Fitch Agency surprised everyone at the beginning of August by deciding to lower the US's credit rating from the highest possible AAA, down to AA+. This marks the first time in just over 10 years that a second rating agency has decided to downgrade the credibility of American debt, causing limited market movements but at the same time significant outrage among US authorities. What stands behind Fitch's decision? Will other agencies decide to review their ratings? What does it mean for markets and should other countries also fear potential problems?

Fitch's Decision Preceded by Earlier Warning

Fitch issued a warning in May this year that there might be a credit rating cut if the United States did not address the debt ceiling issue. This problem was resolved by raising the debt limit until the projected 2025 year, but it doesn't change the issues that Fitch's agency was focusing on. The institution pointed to deteriorating management standards in the USA over the last 20 years, potential fiscal issues in the next three years, and a massive increase in interest costs in recent years. In 2020, after the first hit from the pandemic, the annualized interest cost on American debt was just over $500 billion. Now it's almost $1 trillion, nearly twice as much!

The Fitch decision, of course, met with disapproval from American authorities, particularly Treasury Secretary Janet Yellen and President Joe Biden. They emphasized the strength of the American economy, though forecasts concerning the debt point to it growing from its current level of slightly over 100% of GDP to nearly 200% by 2050!

What Does History Teach Us?

In 2011, the United States lost its "crown" of triple AAA. That's when S&P decided to lower the rating, and it has not raised it since then. That was a sort of milestone. The United States suddenly became not risk-free. The Financial Times wrote that the S&P decision highlighted the weakening financial position of the world's most powerful country. Meanwhile, Time magazine showed George Washington with a black eye on the cover, and the cover headline read "The Great American Degradation." The market reacted with a tremor in the stock market, though context should be remembered – especially Europe's fiscal problems and fears of a breakup of the Eurozone. However, the debt market largely ignored this warning, and bond prices even gained! This was associated with capital inflows into safe havens, and despite the credit rating downgrade, U.S. debt is still considered one of the safest in the world. Gold benefited greatly, with its prices reaching record levels at that time.

The state of the economy was obviously different then. Interest rates were still at zero, and the Fed was between one asset purchase program (QE) and another. Additionally, the European debt crisis was ongoing, positively impacting U.S. assets, and ultimately, the U.S. S&P 500 index gained about 20% within 12 months of the S&P decision.

The market always reacts violently the first time. When something happens a second, third, or subsequent time, the market reaction is no longer as violent. Moreover, the situation in 2011 showed that the cost of incurring new debt in the USA did not essentially rise, and a more significant reaction occurred in the stock, currency, or commodity markets. So, do we have any reason to worry now?

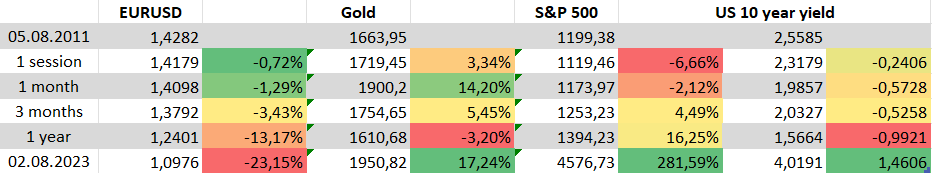

In 2011, the S&P 500 index reacted the worst, and gold was the biggest beneficiary, although that resulted from a bond price rally. A month after the decision, we had a yield drop of over 50 basis points! As can be seen, the currency situation was stable, although it also resulted from European problems. Although there is no debt crisis in the Eurozone now, we can see significant problems with economic slowdown. Source: Bloomberg Finance L.P., XTB Research

In 2011, the S&P 500 index reacted the worst, and gold was the biggest beneficiary, although that resulted from a bond price rally. A month after the decision, we had a yield drop of over 50 basis points! As can be seen, the currency situation was stable, although it also resulted from European problems. Although there is no debt crisis in the Eurozone now, we can see significant problems with economic slowdown. Source: Bloomberg Finance L.P., XTB Research

Did Rating Cuts in Other Countries Matter?

