Summary:

- The Fed announced it would start Treasury bills purchases in mid-October

- The program is aimed to boost the amount of reserves in the banking system

- It will continue offering overnight and term repo operations

The Federal Reserve announced on Friday it would start purchasing Treasury bills at the pace of $60 billion per month. The program will be conducted at least through the second quarter of 2020 and can be adjusted in both size and duration, as the Fed’s statement underlines. The statement also stresses that this program should not be likened to quantitative easing (these comments are in line with what we heard from Jerome Powell several days earlier). We concur because purchases of T-bills are intended to affect a completely different part of the yield curve. Overall, the newly designed program is to boost the amount of reserves in the US banking system to take pressure off money market rates.

Taking into account that these purchases are to last more than 8 months, one may expect the overall amount of reserves to exceed $2 trillion, a level not seen since mid-2018. Concurrently, the Fed will continue conducting overnight and repo operations at least through January 2020. Putting all of the above-mentioned together one may suppose that the upcoming Fed’s meeting later this month will be remarkably interesting.

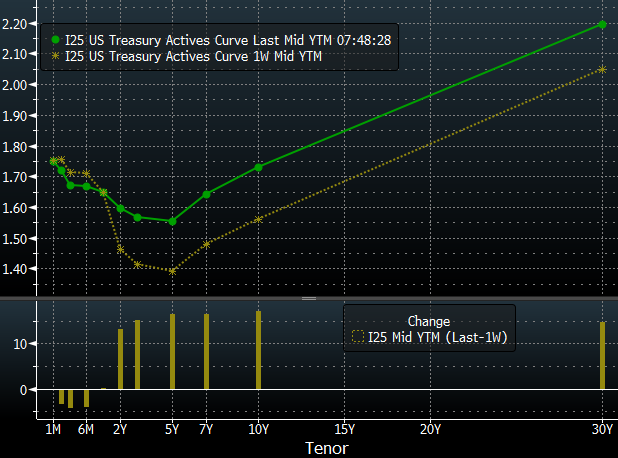

The front-end of the US yield curve lowered over the past week as the Fed announced purchases of T-bills. Source: xStation5

The front-end of the US yield curve lowered over the past week as the Fed announced purchases of T-bills. Source: xStation5

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.