Summary:

-

GBP set for another green week

-

Largest gains seen in GBPAUD and GBPNZD

-

Has sterling gone too far, too fast?

It’s shaping up to be another good week for sterling bulls with the pound chalking up a 3rd consecutive weekly gain. Once more the currency has moved higher across the board with the largest appreciation seen against the antipodean currencies as both GBPAUD and GBPNZD have rallied by over 1.5%. The pound hit its highest level against the US dollar in over 11 weeks following some positive remarks from Jean-Claude Juncker as the president of European Commission suggested he would be willing to renegotiate on the backstop - the issue seen by the UK government as the main hurdle that needs to be cleared to pass a withdrawal agreement through parliament.

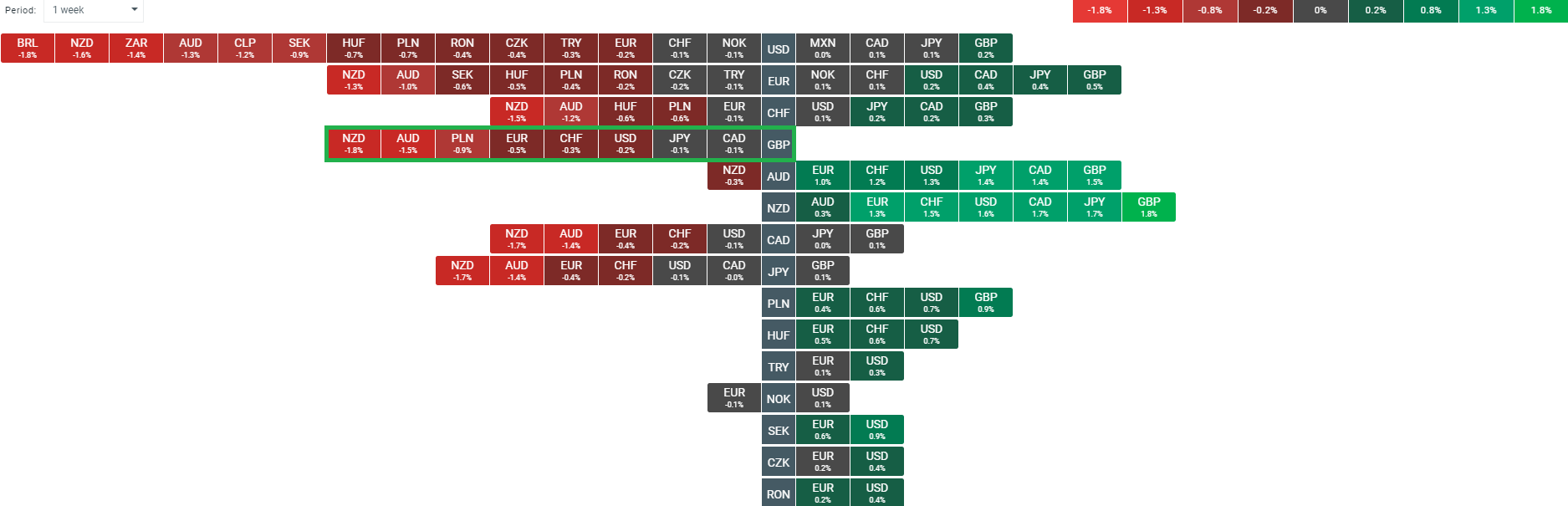

The pound is once more rising against all its peers with the largest gains seen vs the AUD and NZD. Source: xStation

Too far, too fast?

Some cold water has been poured on the markets in recent minutes however with Michel Barnier claiming talks have gone backwards. In the space of three weeks the sentiment in the pound seems to have swung pretty wildly with the excessive pessimism when the GBP/USD rate fell below $1.20 giving way to optimism that is bordering on over the top given the Brexit issues that remain. While a softening of stance from both sides has been warmly welcomed in the markets, it is worth noting that there’s been no tangible progress and Boris Johnson’s proposed alternatives to the backstop could be described as vague, sketchy and hopeful at best.

GBPAUD has rallied 600 pips in not much over a week as the pound has extended its recovery to move up to a 4-month high of 1.8495. The RSI has moved into overbought territory above the 70 mark and there’s also some possible negative divergence seen. Source: xStation

GBPAUD has rallied 600 pips in not much over a week as the pound has extended its recovery to move up to a 4-month high of 1.8495. The RSI has moved into overbought territory above the 70 mark and there’s also some possible negative divergence seen. Source: xStation

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.