FedEx (FDX.US), a US courier and logistics company, warned about deteriorating demand outlook yesterday. Mike Lenz, company's CFO, said that the company projects a lower demand in the foreseeable future. He added that demand trends started to reverse faster than expected and it is becoming visible in the business. While he said that grounding of some aircraft will allow the company to realize cost savings via delaying regular maintenance scheduled based on flight hours, it won't offset revenue lost due to lack of business.

Why is this important? FedEx is one of the biggest logistics companies in the United States and in the world so a warning about deteriorating demand outlook is a reflection of a deterioration not only in the company's business but also the economy as a whole. As such, FedEx is often seen as a bellwether and such warnings from the company used to hit risk assets in the past. We have not seen any major market move following yesterday's comments from FedEx CFO as it's not any kind of breaking news that the global economy is weakening.

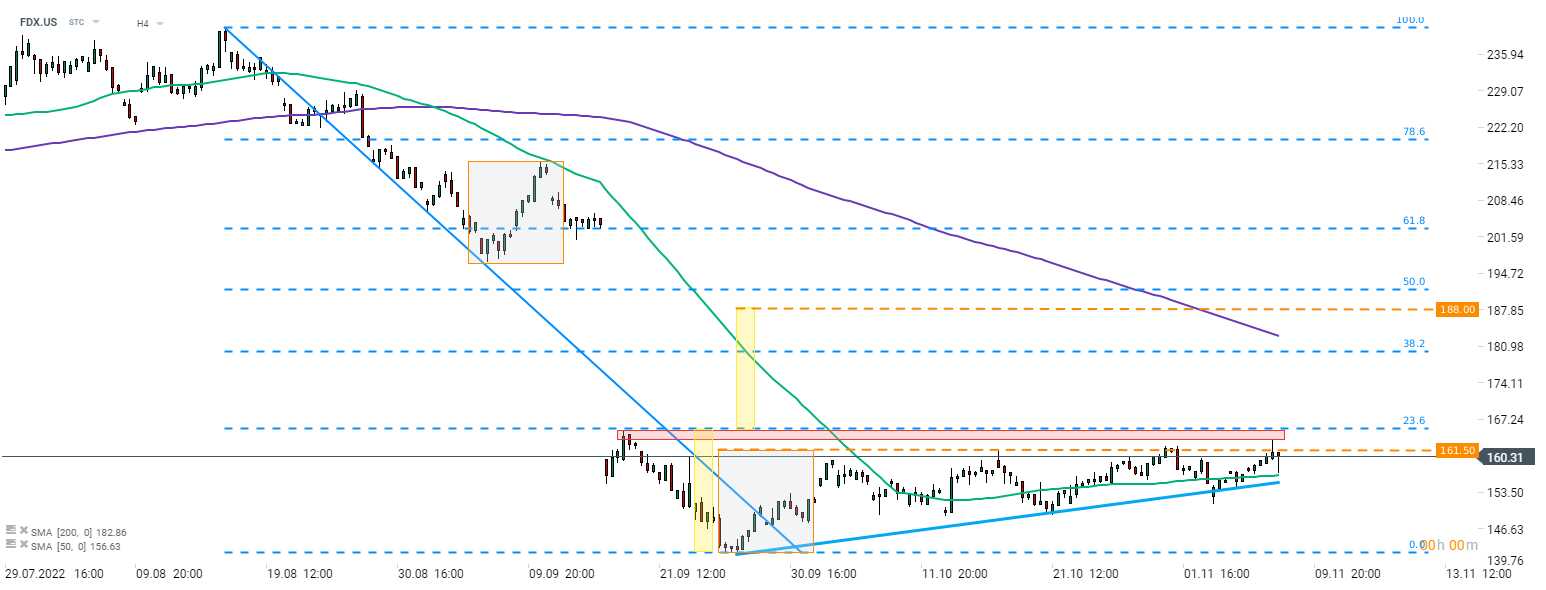

FedEx (FDX.US) is trading little change in US premarket trade today. Stock is set to open near $160 per share mark, slightly below the upper limit of a local market geometry. A break above would brighten technical outlook for the bulls. However, it should be noted that slightly above the upper limit of market geometry lies the upper limit of a triangle pattern. Upside breakout could trigger a bigger upward move with $188 mark being a textbook range.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.