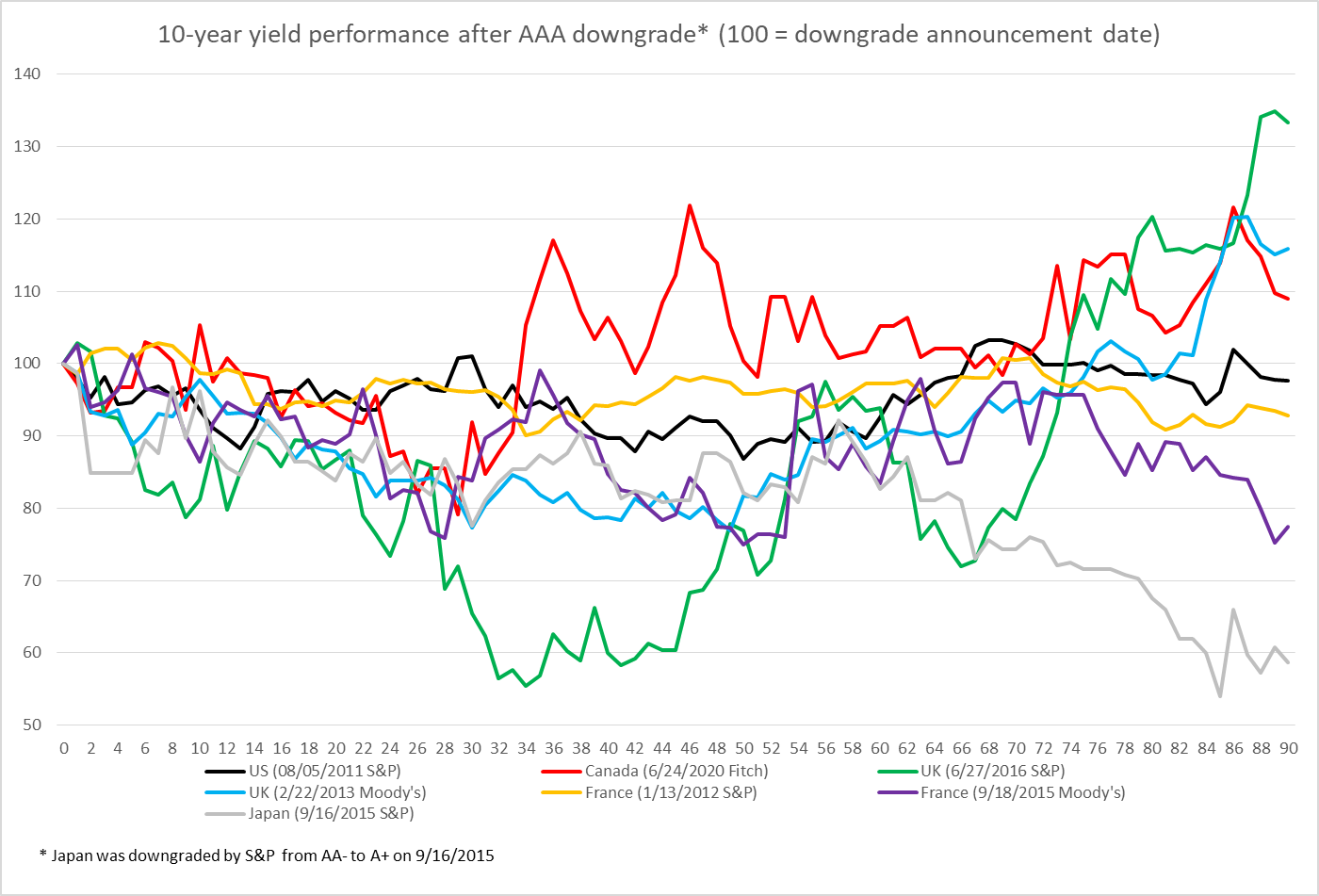

There are some economies that have never dropped from a triple AAA rating, including Australia, Sweden, or Germany. On the other hand, there have been negative rating changes in recent history caused by various factors. In Canada's case, there was a significant increase in spending and thus debt during the Covid-19 pandemic, whereas, for the United Kingdom, it was related to the Brexit referendum. However, it turns out that within a few dozen sessions after the rating downgrade, we did not observe a negative impact; very often, these bonds gained! Of course, we don't want to say that a rating downgrade is positive for the issuer. However, such decisions often merely reflected gradual changes and were treated by investors as a sort of confirmation rather than a new "shocking" piece of information.

The chart shows changes in yield, normalized to 100 on the date of the decision to lower the rating. As can be seen, yields dropped in the initial few dozen sessions! Source: Bloomberg Finance L.P., XTB Research

The chart shows changes in yield, normalized to 100 on the date of the decision to lower the rating. As can be seen, yields dropped in the initial few dozen sessions! Source: Bloomberg Finance L.P., XTB Research

Will There Be an Escape Outflow from American Debt?

Fitch showed in its decision rationale that fiscal policy management has significantly deteriorated over the last 20 years. Such warnings occurred already in 2011 from S&P, and Moody’s also suggested in May that it might decide on such a move. It is worth mentioning that the investment policy of some funds shows that money can be invested only in the safest debt with an AAA rating. Usually, then, as investment committees, they pay attention to the prevailing rating, and from this perspective, it might seem that Fitch's decision is key, as the prevailing rating for the USA is not AAA but AA+. However, there's a "problem". The current U.S. debt market is almost five times larger than the total market of all other government issuers with an AAA rating from all agencies and nearly four times larger considering countries with a prevailing AAA. So where would money from U.S. debt go if managers mechanically wanted to move it? Even if U.S. debt doesn't have special status for a given institution (which often is the case), it would be easier to change the provisions than to actually leave U.S. bonds. By the way, this fact also means that the debt of governments that have retained AAA may be particularly valued by investors (since there's so little of it left).

The U.S. debt is almost 4 times larger than that of countries with the highest credit rating (at least twice AAA). If the U.S. loses the status of the safest debt, will fund managers have nowhere to transfer their funds? Source: IMF, UN, Bloomberg Finance L.P., Macrobond, XTB Research.

The U.S. debt is almost 4 times larger than that of countries with the highest credit rating (at least twice AAA). If the U.S. loses the status of the safest debt, will fund managers have nowhere to transfer their funds? Source: IMF, UN, Bloomberg Finance L.P., Macrobond, XTB Research.

So what is the significance of Fitch's decision?

Empires fall slowly. Fitch's decision may not currently trigger large market movements, and even those we see, are the result of a surprising moment in which it appeared, not the reasoning behind it. However, it is a kind of seal of non-acceptance for U.S. economic policy. Will Washington immediately have a problem with financing the deficit? Absolutely not. Will the dollar lose its reserve currency status through Fitch? This certainly won't happen for many years. The decision should be seen as a warning signal that, without changes, the financial hegemony of the U.S. will decline. This may even be the case with sound economic policy in the face of growing competition from Asia. Fitch, on the other hand, points to risks that could accelerate the passing of the leadership baton. This is how we believe this decision should be viewed.

XTB Analysis Team

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.