Marine Le Pen, leader of the populist-chauvinist National Rally, will probably lose against Emmanuel Macron on Sunday. That would be a relief, but this probable victory shouldn’t disguise the fact that political moderation is in retreat — in France, as elsewhere. The opinion polls that come after the presidential debate (tonight) will be crucial. It wouldn’t be the first time there’s a surprise. We already saw it with Brexit.

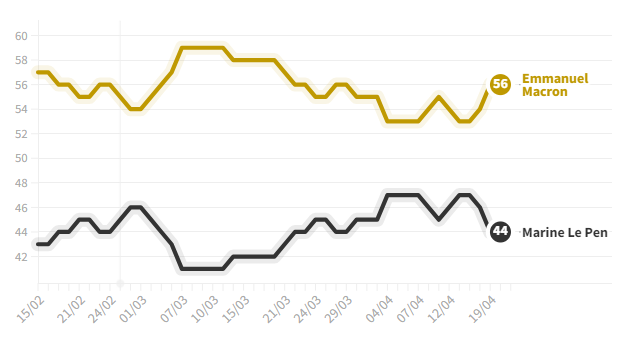

Polls before the presidential debate. Source : Les Echos

Polls before the presidential debate. Source : Les Echos

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appHow could the market be affected if Marine Le Pen is elected?

If Le Pen wins, there could be “a Black Monday” in the stock market, with the CAC 40 Index (FRA40) sinking more than 6%. French stocks such as BNP Paribas (BNP.FR) and Societe Generale ( GLE.FR) suffered last week as polls showed Macron's lead shrinking.

Le Pen’s victory could lead the euro below parity against the dollar, but that may happen after three- to six-month rather than happening knee-jerk on the day. Some analysts see a potential Le Pen victory as sparking a “full capitulation” of those betting on a stronger euro. On the other hand, Macron's victory could be beneficial for large-cap European stocks, such as those listed on the Stoxx 600, due to the president's pro-EU economic stance.

Euro trades near level to around 2017 French vote. Source : xStation 5

Is FREXIT possible?

Le Pen no longer advocates an exit from the EU, she would like a referendum on revising the constitution to make French law superior to European Union rules. She also wants to restore permanent border controls in the Schengen zone, which would contradict law in the bloc. Those measures would weigh on bonds from weaker EU countries such as Italy, the spread between Italian and German 10-year bond yields could widen to close to 250 basis points. The outcome also would undermine other pro-EU leaders such as Italy’s Mario Draghi.

It is worth mentioning that Le Pen would need to win a parliamentary majority in June to fully implement her policies, so market volatility could stay until the legislative elections.

Stances on crypto-currencies

The candidates have said little about crypto-currencies, even though it is at the heart of the issues for some investors. Indeed, according to a study conducted by KPMG, 8% of French citizens have invested in digital assets. Moreover, what constitutes a real challenge for the two candidates is the growing share of the 30% of the French population who intend to invest in crypto-currencies during 2022. While Marine Le Pen was openly against Bitcoin in 2016, calling it "dangerous," she seems to have softened her words since then. She recently stated that she was considering a reflection on the issue of regulation of crypto-currencies, wishing to integrate them into the law of financial markets and thus reduce the double taxation (on the liquidation of the asset and on capital gains) to which investors are subject. The party also added that it would like to consider an attractive tax regime for crypto-currencies backed by projects of general interest.

On the other hand, Emmanuel Macron shares Le Pen's opinion on regulation. Moreover, in May 2019, Emmanuel Macron created the status of service provider on digital assets (PSAN) and the optional visa for fundraising in crypto-currencies (ICO). In 2022, the finance law had clarified the tax framework for crypto-currencies. Emmanuel Macron goes even further with his plan to build an European metaverse, aware of the strategic importance of the sector, and the need to develop a clear framework for the development of blockchain and the establishment of new players.

Réda Aboutika, XTB France

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.