GameStop (GME.US) shares plunged nearly 20% after the games retailer said it planned to sell more shares and offered few details about its turnaround strategy. Also news that the SEC is investigating past trading activity is weighing on its stock. Company also hired two former Amazon (AMZN.US) executives to top positions, with Matt Furlong named CEO and Mike Recupero tapped as chief financial officer. However these news together with better than expected quarterly figures failed to stop the decline in share prices. The first meme-stock icons posted a quarterly loss of 45 cents per share while analysts expected a much higher loss of 84 cents per share. Revenue of $1.28 billion beat market estimates of $1.16 billion. Sales rose 25% in the Q1 as the company focuses on e-commerce and tries to stage a turnaround. However GameStop declined to provide an outlook for the year. It said sales momentum continued into the second quarter, with total sales in May increasing about 27% compared with the same month a year ago.

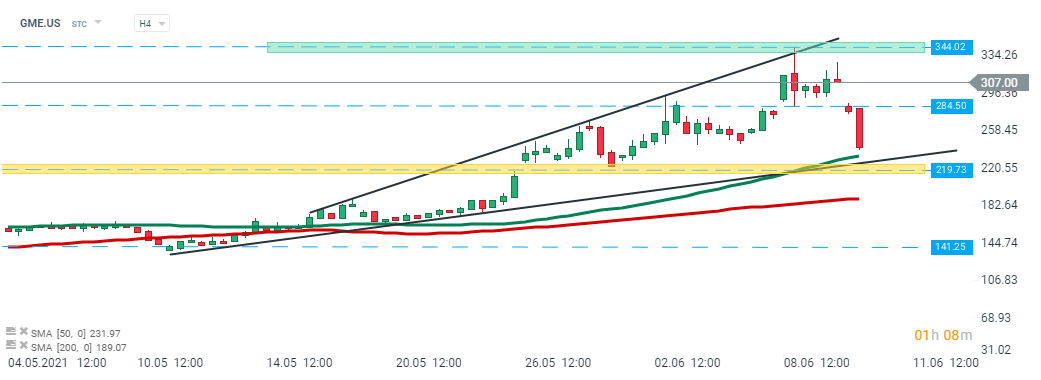

GameStop (GME.US) stock launched today's session with a bearish price gap and is currently approaching the major resistance zone around $219.73 which is strengthened by 50 SMA (green line) and upward trendline. Should break lower occur, then downward move may accelerate towards support at $141.25. However, if buyers manage to halt declines, then another upward impulse towards recent high at $344.02 may be launched. Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appThis content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.