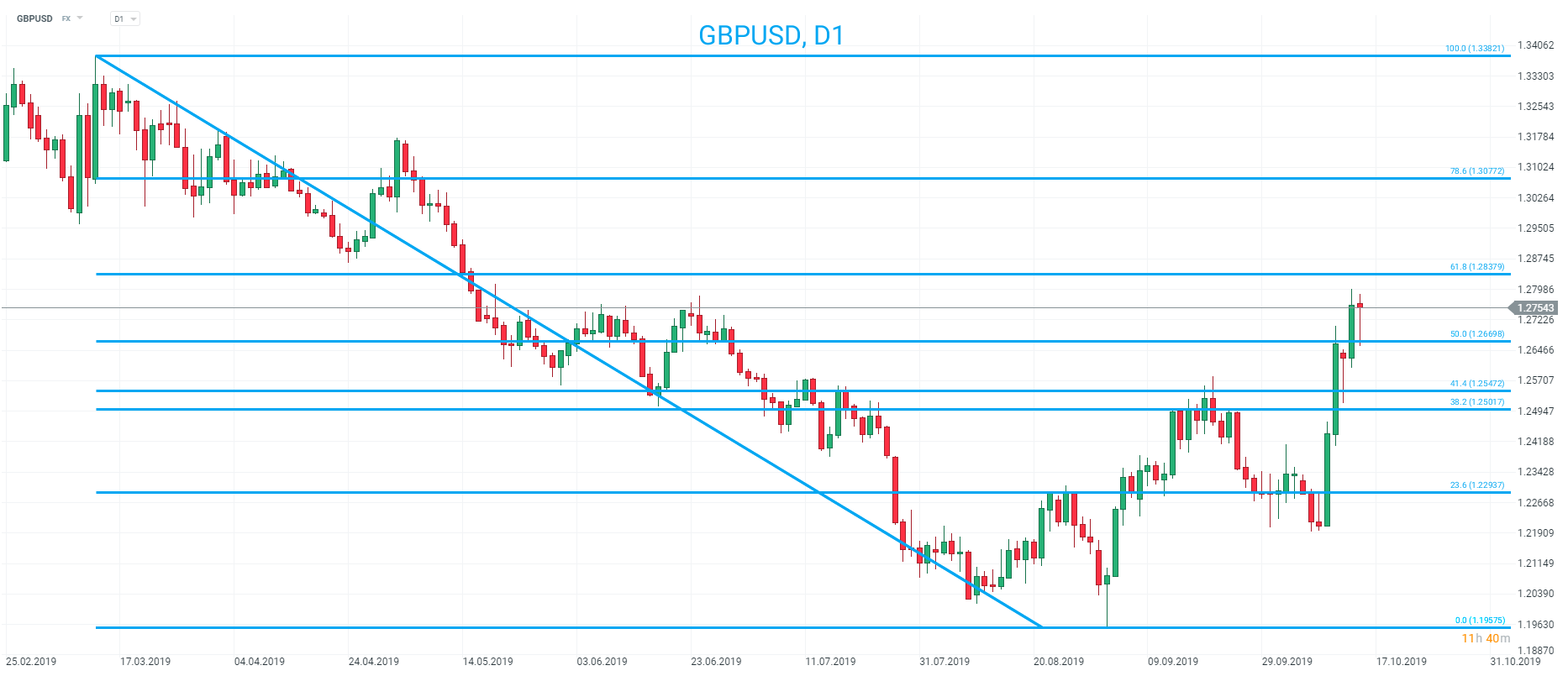

GBPUSD has now moved back above the 50% retracement level of the drop from the YTD high of 1.3380 to the 2019 low of 1.1958. Source: xStation

