The opening on Wall Street indicated a potential rebound after several days of increased selling pressure. However, the first few hours of trading verified this, and currently, both the US500 and US100 are experiencing declines and struggling to maintain key resistance zones.

Fitch Ratings: U.S. Consumer Health Monitor — 3Q23

Today, Fitch published its quarterly report on consumer conditions in the USA. From the document, we learn that consumer spending in the United States remained at a high level throughout 2023, supported by significant job and income growth, a strong consumer balance sheet, and positive consumer sentiments. The robustness is evident with real consumer spending rates of 4.3% in 1Q23, 1.7% in 2Q23, and an anticipated 3% in 3Q23. Fitch Ratings adjusted its annual consumer spending growth forecast to 1.9% from 1.0%.

However, an anticipated slowdown is visible on the horizon due to factors like a cooling labor market, decelerating wage growth, and the effects of the Fed's tightening policy. The slowdown will be noticeable in Q423, with spending expected to decrease by 1.2% and continue to decline in 2024. The consistent spending so far can be attributed to the increase in household incomes, supported by savings accumulated during the pandemic, but this buffer is expected to largely deplete by the end of 4Q23.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appMoody's

On the other hand, the rating agency Moody's also expects an upcoming slowdown in consumer spending. According to Moody's, the decrease in dynamics will be visible in the coming months. Moreover, the quality of consumer debt is declining, which may signal potential risk in certain areas of the credit market.

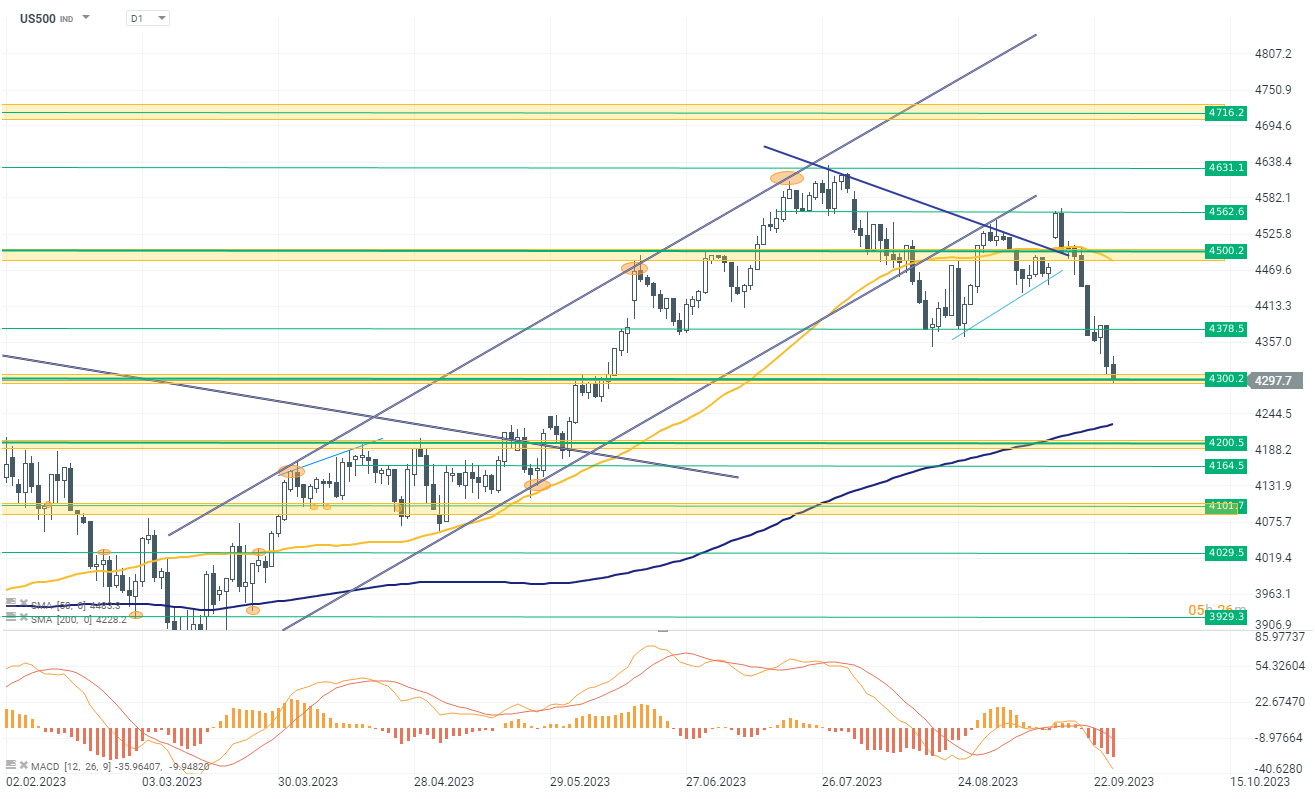

US500

At the beginning of today's session, the US500 opened 0.30% higher. However, initial gains were quickly reversed, and currently, the index is down by 0.60%. Bulls are struggling to maintain another key support zone at the 4300 points level. At the moment, the price is breaking below this level. If the selling pressure remains, the index may head towards the next support zone at the 4200 points level.

Source: xStation 5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.