Final note of caution

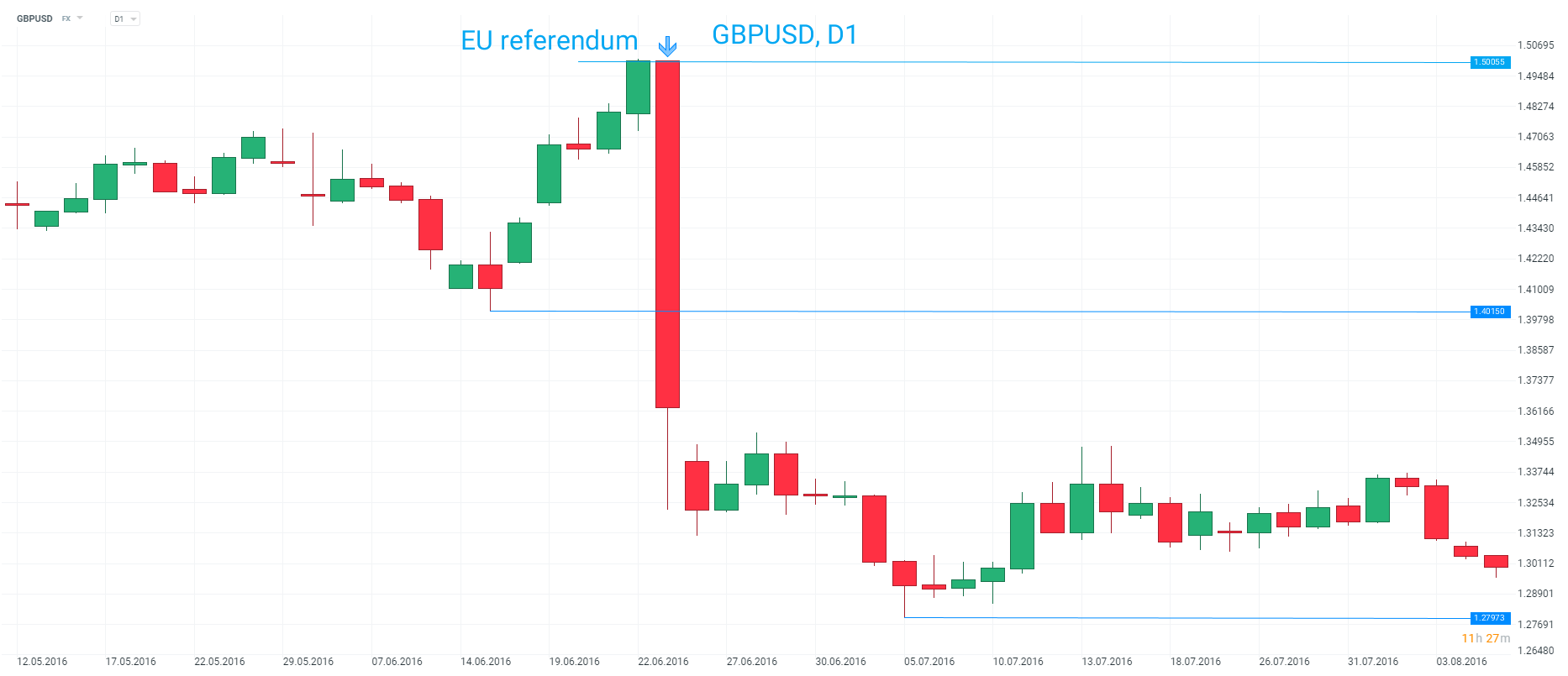

It is worth drawing a parallel with the 2016 referendum when the pound rallied strongly for 6 sessions ahead of the vote, gaining just over 7%. This was due to the market pricing in the prospect of a victory for remain which proved a costly error. The current gains have come over 5 days, accounting for an approximately 5% move higher. While we wouldn’t expect anywhere near as large a drop if no agreement is reached it does suggest that there is scope for a significant disappointment should the recent optimism be misplaced. Source: xStation

It is worth drawing a parallel with the 2016 referendum when the pound rallied strongly for 6 sessions ahead of the vote, gaining just over 7%. This was due to the market pricing in the prospect of a victory for remain which proved a costly error. The current gains have come over 5 days, accounting for an approximately 5% move higher. While we wouldn’t expect anywhere near as large a drop if no agreement is reached it does suggest that there is scope for a significant disappointment should the recent optimism be misplaced. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.